Russian inflation has likely peaked, but the downward slope is unlikely to be steep

Russian inflation ticked up in March, and will now start decelerating thanks to stabilisation in global food prices and the high base effect. But the continued pick-up in non-food prices, particularly for gasoline and demand-driven items, remains a watch factor. Bank of Russia will be deciding between a 25 and 50 basis point hike this month

| 5.8% |

March inflation, % YoYup from 5.7% in February |

| Worse than expected | |

Role of durables gained importance

Russian CPI was reported at 5.8% year-on-year in March, up from February's 5.7% YoY, in line with the market consensus. There are both positive and negative observations from the data and context. On the positive side, the annual inflation rate seems to have peaked, and is likely to go down from here, helped by the stabilisation in the global prices for key agricultural items in March, and by the higher base effect for local CPI, that will be gaining importance starting from now, as inflation picked up by 3.2 percentage points in the last 12 months. On the negative side, we note continued acceleration in prices for most of the non-food products, which could flatten the downward slope of CPI from now on, and can be interpreted by the Bank of Russia as supportive of their positive take on the strength of the consumer recovery.

In more detail:

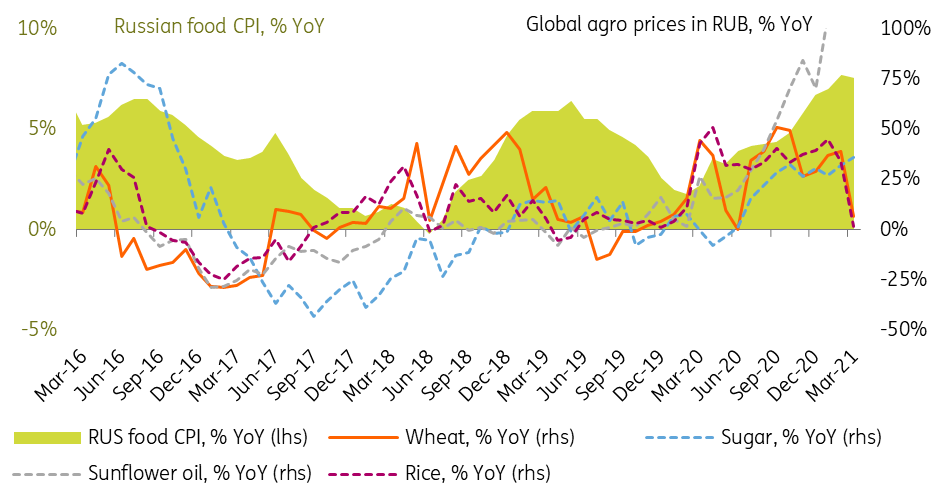

- Food CPI slowed down modestly from 7.7% YoY in February to 7.6% YoY in March, mainly on the higher base effect. There were also some exceptions, such as meat and fish, where price growth continued accelerating. The good news is that the global context of agricultural prices is improving (Figure 1). The bad news, however, is that the recent administrative price control actions can lower the food price sensitivity in both directions.

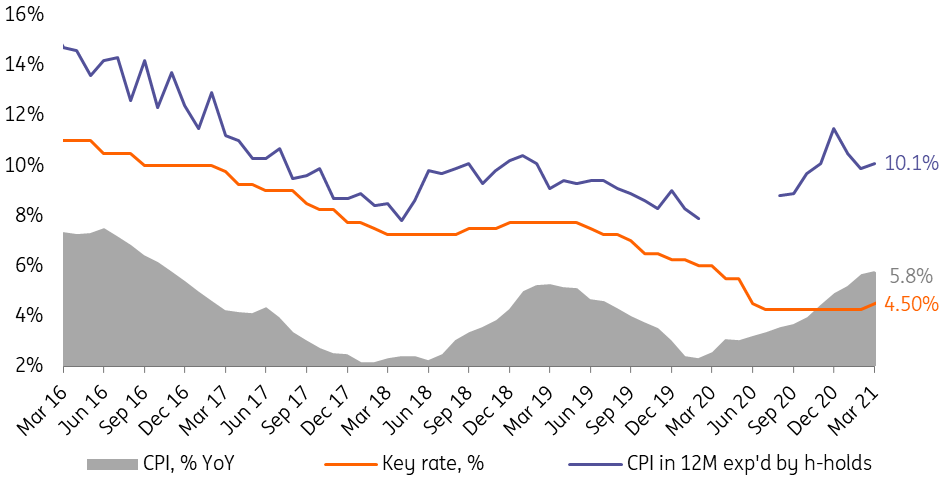

- Non-food CPI kept accelerating from 5.7% YoY to 5.9% YoY despite the higher base effect. The pick-up is seen in most of the items, most importantly in gasoline (up from 4.1% YoY to 5.2% YoY, the highest rate since April 2019) despite the price control mechanisms in place. This makes non-food CPI the key driver of acceleration in inflation in March (Figure 2). There were notable exceptions to the price pick-up, such as consumer electronics, though it remains unclear if that can put a dent in the Central Bank of Russia's confidence in the strong consumer recovery. The upcoming Presidential address, to be held on 21 April, will be a watch factor for signs of extra budget spending plans this year. On the cost side, the recent ruble depreciation is also not helping in terms of CPI expectations.

- Services CPI also accelerated, from 2.9% YoY to 3.2% YoY, the highest level since the end of 2019. The pick-up is seen in most of commercial services, along with higher availability, including in the foreign travel segment.

Figure 1: Food price growth stabilised globally and locally

Figure 2: Non-food price growth has gained importance to the overall basket, hinting at demand-driven pressure

Inflation has peaked, but the outlook is not too rosy

Even though Russian inflation has probably peaked in March and is likely to decelerate to 5.5% YoY in April, we expect it to remain above 5% until November, and see upward risks to our year-end 4.2% target. The risk factors include elevated ruble volatility, delayed effects of administrative price controls in socially-sensitive items, secondary effects of gasoline price growth, and potential increase in the budget spending plan this year ahead of the September Parliamentary elections.

We believe that at the upcoming central bank meeting on 23 April, which will take place after the Presidential Address on 21 April, will remain focused on the pro-inflationary risks and will be deciding between a 25bp and 50bp key rate hike.

Figure 3: Inflation has likely peaked, but the downward slope could be flatter than expected

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap