Russia: CPI keeps edging up, helped by RUB weakness

Russian inflation keeps accelerating on a combination of cost, demand, and technical factors. While we continue to see 2021 CPI risks as limited, the upward price pressure is likely to persist in the near term due to grain price growth and RUB depreciation. This should add to the list of uncertainties calling for central bank caution this month

| 3.7% |

September CPI, YoYup from 3.6% in August |

| As expected | |

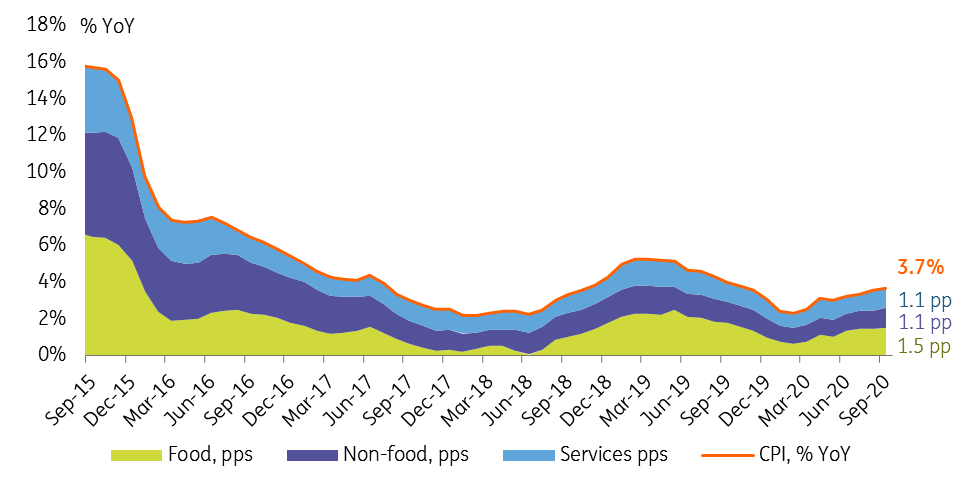

Russian CPI growth accelerated from 3.6% year-on-year in August to 3.7% YoY in September, which is in line with market consensus and our expectations. The acceleration in the annual rate vs. August is largely technical: there still was a 0.1% month-on-month deflation this September, justified by the seasonality, but it was just smaller than the abnormally wide deflation seen last year. Combined with the prevailing market focus on foreign politics and FX market, the importance of inflation readings for now may seem low. However, there are still several observations worth mentioning in our view.

- Weekly CPI data suggest that deflation is nearly over. In fact, the entire 0.1% MoM deflation was assured by the second week of September, while in the other weeks consumer prices were flat.

- Looking at the annual CPI composition, it appears that the upward price pressure is uneven among segments, with non-food CPI taking the lead for the second month in row. The key items posting above-average acceleration include consumer electronics and construction materials, which we take as a reaction to continued RUB depreciation vs. USD (by 8%) and EUR (by 12%) since mid-year, as well as demand on real estate supported by the subsidized mortgage programme, which will probably be extended for the next year.

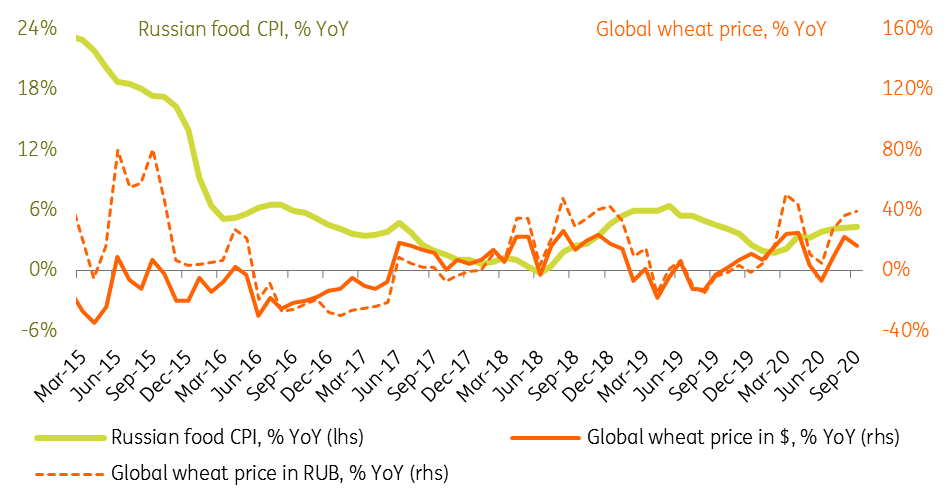

- Local food CPI is experiencing upward pressure from growth in global wheat prices, which were up 17-22% YoY in USD terms and 37-40% YoY in RUB terms in the last two months. This is a factor that is likely to prevent food CPI from posting material disinflation in the coming months.

- Acceleration in the CPI has minimized the ex-post real key rate to around 0.6%, a five-year low. Given the persistent expectations of disinflation in 2021, the ex-ante real rate is higher – at around 1%, but still below the historical highs.

Figure 1: CPI keeps growing on base effect, but role of non-food CPI is increasing

Figure 2: Growth in grain prices prevents disinflation in local food CPI

Figure 3: Near-term CPI risks lower the likelihood of key rate cut in October

Although the active phase of CPI acceleration this year is likely nearly over, our year-end expectations of 3.7% YoY are facing upward risks due to additional pressure from cost inputs and demand drivers. Near-term CPI pressures combined with mounting foreign policy uncertainties and market volatility add up to an easy call for an unchanged key rate at the upcoming Bank of Russia meeting on 23 October.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap