Russia: CPI risks moderate, key rate easing still far away

We no longer expect the key rate to increase from the current 7.75%, as the February CPI growth of 5.2% year on year was slightly below our forecasts, and the inflationary expectations of households and corporates moderated. However, with uncertainties related to gasoline prices, PPI, and sanctions, the central bank is unlikely to ease before 4Q19

| 5.2% YoY |

February CPIvs. 5.0% YoY in January |

Better-than-expected CPI and moderation in inflationary expectations mean no further key rate hikes

The official estimate of February CPI, based on the monthly and the weekly data, released on 6 March, was 0.44% month on month (MoM), or 5.2% year on year (YoY), which is in line with the market consensus and slightly better than our more pessimistic forecast of 0.5% MoM and 5.3% YoY.

The acceleration vs. January's 5.0% YoY took place mainly due to the food segment, where price growth accelerated by 0.4 percentage points (ppt) to 5.9% YoY, while the non-food and services segments saw just a 0.1 ppt acceleration to 4.6% and 5.1% YoY, respectively. The composition and scale of the CPI growth in February tell us that the negative effect of the VAT hike must have been slightly muted by the weakening in the consumption trend and the freeze in gasoline prices effective till the end of March.

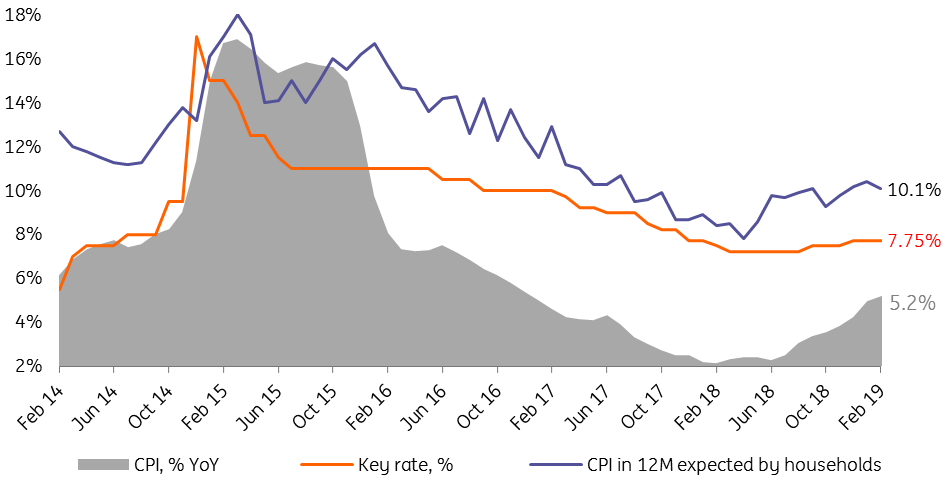

The positive CPI data is accompanied by a moderation in inflationary expectations by households and companies. According to the CBR data, CPI expected by households in 12 months went down by 0.3 ppt to 10.1%, while the index of 3-month CPI expectations by the corporates has declined materially - for the first time in over a year (see the chart below).

The abovementioned set of data somewhat eases our near-term inflationary concerns and provides a factual basis to the softening in inflationary and monetary policy signals by the Central Bank of Russia (CBR): the likelihood of CPI touching 6.0% in mid-year has indeed diminished, and we no longer expect a further hike in the CBR key rate from the current 7.75%.

Russian CPI, inflationary expectations, and key rate

Mid-term CPI uncertainties remain, prospect of monetary easing remains remote

At the same time, we note that despite the better-than-expected start of the year the longer-term inflationary trend is still facing two major uncertainties:

- The freeze of local gasoline prices, which helped contain inflationary pressure, expires at the end of March. Our understanding of the situation is that the ability to extend the agreement between the government and the oil majors may depend on some fiscal concessions, and the likelihood of the latter remains unclear. In our view, the recent downgrade in the official USDRUB forecast for 2019 from 63.9 to 66.4 should eventually lead to the improvement of the Finance Ministry's annual budget revenue plan by RUB300-350 billion - however this sum might be needed for the additional social policy measures required by the president in his recent 'State of the Nation' address.

- As the additional measures to support the household income kick in later in the year, the local corporate sector may have an opportunity to pass through some of the PPI pressure (currently at 9.5% YoY, has been exceeding CPI since September 2017) into consumer prices.

As a result, we still expect acceleration in CPI to 5.7% YoY as of mid-year, with subsequent moderation to 5.0% by the year-end. Combined with persistent uncertainties related to the sanction environment, we expect the CBR to take a wait-and-see approach to the key rate at least until 4Q19.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap