Russian activity exceeds expectations in April

Russian retail trade posted a 34.7% YoY jump in April, mostly on base effect, but also supported by higher employment and income, as well as acceleration in retail lending and still positive budget expenditure growth. Producer activity also exceeded expectations, creating upside to our full-year projections and supporting central bank hawkishness

| +34.7 |

Russian retail trade in April-2021, % YoYafter 22.0% YoY drop in April-2020 |

| Better than expected | |

Consumption growth surprised on the upside

The annual St. Petersburg International Economic Forum ended on a positive note, thanks to Rosstat. Retail trade was reported up 34.7% year-on-year, exceeding our and consensus expectations. While such a large number is obviously assured mainly by the low base effect (in April 2020, the first quarantine month, retail trade was down 22.0% YoY), the result is still positive. First, it suggests that the April 2021 retail trade is 5.1% higher than in April 2019. Second, part of the recent strong results reflect real improvement in the underlying trends.

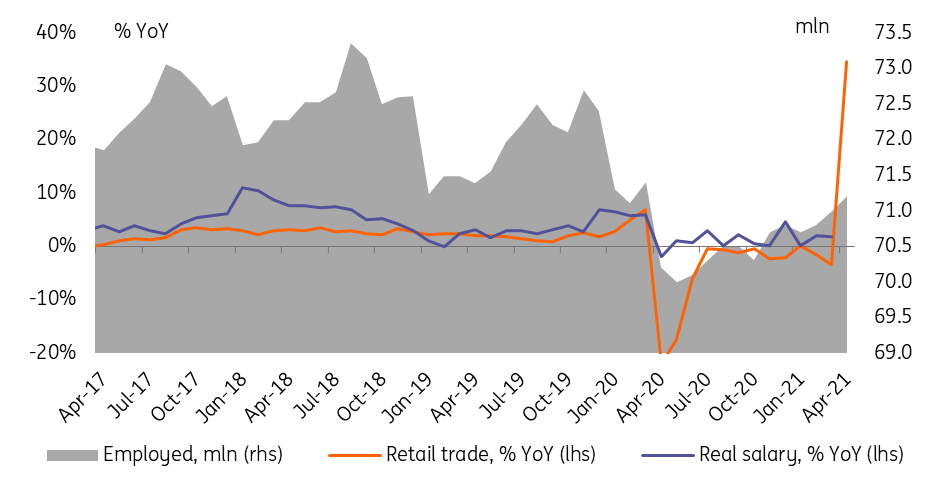

- Labour market conditions improved (Figure 1), with unemployment down from 5.4% to 5.2% and the number of officially employed up to 71.2 million, close to the pre-Covid March 2020 level of 71.4 million. Real salary growth (reported with a lag for March 2021) remained strong at 1.8% YoY, also exceeding expectations.

- With extended limitations for outward tourism to popular destinations, including Turkey and Egypt, the local retail trade appears well supported at least till June. This led to increased reliance on imports. According to preliminary customs data, the non-CIS imports (covering around 90% of Russia's total imports) were up 49% YoY in April and 39% YoY in May, with food imports growing 15-20% YoY, electronics by 40-50% YoY and vehicles by 140% YoY.

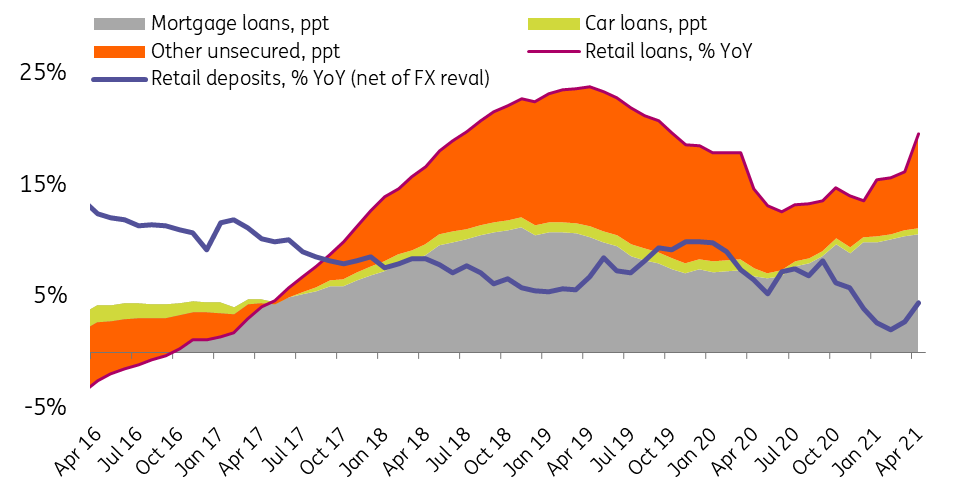

- The role of the banking sector in funding the consumer activity also seems to have increased (Figure 2), as retail lending picked up to 20% YoY, back to growth rates seen in 4Q19, prior to Covid. Recent indications by the Bank of Russia suggests that the acceleration seen in the recent months is driven by consumer lending. Retail deposit growth also recovered, but very modestly to 4.4% YoY in April (net of FX revaluation effects), which is still close to historical lows.

Figure 1: Retail trade is up mostly on low base effect, but also thanks to a stronger labour market

Figure 2: Reliance on retail lending is increasing

Producer trends also constructive

In addition, the producer side proved stronger than expected:

- Industrial output, as we mentioned earlier, posted a broad-based recovery, exceeding the low base effects. Expectations of a further increase in oil&gas production and support to consumer-focused sectors create positive expectations for the near term.

- Construction growth finally picked up to 7.2% YoY in April after a largely flat beginning of the year, with housing construction being up 87.6% YoY reflecting the sector finally catching up with the increased demand for real estate, propelled by the subsidised mortgage programme (the latter has been extended by the president on Friday).

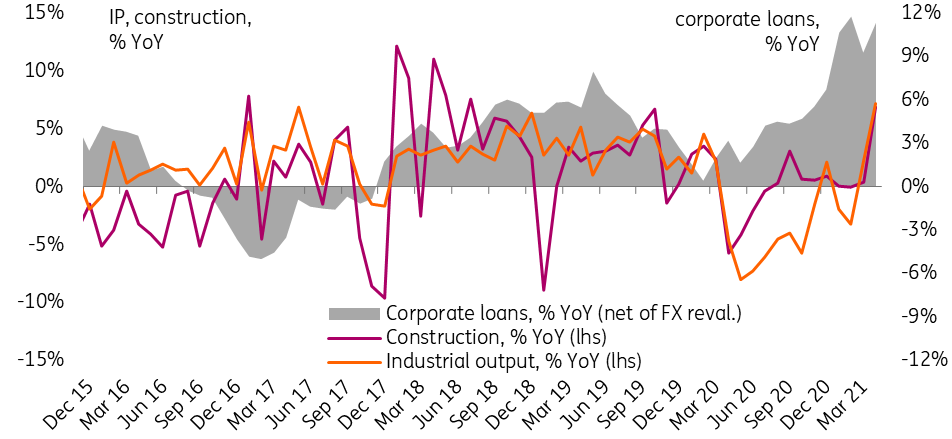

- The uptick in the industrial and construction numbers seem to be accompanied by some increase in the lending activity (Figure 3), with corporate loan book growth at 11% YoY (net of FX revaluation), the third double-digit month this year. That may signal some recovery in private CAPEX activity. So far, the fixed investment trend has been weak, with only 2.0% YoY growth reported for 1Q21, with an increased share of budget-funded projects.

- The fiscal policy has so far been accomodative of the producer trends, as nominal federal expenditure grew 6% YoY in April despite a high base. The primary drivers of the increase seem to be defense and healthcare spending, positive for the state-focused industries.

Figure 3: Producer trends are looking up on low base effect, but also accompanied by higher lending activity

GDP, CPI, and key rate forecasts have upside

Based on the strong and broad-based economic performance in April, our 2Q21 GDP expectations of just 6.0% YoY and full-year 2.5% YoY are starting to look conservative. However, the fast recovery in imports is a watch factor.

In addition, the April numbers, which show strong consumption amid faster lending and tighter labour markets, may add strength to Bank of Russia's cautiousness about inflation. The upcoming May reading is likely to reach a new high of 5.8-5.9% YoY, suggesting that the 11 June rate decision will again be between a standard 25bp and a more aggressive 50bp hike.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap