Russian balance of payments affected by one-offs in August, generally benign for rouble

The Russian balance of payments seems to be affected by one-off events, which had little effect on the exchange rate. Meanwhile, the apparent strength in the underlying current account trend and continuing portfolio inflows into OFZ are supportive of the rouble for the time being

Russia's preliminary balance of payments numbers for 8M21 suggest a material and surprising widening in August's current account surplus and net private capital outflow.

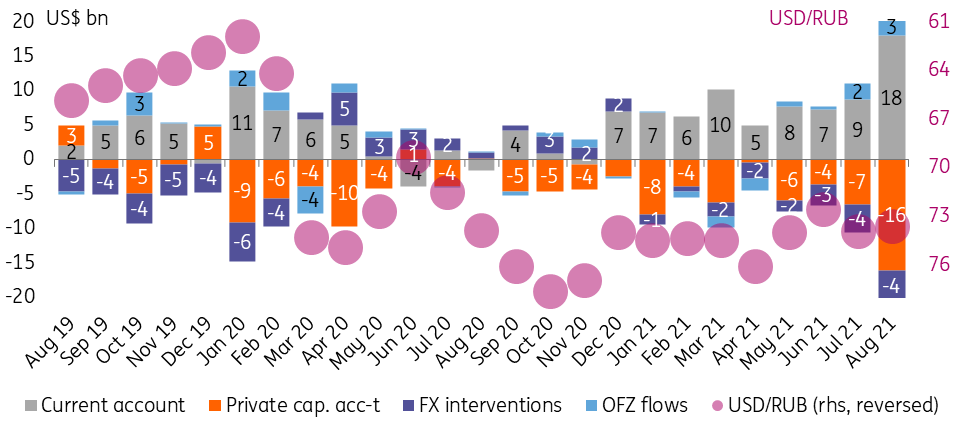

Based on those estimates, the current account surplus widened to US$18.0 bn in August (to US$69.7 bn year-to-date), which is twice the July figure and is materially higher than the US$5-8bn we anticipated. A similar situation is with the net private capital outflow picking up from monthly US$4-6 bn in May-July to US16.2 in August. The counterbalancing effect of the two resulted in a muted USD/RUB performance in August (Figure 1), suggesting that the widening in both items was technical, most likely reflecting a large export prepayment that the receiver opted to keep abroad.

The less realistic explanations include additional transactions with Belarus following the EU sanctions on the latter (although the volumes of transactions would appear too large for Belarus' monthly exports of US$2-3 bn) or accounting for IMF's allocation of US$17.5 bn in SDRs for Russia (but the latter is already accounted for in central bank reserves and does not require the private sector to be involved).

In any case, even excluding the surprising volumes, the overall balance of payments structure appears solid for now.

- According to the CBR commentary, the current account in 8M21 benefitted from strong fuel and non-fuel exports, which in our view reflects higher commodities prices (oil, metals, grain) and volumes of oil exports starting 2H21. The growth in exports is so far outpacing the recovery in imports of goods and services, as foreign travel remains relatively restrained. Based on the 8M21 result, the full-year current account may reach US$90-95bn.

- The private capital account remains the weak link, as the apparent acceleration reflects the non-financial corporates' outward investments, including FDI. This highlights the lack of interest for the corporate sector to convert export revenues into local investments. This is an important restraining factor for the ruble appreciation in the long term.

- Minfin's FX interventions appear less of an issue, given that they are likely to peak at US$4-5 bn per month this year, not exceeding the expected current account. In addition, the government's plans to invest RUB1.5-1.6 tr, out of the National Wealth Fund into the local infrastructural projects in 2022-2024 should lead to a respective cut in the FX purchases by the CBR (provided the government proceeds with the plan).

- Portfolio inflows into OFZ remain the tipping point for the ruble in the near term. So far, the context has remained favourable, with inflows picking up from US$2.3 bn in July to US$2.5 bn in August, and inflows continuing into September at US$0.6 bn to date, on a combination of weak US labour data and hawkish CBR. However, the portfolio flows remain the most volatile item, subject to a constellation of risk in the medium term.

Figure 1: August balance of payments affected by record high current account and capital outflow, a suggesting a possible one-off factor

Near-term RUB outlook favorable, longer-term trend clouded

A combination of strong exports and continuing portfolio inflows into OFZ amid delayed Fed tapering suggests some room for USD/RUB appreciation to 71.5-72.5 range in September. At the same time, the traditional set of external and local challenges to the capital account suggest limited room for appreciation till the year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap