Cut in Russian FX purchases could give the ruble time to breathe

A $0.8bn cut in monthly FX purchases to $1.6bn in May, amid a strong oil price environment, recovery in foreign portfolio inflows, and extended foreign travel restrictions, creates a favourable environment for the ruble this month. But the global mood, local imports, private capital flows, and foreign policy remain restraining factors

| 124 |

May FX purchases, RUB bndown from April's RUB 186bn |

| Lower than expected | |

Monthly FX purchases cut in May, below expectations

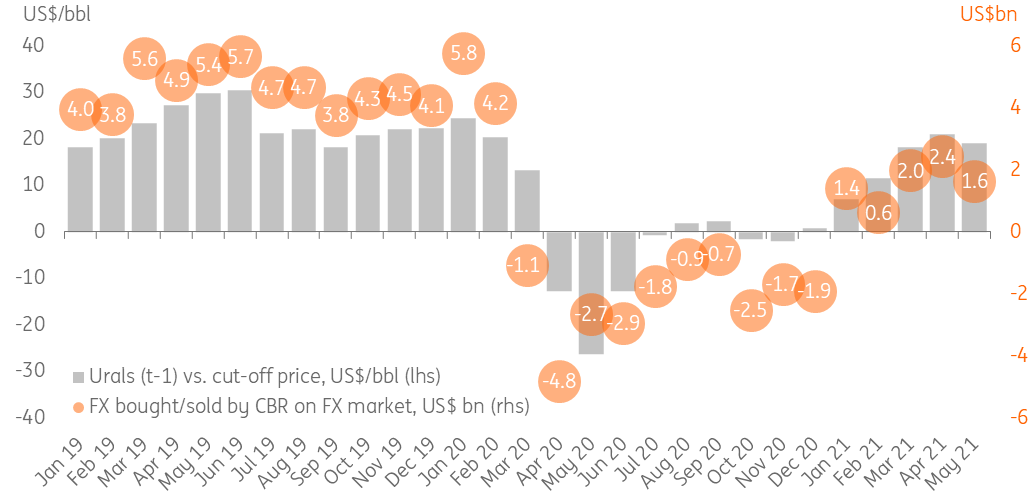

The Russian Finance Ministry announced a cut in monthly FX purchases from $2.4bn in April to $1.6bn in May (Figure 1), underperforming the market consensus, which expected relatively unchanged volumes. While a decline was in line with our expectations, the scale of it was twice as large.

Looking at the structure of the May purchases, it appears that the $1.6bn is comprised of $2.3bn of expected extra budget oil and gas revenues and a $0.7bn downward revision in the April revenues. The de-facto expected increase in the oil and gas revenues of the budget in May, despite a relatively flat oil price environment in April, is not entirely surprising and related to the 2% monthly increase in oil production in Russia.

While in the long-run, FX intervention is largely neutral for the ruble, the current drop in May purchases coincides with a recovery in oil prices closer to $70/bbl, and the latter will be reflected only in June's FX purchases. This may create a small and temporary sweet spot for the ruble this month.

In addition, as soon as the government finalises its plans for local investments from the National Wealth Fund (earlier statements suggest around RUB1tr over the period of 2021-2023), the central bank should react by lowering the market FX purchases by that amount. If the preliminary government estimates are confirmed, it should mean a drop in expected annual FX purchases for 2021-23 by $4-5bn per year, potentially lowering our annual expectations for 2021 from $25bn to $20-21. However, the timeframe for the announcement has yet to be determined.

Figure 1: Monthly FX purchases to decline despite strong oil price environment and recovery in production

Balance of payments still in focus

We see additional short-term support factors for the ruble this month:

- First, the monthly current account, which is stable in Jan-Apr, usually starts to decline in May due to the start of the vacation season, subsequently falling to or below zero in June due to the accrual of corporate dividends attributable to strategic foreign investors. However, those factors are unlikely to have a strong effect this time. This is thanks to the travel ban on outward tourism to Turkey at least until the end of May, while charters to Egypt will likely commence only in the second half of May. Also, the 24% year-on-year drop in 2020 corporate profits (according to Russian accounting standards) may suggest smaller pressure from dividend outflows this year relative to the $10bn accrued in June last year. Because of that, we expect the 2Q21 current surplus to remain in a $10-15 range, close to the $17bn reported in 1Q21.

- Second, foreign portfolio flows related to state ruble bonds (OFZ) seem to be improving this month, with $0.4bn of inflows seen in the last five trading days after four months of continuous outflows totalling almost $6bn and leading to the foreign participation share dropping from 23% to below 19%. The current recovery is supported by the recent improvement in the global bond market mood, an easing in foreign policy tensions related to Russia, and tightening in the local monetary policy approach.

At the same time, these support factors alone are not enough to guarantee the ruble's appreciation deeper into the USD/RUB 70-75 territory. This is still conditional on developments in several areas:

- The current account may still come under pressure from accelerating import growth, which totalled 12% YoY in 1Q21 and may jump 18% in 2Q21, largely on low base effects, but also reflecting some substitution of foreign travel with foreign goods consumption and intermediary and investment imports related to infrastructural investment programmes.

- The private capital account remains a risk factor, with 1Q21 net private outflows reached $12bn on the resumed accumulation of foreign assets.

- The public capital account is also not out of the woods given the persistent uncertainties around foreign policy and sanctions prospects (2 June is the deadline for the US to decide on the sanctions against Russia related to the use of chemical and biological warfare).

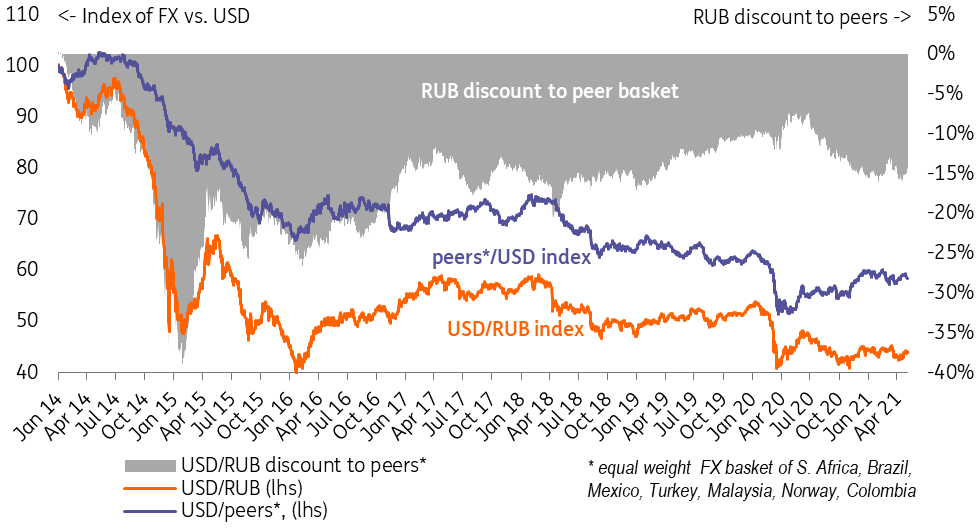

- Global emerging market risk appetite is also a factor to watch: while the ruble's discount to EM/commodity peers seems to have stabilised (Figure 2), the overall EM FX space is so far reluctant to show more strength relative to USD, staying virtually flat year-to-date despite an accommodative monetary policy stance in developed markets. The Federal Reserve, which may be forced to tighten its stance earlier than expected, is also one to watch in this regard.

Figure 2: EM/commodity FX flat to USD year-to-date, RUB's discount to peers also stabilised

The ruble has further room to recover in May , but the mid-year target of USD/RUB 75 still stands

The drop in FX purchases amid strong oil prices, the potential announcement of a cut in annual FX purchases due to NWF's local investments, extended foreign travel restrictions, and a recovery in foreign inflows into OFZ support positive momentum for the ruble this month. Meanwhile, uncertainties around global risk sentiment, accelerating local import growth and the volatility of capital flows limit the room for long-term appreciation. We see USD/RUB in a 73-75 range in May, confirming our 75 target for the end of June.

The Bank of Russia's preliminary estimate of April's balance of payments, to be released on 19 May, will be the next important data point to watch.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap