Why we expect a significant rate rise in Russia this week

We're expecting at least a 75bp rate hike in Russia on Friday and it could be even bigger given the near-term inflationary risks. But moderating food inflation, a slowdown in M2 growth, a likely weakening in GDP momentum and the already high ex-ante key real rate should limit the mid-term rate ceiling at 6.5 to 7%

| 6.25% |

Russia's expected key rateA 75 basis point hike on 23 July |

Inflationary pressures in Russia are building and that's why we're expecting the country's central bank, the CBR, to make a 75 to 100 basis point hike to either 6.25 - 6.50% this Friday. That's towards the upper band suggested by previous guidance.

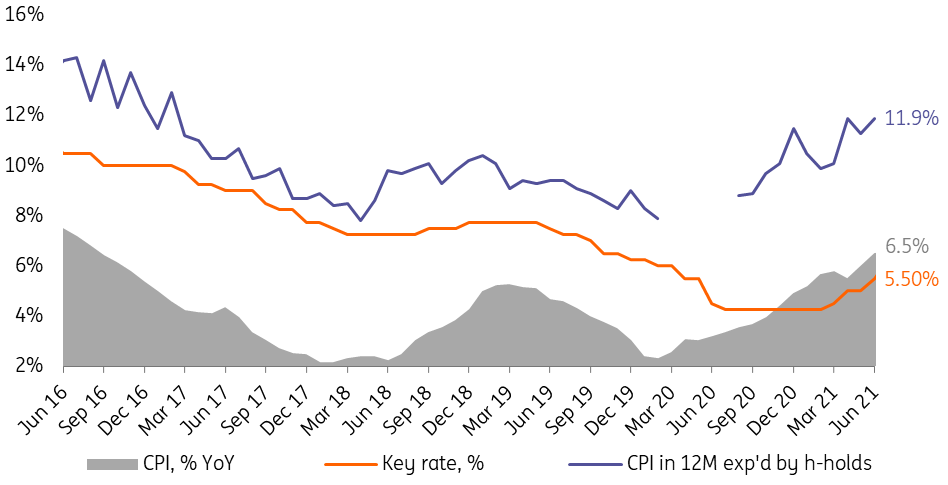

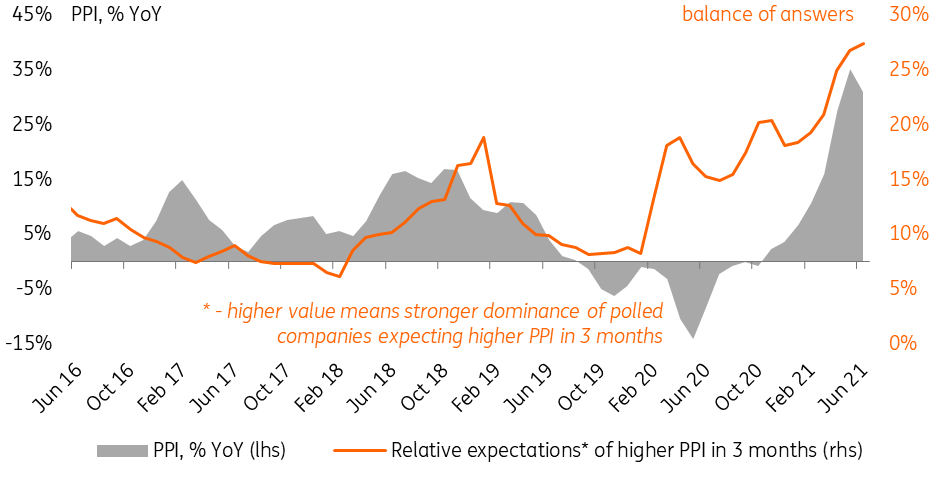

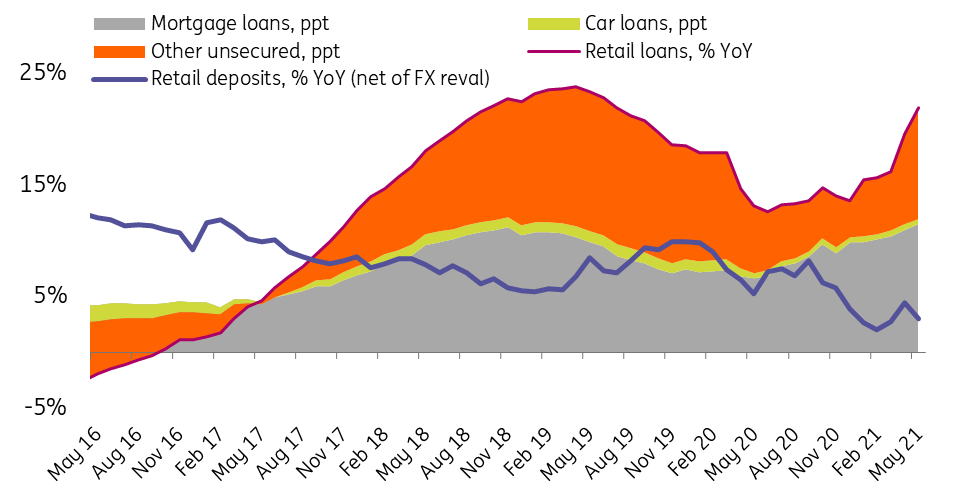

All that's illustrated by the charts below. Russian CPI spiked by 0.5ppt to 6.5% YoY in June, exceeding market consensus. The second shows banking sector data pointing to a decline in households' preferences to save. The third indicates that inflation expectations by households and corporates are continuing to climb on both supply and demand-side push factors.

The tightening cycle may continue afterwards, as near-term inflationary risk appears significant, with global CPI on the rise, the local labour market becoming tighter, cost inflation continuing, and credit demand increasing. We see the medium-term ceiling for the nominal key rate in the 6.50-7.00% range, which should be reflected in a somewhat less aggressive tone from the CBR commentary this Friday.

CPI hit a new high of 6.5% YoY in June

Consumers’ inflationary expectations keep growing

Corporate inflationary expectations at historical highs

The Producer Price Index exceeded 30% YoY

Household savings rates keep declining

We see several factors limiting the key rate upside after 23 July:

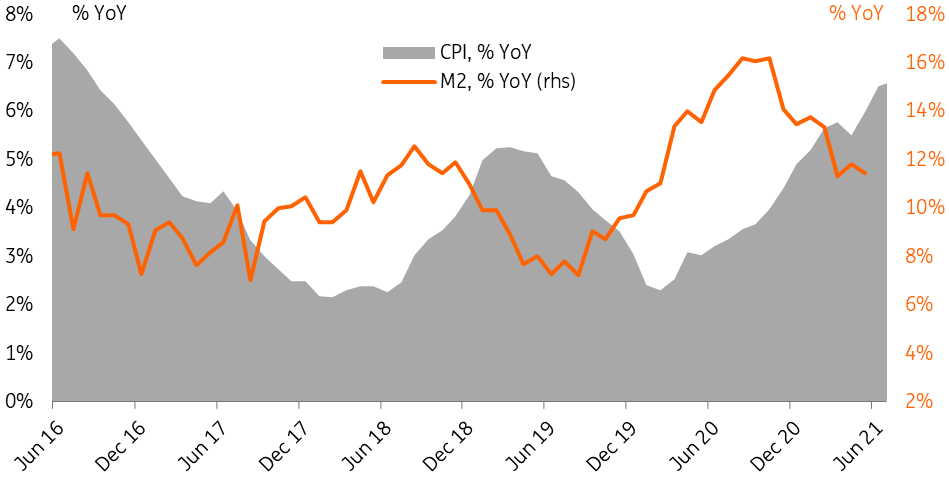

- First, monetary inflation in Russia should moderate from September this year, or around 12 months after monetary supply growth had peaked, in line with historical sensitivity.

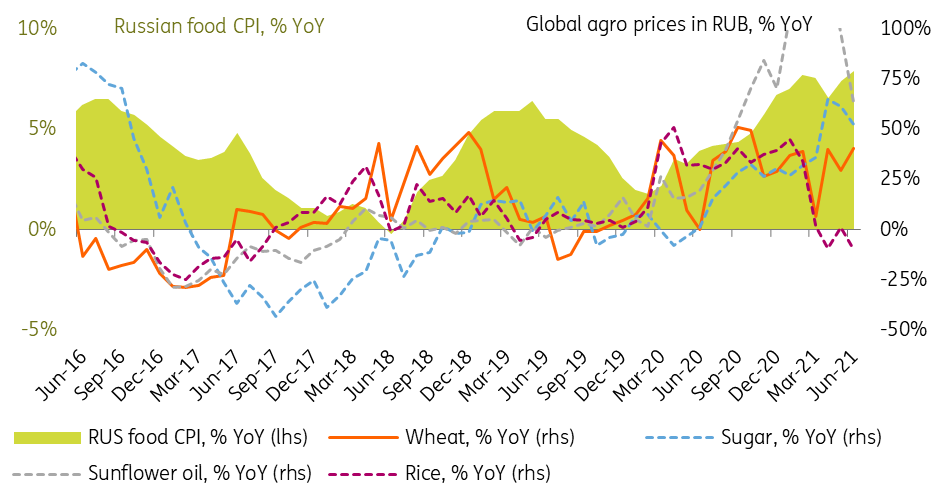

- Secondly, the risks in the food CPI segment seem to be stabilising thanks to global trends. We now see limited upside to our year-end CPI target of 5.7%.

- Thirdly, GDP growth prospects starting from the second half of this year appear less certain as the economy has reached pre-pandemic levels, outward tourism is reopening, while fiscal and monetary policy are becoming conservative and risks of a third wave of the pandemic are materialising.

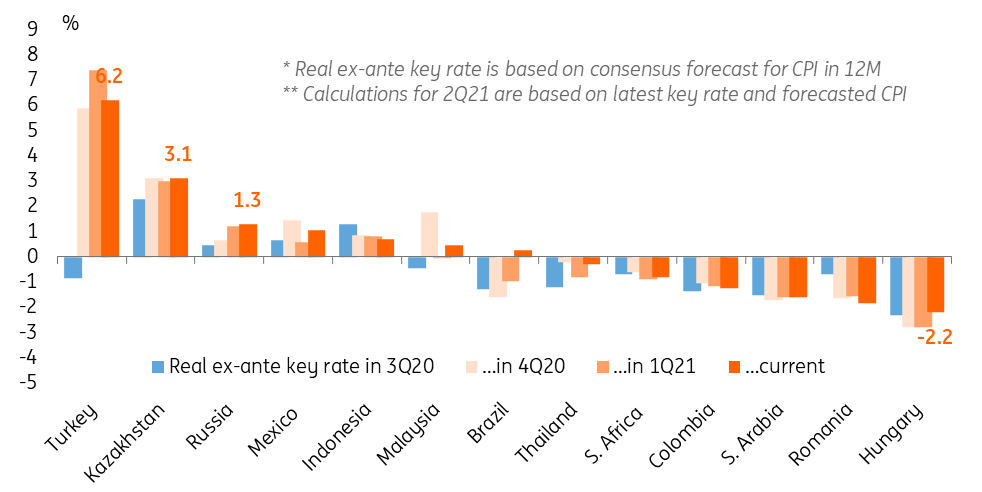

According to the latest data, even though the vaccination rate in Russia improved in July, it is still at 22%, which is lower than the peer average of 34% (including 50%+ in the Czech Republic and Hungary), while the new infection rate is close to the second wave peak of 25 thousand per day and mortality is 700-800 per day, which is a historical high for the Covid pandemic locally (the second wave peak was in the 500-600 range). Finally, a 75-100 bp hike this Friday would lead to the ex-ante real key rate of above 2%, the upper border of the neutral policy stance, leaving some room for higher CPI expectations without the need to push the nominal rate higher.

M2 growth peaked around one year ago

This suggests an easing in monetary inflation starting in September

Global food price growth is stabilising

Russian real rate is in the top 3 among its peers

It is, so far, within the CBR’s neutral 1.0-2.0% range

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap