Russia: Post-electoral blues continue

Latest figures confirm our expectations of a weakening of consumption amid slowing income growth and a higher preference for saving. Producers are also cautious, as faster industrial output and construction reflect a low base effect. The latter seems to be the only guaranteed support factor for 4Q18 GDP growth

| 1.9% |

Retail trade growth YoY2.6% YoY for 9M18 |

| Worse than expected | |

A weakening in the overall consumption trend

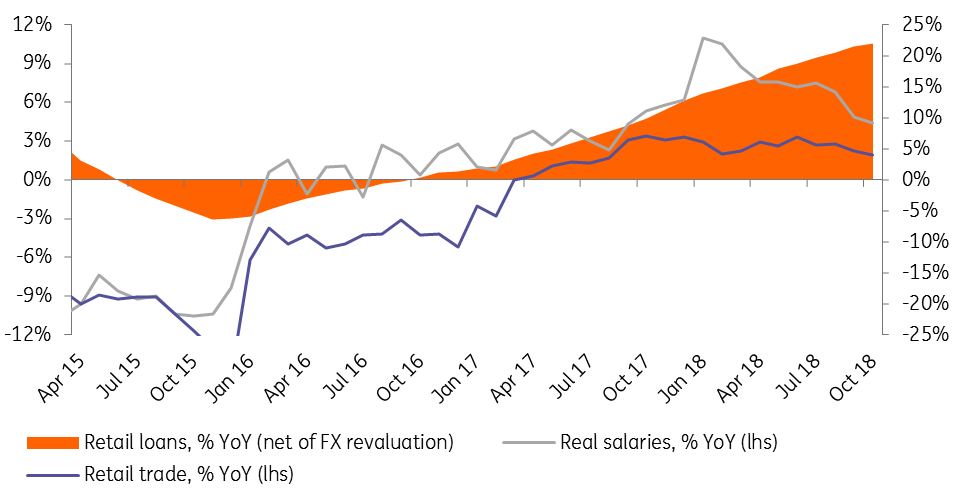

Russian retail trade decelerated from 2.2% YoY in September to 1.9% YoY in October, close to our 2.0% YoY forecast, which was more cautious than the 2.4% YoY consensus. The slowdown was driven purely by the non-food segment and most likely reflected a gradual decline in consumer confidence. The income trend weakened, with unemployment increasing from 4.5% to a still low 4.7% YoY, and real salary growth decelerating to 4.4% YoY (vs our 6.0% YoY forecast and 7.0% YoY consensus). In fact, Rosstat, the national statistics service, has materially downgraded the September real wage figure from 7.2% to 4.9% YoY, reflecting a ~2 percentage point cut in nominal wage growth estimates for September. A brief glance at the sector breakdown of the salary growth suggests that the slowdown in nominal wage growth from 10.7% YoY in 9M18 to 8.1-8.4% YoY in September-October took place among all of the major sectors, except for commodity extraction, financial sector, healthcare and education. This suggests that the income growth coming from the high oil prices and state support as part of social support from the state has failed to prevent a weakening in the overall income trend.

We do note, however, that despite the deceleration, labour income still materially outperforms the consumption, which allows the population to accumulate savings. According to the recent Central Bank (CBR) data, retail deposit growth accelerated to 9.3% YoY in October, including 10.4% YoY growth in ruble deposits, which account for 79% of the total retail deposits. Meanwhile, the continued acceleration in retail loan growth to 22.1% YoY in October suggests that the higher income households maintain consumer confidence, however, the fast lending trend might be approaching its turning point in the medium term.

Overall, we expect the consumption trend to remain under pressure due to slowing income growth, the upcoming VAT hike in 2019 and limited scope for further reliance on leverage.

Key events in EMEA and Latam next week

https://think.ing.com/articles/key-events-in-emea-and-latam-next-week-151118/

Key indicators of the consumer trend

Producer trend to provide support in 4Q18, but only statistically

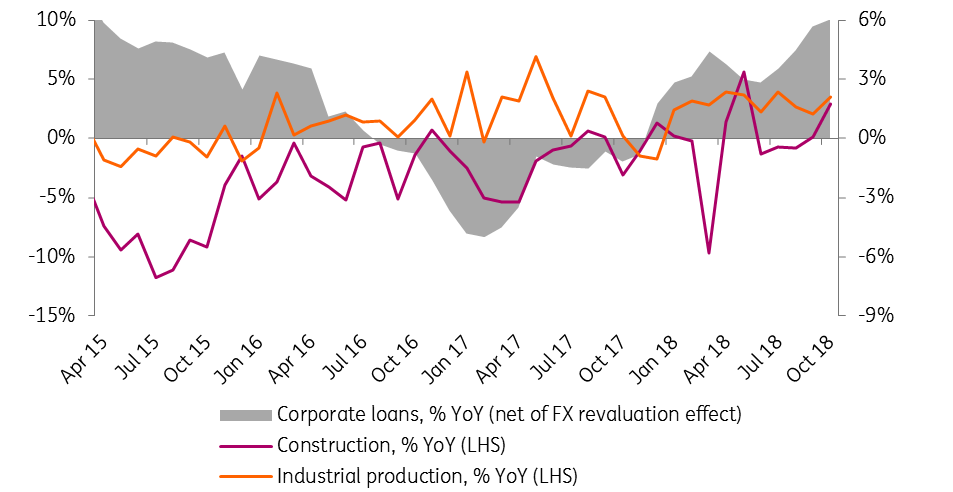

October producer data may appear more inspiring, but only at first glance. Indeed, industrial production growth accelerated from 2.1% YoY in September to 3.7% YoY in October, however, this number was very close to our 3.5% YoY expectations and reflected mainly the low base effect of October 2017. The same is true for the construction data, which showed an acceleration from 0.1% YoY in September to 2.9% YoY in October. We see Russian production data benefiting from the low statistical base through all of 4Q18, which should accelerate from 1.3% YoY in 3Q18 to 1.6-1.8% YoY in 4Q18 - but this should not be taken as a sign of higher producer confidence.

We also do not see corporate lending growth, which accelerated to 6.0% YoY (adjusted for FX revaluation effect) in October from 5.7% YoY in September, as a sign of faster activity, as it is still low and may reflect the replacement of foreign debt (down by US$15 billion in 3Q18) and local bonds (stagnating since April this year) amid challenging external market conditions.

One positive news from the recent set of producer data is the acceleration in fixed investment from 3.2% YoY in 1H18 to 4.2% YoY in 9M18. This implies a 5-7% YoY investment growth in 3Q18. At the same time, the longevity of this trend remains a question, especially given the recent indication from Gazprom, that the main bulk of the Power of Siberia project, which has been one of the key drivers of investments, will be completed before this year-end.

Key indicators of the producer trend

Overall, we reiterate that the weakening consumer trend and uncertainties surrounding investments could result in calls to ease the budget policy in 2019-21 relative to the current draft, which assumes a breakeven Urals price of US$50 per barrel and a budget surplus of 0.8-1.8% of GDP per annum amid flat expenditures at 17% of GDP and higher taxation. Meanwhile, the accelerating CPI and persisting external uncertainties are likely to prevent any easing in monetary policy anytime soon.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap