Russia: Higher FX purchases in July put non-oil balance of payments in focus

The increase in FX purchases in July, to US$4bn, is in line with expectations and reflects strong exports. But we doubt that high oil prices and a tighter monetary stance can offset the negative effect of accelerating goods and services imports, ongoing dividend payments and weak local and global capital flows. We remain cautious on the ruble for 3Q21

| 296bn |

July FX purchases, RUBup from RUB221bn in June |

| As expected | |

Higher FX purchases are in line with expectations and reflect stronger oil & gas exports

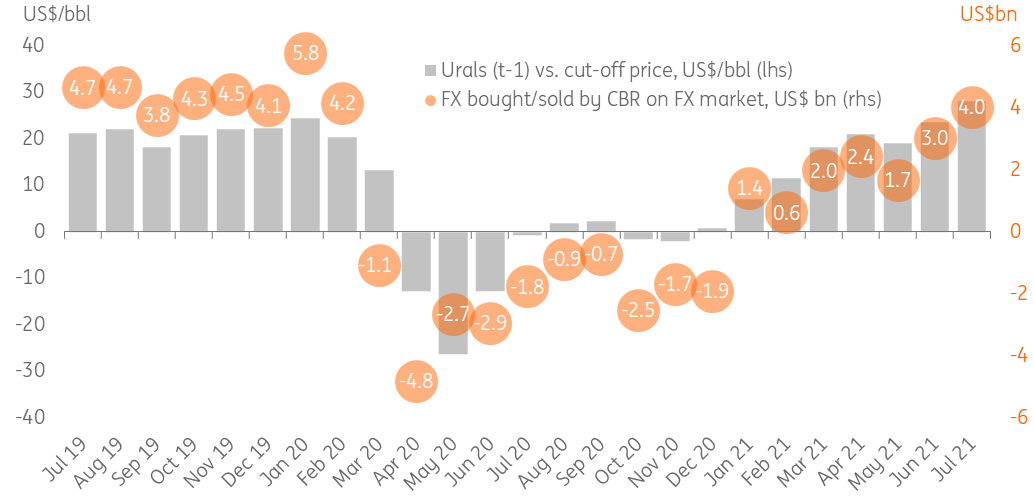

The Russian Finance Ministry announced today that monthly FX purchases will increase from June's RUB221bn to RUB296bn in July, corresponding to an increase from US$3.0bn to US$4.0bn, close to the levels seen at the beginning of 2020 (Figure 1), i.e. prior to the global Covid outbreak. The increase in July was not a surprise (we expected US$4.1bn) and was driven by continued strengthening in oil prices and an improvement in the physical volumes of oil & gas exports from Russia. From that standpoint, stronger FX intervention should be neutral for the ruble.

Based on the recent improvement in the annual average Urals assumption for 2021 from US$62.5/bbl to US$66.0/bbl, we increase our full-year current account surplus expectations from US$55bn to US$65bn. This extra $10bn will be largely sterilised by FX purchases which we now see at US$33bn for the full year (suggesting that the FX purchases in 2H21 will double vs. 1H21's US$11 bn) vs. previous expectations of US$25 bn. We note however, that the actual FX purchases volume for the year could be reduced by $3-5bn if the government manages to finalise the plan to invest that amount annually from the National Wealth Fund in 2021-23.

Figure 1: July intervention up to pre-Covid US$4bn, sterilising the strengthening oil & gas exports

Uncertainties around non-oil balance of payments force us to remain cautious on USDRUB for 3Q21

With oil & gas exports effectively sterilised by the FX purchases, the non-oil & gas portion of Russia's balance of payments should now come into focus. We believe the current account surplus for 2Q21, to be reported on 9 June, should be in a strong US$15-20bn range after US$23bn in 1Q21. But our concern is that in the second half of the year, a quick acceleration of merchandise imports (driven by the faster than expected economic recovery), and the reopening of popular foreign tourist destinations could put pressure on the non-oil current account.

The resulting contraction in the monthly current account surplus from US$5-10 bn in 1H21 to US$3-5bn amid stable FX purchases could leave the local FX market exposed to the risks related to the capital account. According to the recent estimates, the private sector's net capital outflow stood at US$18bn in 1Q21, and may remain strong in 2Q21. Meanwhile, portfolio flows to the local public debt market (OFZ) remain weak (according to our estimates, 2Q21 saw net outflows of $0.2bn after -US$2.5bn in 1Q21) and subject to risks related to foreign politics and global USD trends. Finally, we do not see the tightening in Russia's monetary policy as a strong factor of support to the ruble, as the higher expected nominal key rate trajectory reflects higher CPI expectations, which should be largely neutral from the ex-ante real rate perspective.

As a result, acknowledging the improved oil price and rate context for the ruble, we maintain our cautious view, suggesting that in 3Q21, the balance of risks to USD/RUB are tilted towards weakening to the upper border of the wide 70-75 trading range. The period from mid-July to mid-August, when the large corporate dividend payments are finalised, will be an important stress test to this view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap