Russia key rate to be cut, dovish guidance may be reinforced

The central bank has an opportunity to make the first rate cut - to 7.50% - on 14 June, as a number of risks have failed to materialise. The central bank is also likely to confirm room for further rate cuts in the future. However, we still see a number of risks of cuts being too fast on the way to the terminal 6.5% rate

CBR to make the first cut as early as 14 June

While following the Central Bank of Russia's (CBR’s) April announcement that the first key rate cut may take place in 2-3Q19, we were unsure about the CBR’s ability to make the first move before September 2019, a number of global and local developments has pushed the likely timing to June.

- global markets are now confident in a more dovish Fed stance, with the implied probability of a September Fed cut increasing from 30-50% to nearly 100%.

- risks to RUB exchange rate have so far failed to materialise, as the local currency remained stable in May, supported by continuous foreign portfolio inflows into the local state debt market (OFZ) of around US$3 billion.

- local CPI rate continued to undershoot expectations, decelerating from 5.2% YoY in April to 5.1% YoY in May, and preliminary data for the first week of June suggests a possibility of CPI going below 5.0% YoY soon. Households’ inflationary expectations seem to have moderated.

Mid-term guidance the key focus

Now, as only a very strong negative external surprise could stop the cut next week, the key question is the forward-looking guidance. We expect some downward revision in the CBR’s CPI outlook for year-end 2019, which is currently 4.7-5.2%, higher than our 4.6% forecast. This would confirm the downward mid-term trend in CPI and the key rate, however, a number of risks could still prevent the CBR from being too aggressive in the way to the terminal rate, which we see at 6.5% and to be reached in 2020:

- the recent US$15/bbl drop in the oil price, re-ignition of US-China tensions, combined with the local dividend season (up to US$9 billion to be converted into FX) and stable US$5-6 billion monthly FX interventions suggest persisting risks to RUB.

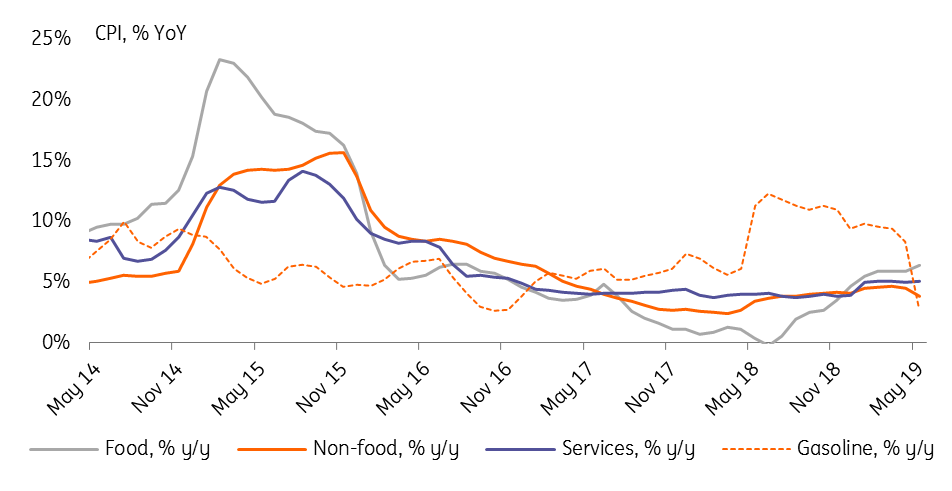

- we are concerned that the May CPI slowdown was driven largely by the base effect-related slowdown in gasoline price growth (from 8.3% YoY in April to 2.8% YoY in May), which may have started to pick up again, based on the most recent weekly CPI data. Other components of the CPI basket, including food and services, have shown an acceleration in the annual price growth, and the core CPI posted an acceleration from 4.6% to 4.7% YoY.

- the slowdown in RUB retail and corporate deposits evident from the recently released April banking data suggest that too fast cuts may increase risks of re-dollarization.

CPI growth by segments

For now, we expect two 25 basis point cuts to take place this year – in June and September, with risks to this view skewed towards more cuts in 2019 depending on the tone of the CBR guidance on 14 June and if the risks to RUB for 3Q19 we have indicated earlier keep failing to materialise.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap