Russian inflation hits 6.5%, and can go higher

Russian CPI jumped to 6.5% YoY in June and kept accelerating in the first week of July. While supply-side inflation seems to have stabilised, demand-driven CPI stands out in pharma, construction materials, and tourism sectors. Near-term inflationary risks remain high, keeping the Bank of Russia – and the markets – on their toes

| 6.5 |

June CPI, % YoYup from May's 6.0% YoY |

| Worse than expected | |

Inflation keeps accelerating but is becoming more segmented

Russian CPI totalled 0.7% month-on-month and 6.5% year-on-year in June. This result represents a material acceleration from the May figure of 6.0% YoY, and it is in line with our expectations, which apparently were a bit more pessimistic than the market consensus. In addition, the weekly data points at 0.33% price growth in the first 5 days of July vs. 0.3% in the first 6 days of July 2020, suggesting an inflation rate of 6.5-6.6% YoY as of 5 July. We have the following observations and takeaways.

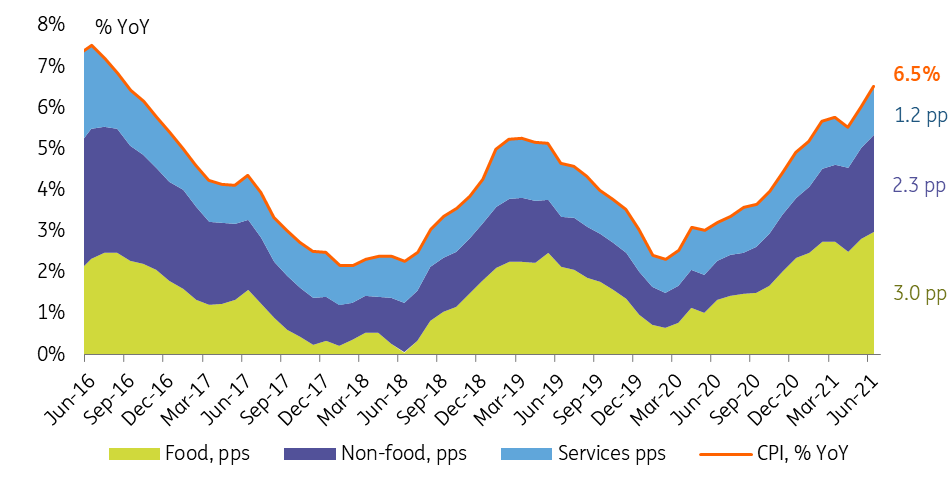

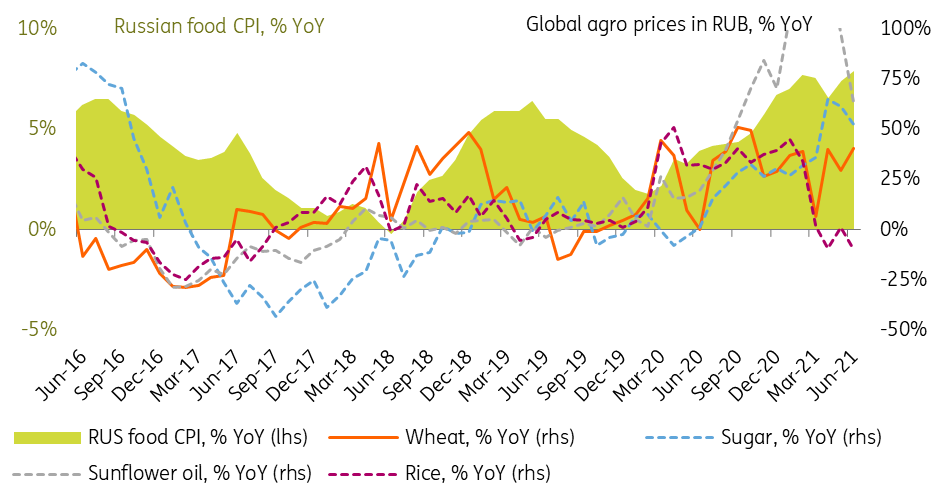

- Cost-pressures in the food segment persist but are becoming more nuanced. Food CPI continued to accelerate from 7.4% YoY in May to 7.9% YoY in June, and its contribution to the overall inflation went up 0.2 percentage points to 3.0% (Figure 1). Meanwhile, if previously the acceleration was more or less even, now we see outperformance of the meat, fish, and volatile fruit and vegetable segment. At the same time, grains and bread price growth saw deceleration, reflecting some stabilisation of the global agro price growth (Figure 2).

- Construction materials and pharma are leading the non-food inflation, which also kept creeping higher from 6.7% YoY to 7.0% YoY, now contributing 2.3 ppt to the overall CPI. Much like in the food segment, the situation here is also uneven. On the positive side, price growth in gasoline, regular consumer goods (including electronics) stabilised. But on the negative side, we see rapid acceleration in construction materials from 16.4% YoY in May to 23.9% YoY in June amid the extension of the subsidised mortgage programme and faster retail lending growth. Also, pharma price growth accelerated to 6.2% YoY, possibly reflecting higher demand as Russia entered the third wave of Covid in June, with new infection rates and mortality increasing significantly.

- Summer travel is heating up. Services segment also saw a spike in price growth from 3.3% YoY to 4.0% YoY and its contribution to overall CPI by 0.2 ppt to 1.2%, partially due to the low base effect, but also on increased demand for travel. The key subsegments contributing to the pick-up include passenger transportation, rehabilitation, foreign tourism, and insurance. This coincides with the summer vacation season (last year, strict lockdowns lasted till midsummer) and reopening of a number of foreign travel destinations.

- Early July numbers are not as bad as they might seem, but still point at risks. A 0.3% CPI spike in the first 5 days of July (and 0.5% in the week starting 29 June) may seem as an extremely large figure after 0.7% growth for the whole June, but there's no need to panic. First, there's an annual increase in the regulated tariffs for communal housing services every 1 July, which this year totalled 3-4% and contributed to up to 0.2 ppt out of 0.3% month-to-date CPI growth. Second, starting this July, Rosstat has started accounting for the average prices of tours to Turkey and expanded the list of construction materials included in the weekly CPI item list, which may also have added pressure to CPI numbers. On the positive side, we see stabilisation of the weekly price dynamics in some food items and even seasonal deflation in some fruits and vegetables. On the negative side, the overall price pressure in the consumer goods remains elevated.

Figure 1: CPI back to a 5-year high, pressure comes from all key segments

Figure 2: Global agro price context stopped deteriorating, but the risks are there

Risks of further acceleration remain high

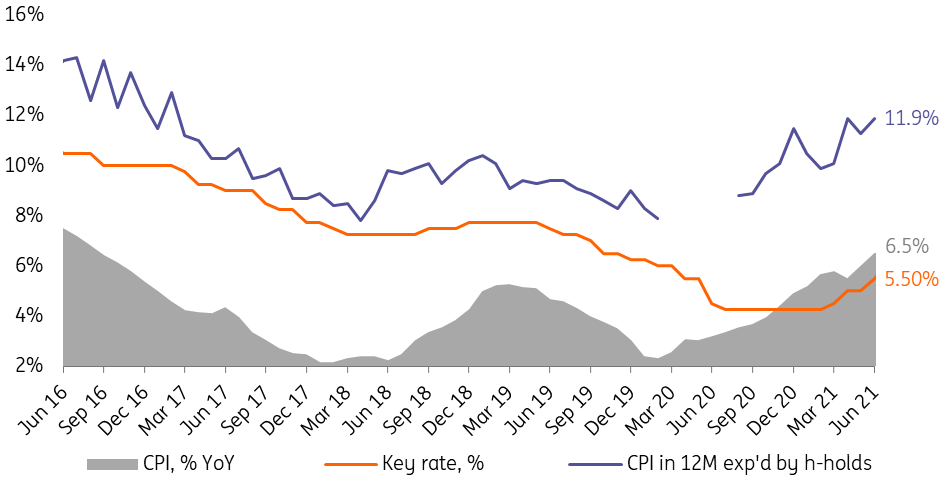

Overall, the CPI performance in June and early July supports our recent decision to worsen Russia's CPI and the monetary policy outlook. While the inflationary risks in the food and consumer electronics sectors may subside thanks to global commodity and FX factors, the demand-driven pressure in construction materials, pharma, and tourism are here to stay, as long as the real estate market is booming, the Covid context is worrisome, while demand for travel is high. We would not exclude further accleration in the CPI rate to 6.6-6.7% YoY in July, with deceleration possibe only in the very end of the year thanks to the higher base efect. The balance of risks to our new year-end CPI target of 5.7% YoY is still tilted to the upside. The base case for the 23 July rate hike is 75bp, and the highest discussed 100bp also cannot be fully ruled out.

Figure 3: Fast acceleration in the CPI suggests that the key rate ceiling is in the 6.5-7.0% range

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap