Russian key rate up 75bp and the cycle is not over

Bank of Russia made a sharp 75 basis point hike to 7.50%, and reiterated guidance for possible further hikes (plural) in the future. The move clearly suggests that spiking CPI and expectations have the priority right now, while the new outbreak of a local pandemic and lockdowns are to be addressed by the budget. We expect another 25bp hike in December

| 7.50 |

Russian key rate, %a 75 basis point hike |

| Higher than expected | |

Sharp key rate hike, hawkish signal reiterated

Bank of Russia made a 75 basis point hike, leading to a 7.50% key rate level. This move is sharper than expected, as consensus was split between a 25 and 50 basis point hike, while we were leaning towards 50bp on the sharp inflation surprises of September and October. The tone of the accompanying statement remained hawkish, as the Bank of Russia is still "open the prospect of further key rate rises (plural) at its upcoming meetings".

We believe the decision and the statement is intended to send a clear signal about the priorities of monetary policy at the moment, and these lie with addressing the spiking CPI and the inflationary expectations. Since the previous meeting, inflation spiked by 1.1 percentage point to 7.8% year-on-year as of 18 October, forcing the Bank of Russia to raise its year-end CPI forecast from 5.7-6.2% to 7.4-7.9%, and the 2022 average from 4.1-4.9% to 5.2-6.0% (while surprisingly keeping year-end 2022 at 4.0-4.5%) – all of which called for exceeding the standard 25 basis point step at the meeting. The average expected key rate for 2022 us now up from 6.0-7.0% to 7.3-8.3%.

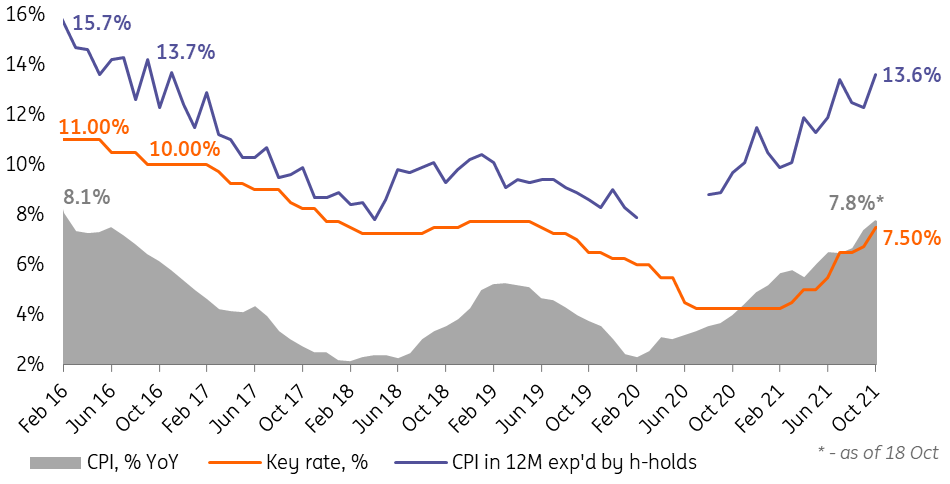

Deterioration in the households' inflationary expectations to a 5-year high in October (Figure 1), reported yesterday, may have been an important contributor to the final decision, as the Bank of Russia consistently assigned meaningful weight to medium-term expectations over the near-term CPI trends. In other words, even if the current spike in CPI is driven largely by supply-side and other one-off effects, such as a poor vegetable harvest and pre-election social payments, the CBR has to react to contain second-round effects on inflation.

The CBR has to react to contain second-round effects on inflation

The recent new wave of a pandemic in Russia was apparently neutral for the decision. To remind, amid record high rates of new infections, mortality, and sluggish vaccination rate the government has implemented a nationwide period of non-working days in the first week of November, while the city of Moscow and the Moscow region (26% of the Russsian GDP) announced a 1.5 week semi-strict lockdown starting 28 October affecting offline non-essential retail and services (we believe up to 30% of the gross regional product could be affected). According to our estimates, such a lockdown could cost around 0.1% of annual GDP per week (vs. 0.25% during the first lockdown of April-May), unless it is extended in time and geography.

Strictly speaking, the local pandemic is indeed supposed to be neutral for the CBR position, as there are no historical indications that lockdowns are disinflationary, and the CBR's more dovish "Worsening Pandemic scenario", mentioned in the recent monetary policy guidelines, pertains to global pandemic and decline of global prices and demand, rather than local deterioration. In fact, the global picture is creating risks of materialization of another CBR's alternative "Global Inflation scenario", which is more hawkish. Ideally, the negative effects of lockdowns on businesses and households are to be addressed through the budget policy tools, not monetary ones.

Figure 1: Bank of Russia raises rates, as CPI and households' inflationary expectations touch 5-6 year highs

Hike cycle not over, positive for ruble in the near-term.

Ahead of the governor's press-conference, which may add some more colour on the Bank of Russia's way of thinking, we take the decision and the medium-term signal as hawkish. Our base case now is a 25 basis point hike at the upcoming December meeting. The longer-term trend appears clouded. On the one hand, the signs of stabilisation on the global agro market, recent decline in PPI off its peaks, a 12-month long deceleration in the monetary supply in Russia, tight fiscal signals, strong ruble – are all arguments in favour of normalisation in the inflationary trend in Russia due to local factors. On the other hand, the deterioration in the global inflationary context may be creating grounds for a shift from the Bank of Russia's base case scenario to the Global Inflation scenario, which would call for a more restrictive approach of the local monetary authorities.

Ahead of today's meeting the market was ready for a 50 basis point hike, and the ultimate 75bp decision accompanied by a hawkish signal was a surprise to analysts and the market participants. Given that the market CPI expectations are rather sticky, the real key rate in Russia is now 3.0-3.5%, according to our estimates, which is materially higher than 0.5-1.0% seen a year ago. This can further increase attractiveness of the ruble from the portfolio flows perspective. The ruble should now more strength against peers and euro, may now test the USDRUB 70 level in the near-term, while our year-end 73.0 target is now seriously challenged.

For the long-term prospects of ruble and OFZ (the latter has naturally reacted negatively to today's decision), Bank of Russia's credibility as an inflation targeter is gaining importance. The fact that the regulator decided to maintain the 2022 year-end CPI forecast unchanged at 4.0-4.5% is a risk factor for the market to trust the CBR. If for various reasons the CBR is forced to increase it, the perception of CBR's control over inflation may deteriorate, and the perceived real rate will decline.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap