Russian key rate is on the way to double digits

Russia's central bank has raised its key rate by 1 percentage point to 9.5%, and the upside remains. The wording of the commentary has become more hawkish, and new guidance of CPI and the average key rate now exceed levels outlined earlier in the central bank's alternative 'Global inflation scenario'. We are on the way to double digits

| 9.5 |

Russian key rate, %a 100 basis point hike |

| As expected | |

Headline decisions in line with expectations, but details are pointing at bigger near-term concerns

Bank of Russia raised its key rate by 100 basis points to 9.50% on Friday, in line with our expectations. The market consensus was also hovering around 9.50%, but the range of expectations was rather wide, between 9.0% and 10.0%.

The commentary reiterates the signal given in December: "The Bank of Russia holds open the prospect of a further key rate increase at its upcoming meetings", confirming further upside to the key rate. At the same time, looking deeper into the text, we see qualitative signs that the Central Bank of Russia (CBR) has become more worried about inflation in the near term. We would like to highlight the key changes versus the previous statement:

- "The balance of risks has tilted even more towards proinflationary ones", "dominating influence of inflationary factors has led to a more substantial and prolonged upward deviation of inflation from the target"

- Corporate "price expectations are growing, reaching new multi-year highs"

- "Rising nominal interest rates has not yet ensured a sufficient increase in the propensity to save and more balanced lending dynamics"

- "In Q4 2021, the Russian economy noticeably deviated upwards from the balanced growth path"

- "Short-term proinflationary risks associated with volatility in global financial markets caused by, among other factors, various geopolitical events, intensified, which may affect exchange rate and inflation expectations

The quantitative part of the communication is also inflation-weary, with year-end 2022 consumer price index (CPI) guidance raised from 4.0-4.5% to 5.0-6.0% (in line with our expectations) and average key rate expectations increased from 7.3-8.3% to 9.0-11.0%, higher than our 9.0-10.0% call and exceeding the numbers outlined earlier in the Bank of Russia's alternative Global Inflation Scenario. The 2023 forecasts were also raised, but 2024 remained largely unchanged.

Double digits are possible in March

Ahead of the governor's press conference today, the CBR's written communication looks hawkish. The guidance suggests that the average key rate until the year end could be anywhere between 9.1% and 11.3%. Our average CPI projections for 2022 are currently at 7.5%, closer to the upper range of CBR's 6.8-7.7%. Combined with growing external inflationary risks, the ultimate Russian average key rate is more likely to approach the upper border of the CBR's expectations rather than the lower one.

With this in mind, it is clear that the hike cycle is not over, and entering the double digits is a question of time. The next decision will take place on 18 March, which is a limited timeframe for important data to come in. That might limit the next hike at 25-50 basis points, in our view. But the overall upside from the current levels should now be seen at 50-100 basis points at least, with limited visibility in terms of timing of reversal.

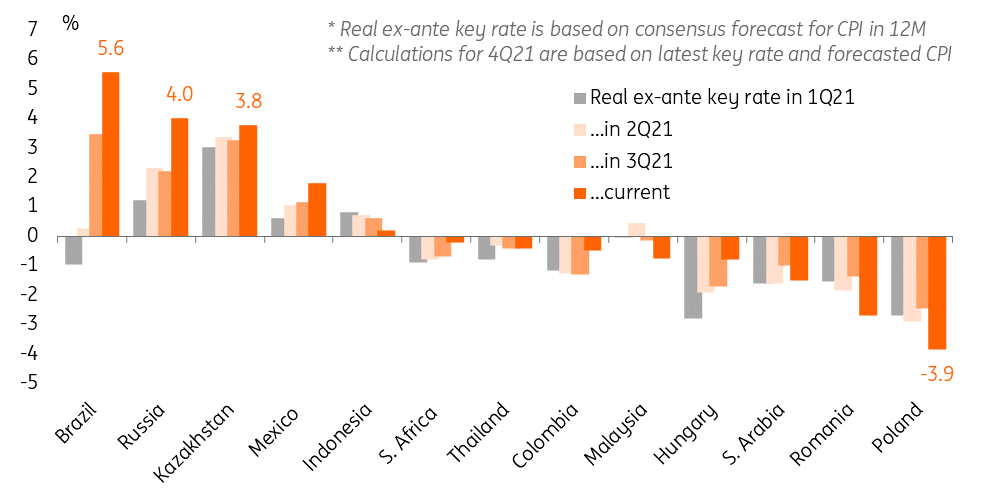

The factors that are constraining the upside to the key rate include relatively high nominal and real levels vs. peers (Figures 1 and 2), a spike in Covid infections amid elevated mortality (Figures 3 and 4), and the focus of current CBR communication on the near-term risks amid relatively stable longer-term outlook.

Figure 1: Nominal key rate in Russia and peers

Figure 2: Real key rates in Russia and peers (based on expected CPI in 12 months)

Figure 3: Covid infections are on the rise in Russia

Figure 4: Covid mortality stopped moderating in Russia

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap