Russian FX purchases likely peaked in September

The Finance Ministry announced FX purchases of US$4.5bn for September, in line with our expectations. The limited scope for a further increase in purchases, continued strength in the current account, and portfolio inflows into OFZ are all positive for the ruble, but a bullish take is vulnerable to risks of private capital outflows and global USD strength

| 327bn |

September FX purchases, RUBup from RUB316bn in August |

| As expected | |

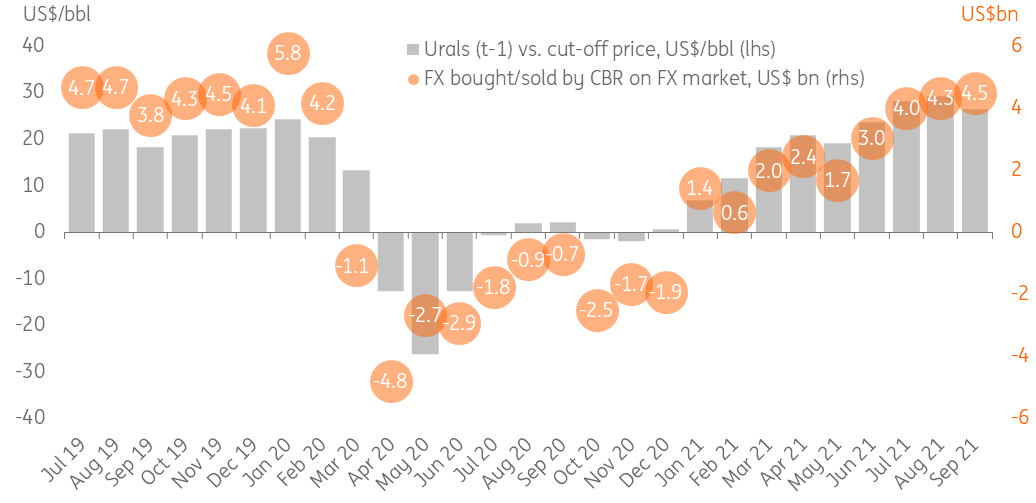

The Russian Finance Ministry announced today that monthly FX purchases will increase from August's RUB316bn to RUB327bn in September, corresponding to an increase from US$4.3bn to US$4.5bn (Figure 1) at the current FX rate. This increase is in line with our expectations and slightly higher than Reuters' consensus of US$4.2 bn. Noteworthy, the FX purchases, which are equal to the extra fuel revenues of the budget, showed a minor increase despite the recent decline in the average monthly oil price. This suggests that the price effect was offset by higher volumes in response to an easing in the OPEC+ quotas starting August. We continue to see FX purchases as neutral for the ruble in the near term.

- Given the recent stabilisation of oil prices and based on the ING house view on crude, we do not see material upside in monthly FX purchases until year-end.

- This year, the ruble is not facing the usual seasonality for the third quarter, meaning that because of still-restrained outward tourism, elevated non-fuel exports (metals, grains, etc.), and lower dividend outflows, the overall shrinking of the current account has been avoided. Following the higher-than-expected July current account surplus of US$8.7 bn, we expect August and September figures to be in a US$5-8bn range each, which is enough to finance the FX purchases.

- In addition, portfolio inflows to the local currency public debt (OFZ) remain strong, with net inflows picking up from US$2.3 bn in July to US$2.5 bn in August, with inflows continuing into the beginning of September. Russia's relatively solid fiscal position and prudent monetary policy stance (based on expected CPI, the real key rate is 2.0-2.5%) are supportive for inflows. The forthcoming key rate decision, where we expect another 25bp hike to 6.75% combined with a cautious signal, would further highlight the attractiveness of local assets.

- Still, there are at least two risk factors to a benign ruble view for the medium-term. Domestically, private capital outflow remains an issue, and we believe the ruble's underperformance vs. its peers (the ruble depreciated against the USD by 0.1% throughout August, while the ruble's peers gained 0.9%) is an illustration. Externally, the growing uncertainties regarding the global USD prospects in the face of a coming Fed taper and interest rate tightening also cannot be ignored.

September FX purchases up to US$4.5 bn, likely at peak

FX purchases should remain neutral for the ruble as long as the non-fuel portion of the current account remains strong. This seems to be the case so far, with the next checkpoint being the August balance of payments data on 9 September. The continued portfolio inflows into OFZ are creating positive near-term momentum for the ruble, challenging our USD/RUB74.0 target for the end of 3Q21. Meanwhile, we would warn against making bullish medium-term calls now, when the issue of high private capital outflows from Russia remains a concern, and there is little clarity regarding the global market's potential reaction to a coming Fed taper.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap