Russian Inflation surprise strengthens case for rate hikes in 2021

High CPI of 5.7% calls for a half percentage point increase of our year-end forecast to 4.2%, with deceleration still expected on the more stable ruble, agricultural prices and a higher base effect. There's a case for two 25 bp key rate hikes, in April and July. Uncertainties surrounding the economy and CPI itself preclude an earlier or stronger move

| 5.7% |

February CPI, % YoYU p from 5.2% YoY in January |

| Worse than expected | |

Russian CPI trend worse than expectations - again

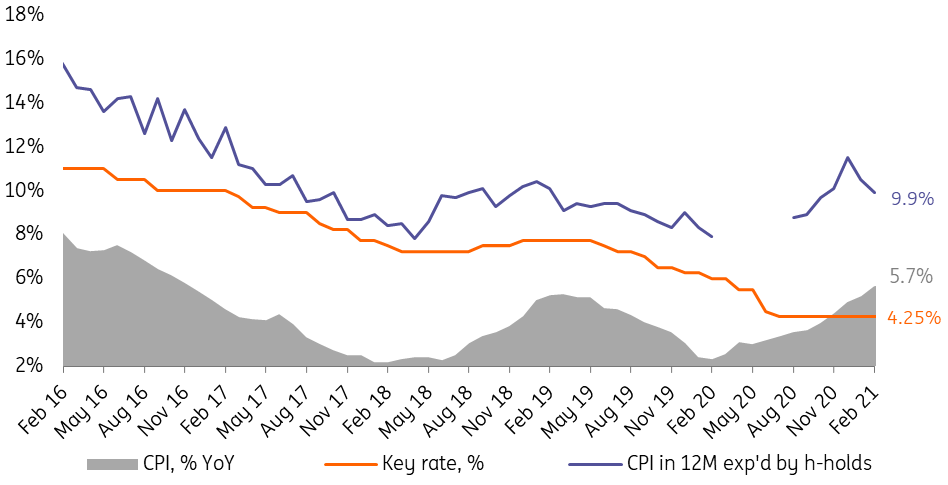

Russian inflation picked up from 5.2% YoY in January to 5.7% YoY (FIgure 1), exceeding our and the market expectations of 5.5% YoY. Here are the key takeaways:

- The acceleration itself was not a surprise, but the magnitude was higher than expected. Only 0.1 pp of the acceleration is attributable to the low base effect of February 2020 (when CPI was at a local low of 2.3% YoY), while the remaining 0.4 pps reflects an actual increase in inflationary pressure.

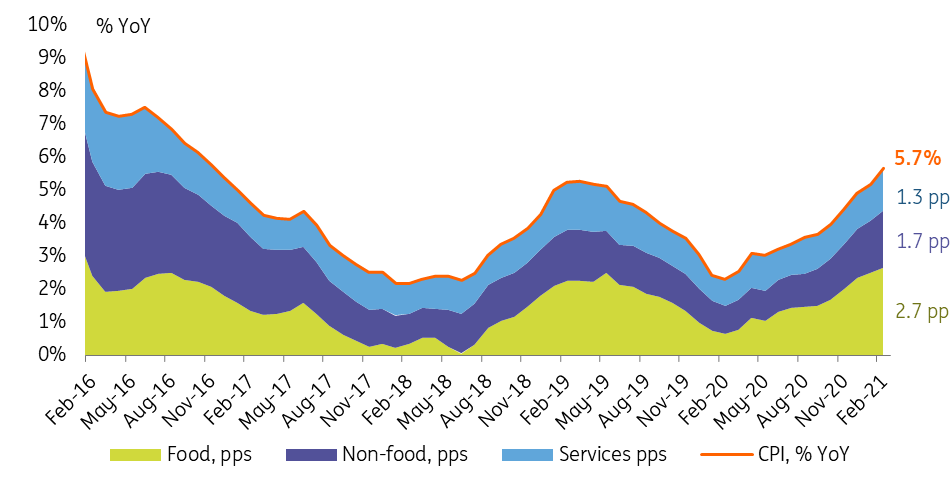

- The CPI's structure suggests that the continuing acceleration in food prices was joined by non-food and services segments (Figure 2), pointing to the lack of noticeable success in the government's food price curbing measures and hinting at the secondary effects of agro inflation on other segments.

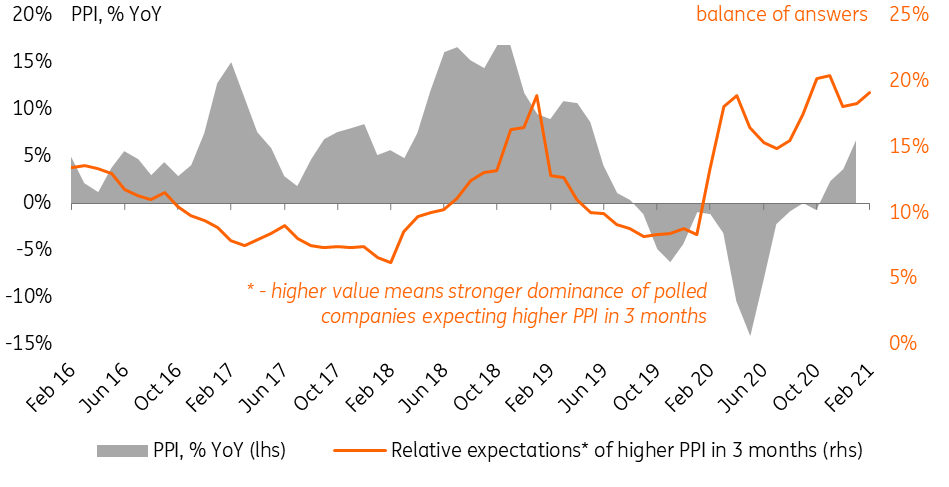

- The pickup in CPI seems to be supported by a recovery in the Producer Price Inflation, which was up 6.7% YoY in January (Figure 3), with corporate inflationary expectations close to historical highs in the last few months. The apparent pressure on corporate margins could serve as an explanation for the lack of demand-driven disinflation in 2020-21 following a long period of below-expected CPI in 2017-2019.

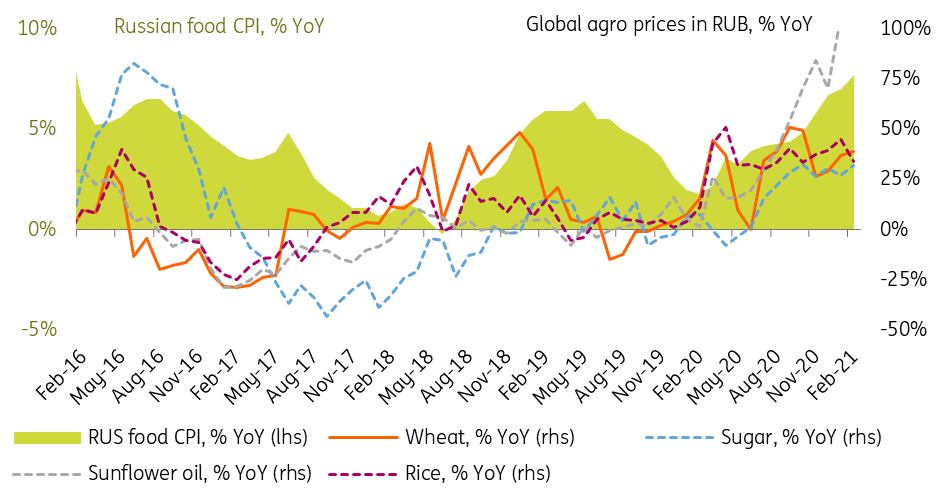

- On the positive side, one can mention stabilisation of the ruble exchange rate (supported by an improvement to the oil price outlook), and lack of further acceleration in the global agro prices in February (Figure 4). That suggests that the pro-inflationary risks are concentrated in the near-term rather than the long-term. Coincidentally, the 12-month inflationary expectations of the households seem to be off their recent peaks.

Based on the negative surprise of the CPI in February and the mounting pressure of the PPI, we raise our year-end consumer inflationary forecast by 0.5 pp from 3.7% to 4.2%, which is the upper bound of the central bank's guidance which assumes that we'll still have ruble stability and there'll be a normalisation of agricultural prices, Russian inflation should gradually decelerate from its 1Q21 peak of 5.7%, staying above 5.0% till October, but dropping rapidly in 4Q21 and 1Q22 (to below 4.0%) thanks to the high base effect. Meanwhile, the global reflation story and potential easing on the local fiscal stance ahead of parliamentary elections this September pose upward risks to this new forecast.

Figure 1: CPI up 5.7% YoY in February highlights more near-term risks, but longer-term expectations seem to have moderated

Figure 2: Higher pressure in the food segment is crawling into others

Figure 3: Demand-driven disinflation is limited by the recovery in PPI and corporate inflationary expectations

Figure 4: Stabilisation of the ruble along with agro price growth allow hopes for the stability of local food CPI in the coming months

Case for unchanged key rate in 2021 no longer sustainable

Higher than expected inflationary pressure in Russia, at least in the near term derails our earlier call for unchanged key rates in 2021, and the beginning of the key rate hike cycle, is now likely to be brought forward. A 0.5 pp increase in the expected CPI in 2021 is making two 25 bp key rate hikes to the level of 4.75% by the year-end, our new base case. Our expectations are still less aggressive than that of the markets:

- While some market participants are not excluding a hike as early as the upcoming 19 March meeting, we find it unlikely that the CBR will be ready to act without confirmation of ongoing economic recovery. Given that the February economic data is also published on the 19th, we consider the April core meeting to be the earliest possible point for a first hike.

- We continue to see the central bank's base case of 3-4% GDP growth this year as optimistic. Should the near-term economic statistics disappoint, CBR's ability to tighten the real rate would be limited.

- Stable longer-term CPI expectations of Russian households and market participants combined with expectations of flat key rate among Russia's peers (Figure 5) lower the urgency to raise the rate from the portfolio flows' perspective unless a negative scenario of tightening in Russian sanctions (state debt) materialises.

- The likely deceleration in Russian CPI at the end of the year makes April and July's core meetings a more suitable window for hikes, rather than the subsequent 2H21-1H22 period. We continue to expect another two more hikes in the second half of 2022 given the hoped-for recovery in economic activity.

As always with the case of CPI forecasts, the balance of risk to the expected rate trajectory remains skewed towards more tightening in case of a shift in peers' monetary policy stance and better than expected local growth patterns.

Figure 5: Russian real rate remains stable relative to peers, no sharp tightening needed

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap