Russia: higher FX purchases in March - not yet a challenge to the rouble

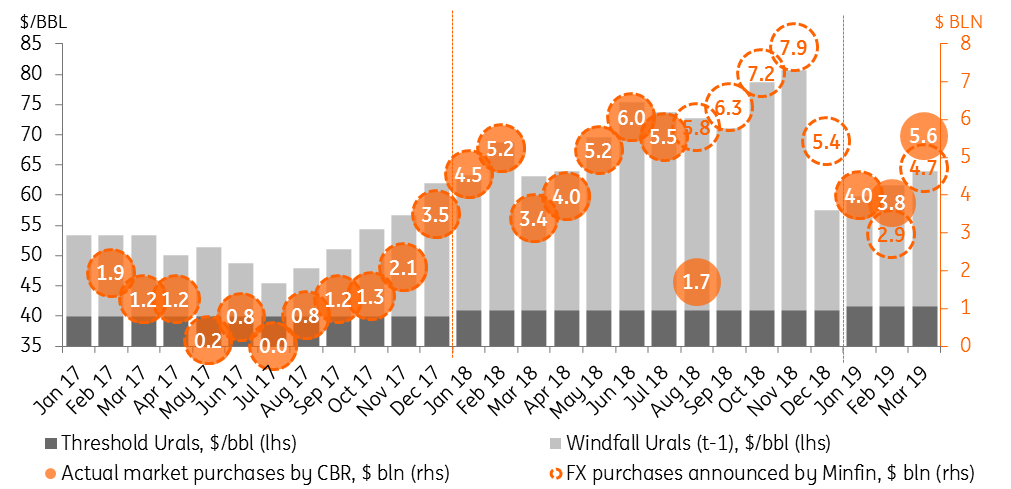

The Russian Ministry of Finance has announced $4.7 bln FX purchases for March, exceeding $3.7bn consensus and our $4.1bn expectations. Combined with the backlog from 2H18, total FX purchases in March will reach $5.6 bln. We do not see this as a threat to RUB in the short-term thanks to the $9-10bn monthly current account in 1Q19. Mid-term risks are mounting.

| RUB310bn |

Minfin's FX purchases for Marchup from RUB194 bln in February |

| Higher than expected | |

The Russian Finance Ministry announced that it will channel RUB310bn ($4.7bn equivalent at the current FX rate) for FX purchases between March 7 and April 4, in accordance with the budget rule. The sum comprises the RUB270bn in extra oil&gas revenues of the budget expected in March (in line with our forecasts) and the RUB40bn upward revsion in the extra oil&gas revenues for February (the only reason why the total number is higher than expected). Combined with the catching up on the August-December 2018 backlog, when the Bank of Russia put market purchases on hold, the total amount of FX purchased on the market will total $5.6bn in March, up from the $3.8-4.0bn seen in February.

The upward revision in February oil&gas revenues is a positive surprise in terms of budget execution, suggesting that the budget surplus might have increased from RUB0.3trln in January 2019 to RUB0.35trln in 2M19. At the same time, the increase in FX purchases in March vs. February was not a surplrise given the recent growth in the oil price and the calendar factor, which suggests higher physical volumes of produced and exported hydrocarbons this month.

Monthly FX purchases by Russian Finance Ministry/Central Bank

We do not see the increased FX purchases as a near-term threat to the ruble exchange rate. The expected current account surplus of $9-10bn per month in February-March (after $12bn in January) is enough to cover both the FX purchases and the very light net redemption of the corporate foreign debt (c.$1bn per month), allowing us to keep to expectations of RUB appreciation in the near term. At the same time, from the balance of payments perspective we are increasingly concerned by the large net private capital outflow of $10bn seen in January, related mainly to foreign asset accumulation. Uncertainties related to corporate flows, combined with a more cautious global market mood, forces us to moderate our optimism for RUB, seeing end-March USDRUB at 65.0 vs. our previous 64.0 forecast.

Due to seasonality, Russia's current account surplus is set to shrink to $4-6bn per month in 2-3Q19. Assuming unchanged FX purchases, this could make the ruble more vulnerable to portfolio flows that are subject to mood swings. Russia attracted $0.8bn of foreign inflows into the local state bond market (OFZ) in January on the back of recovery in global risk appetite and the lack of new foreign policy pressures. The ability to boost this inflow going forward remains uncertain. We now see our year-end RUB target of USDRUB 65.0 as a a bit optimistic even under the assumption of geopolitical status quo.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap