Russia: CPI accelerates in July, mostly on base effect

CPI picked up by 0.2 percentage points in July, and is likely to keep crawling up, mainly on the base effect, which is largely neutral for the central bank's moderately dovish stance. Meanwhile, with demand-driven disinflation not too pronounced, and some cost inflation factors emerging, the immediate rate cut in September is not guaranteed

| 3.4% |

July CPI, YoYup from 3.2% YoY in May |

| As expected | |

July CPI accelerates, mostly on the base effect but also possibly on lack of suppression from demand

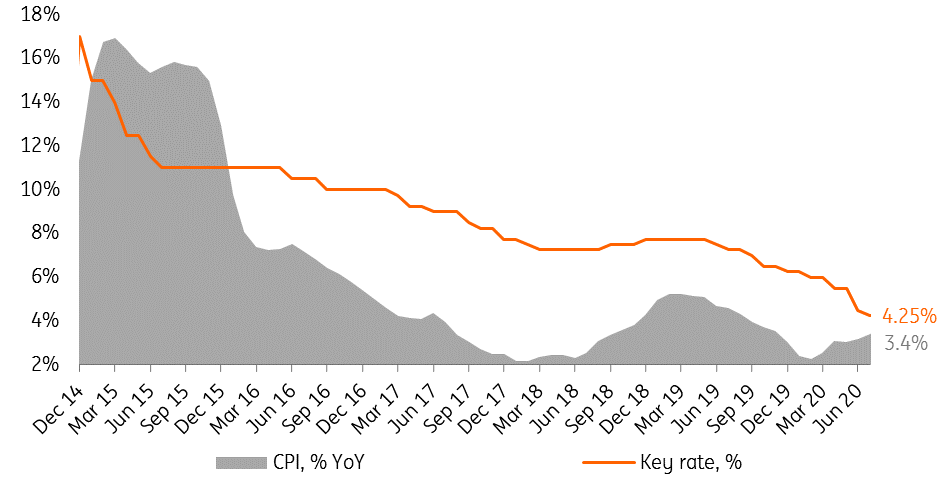

Russian inflation accelerated from 3.2% year-on-year in June to 3.4% YoY in July, in line with the consensus forecast, but slightly exceeding our 3.3% YoY forecast. As with the case of June, the July numbers were pushed up by the low base effect of 2019 (see Figure 1). To remind the freeze in gasoline prices and other temporary factors, including fiscal tightening, have resulted in CPI decelerating from 4.7% YoY in mid-2019 to 3.0% YoY expected by the year-end. However, we note that the monthly CPI growth this July (+0.4% MoM) is in line with the 2016-18 average, which is a bit of a surprise to us and calls for a closer look at the underlying data.

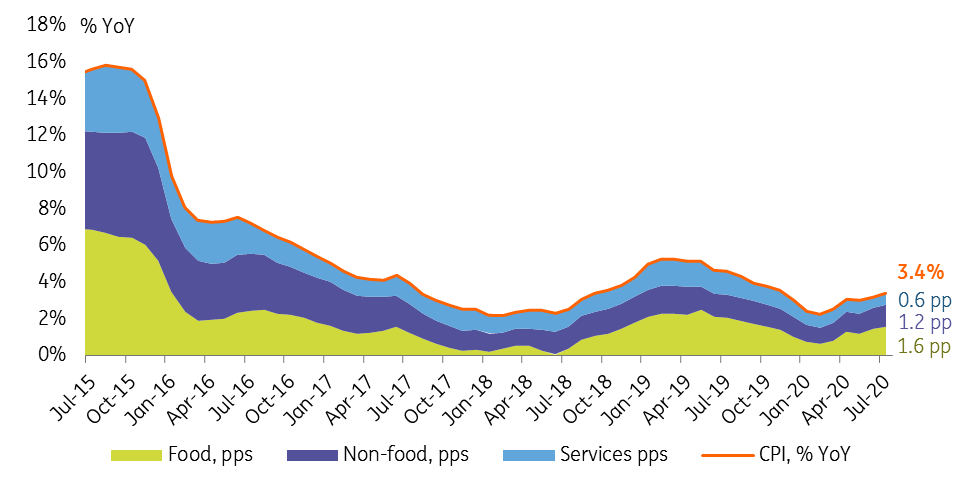

- Food CPI was the primary driver of acceleration in the overall CPI, picking up from 3.9% YoY in June to 4.2% YoY in July despite the lack of a lower base. The acceleration took place in bread, meat, eggs, vegetables and alcohol, with only dairy products showing disinflation. As a result, the contribution of food to the CPI has increased from 1.5 ppt to 1.6 ppt (see Figure 2).

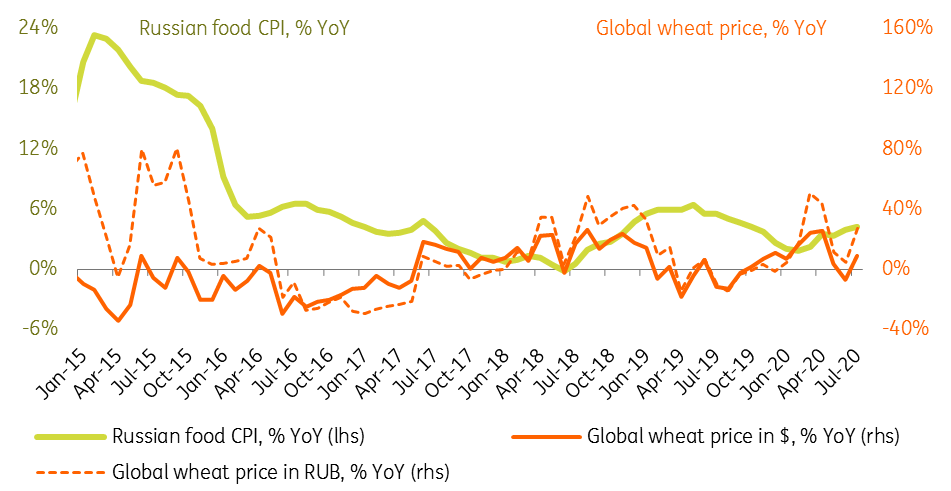

Going forward, the food CPI will be pushed up mainly by the lower base effect (as food CPI gradually decelerated from 5.5% YoY in July 2019 to the low point of 1.8% YoY in February 2020). However, the recent spike in global argo price volatility (see Figure 3) and the lack of evidence to demand-driven disinflation (eg, in the more expensive meat segment) are also watch factors.

- Non-food CPI also contributed to overall acceleration in the CPI, accelerating from 3.0% YoY in June to 3.1% YoY in July (and contribution to overall CPI increasing from 1.1 ppt to 1.2 ppt) despite a higher base. Most of the non-food items showed no noticeable disinflation, while a number of items, including apparel, electronics, and gasoline showed acceleration in price growth. This can partially be caused by the sector specifics and regulation in the oil downstream sector, as well as noticeable RUB depreciation in July – by 4.3% to USD and 8.7% to EUR, the currencies of Russia's primary import partners. However, it also challenges the weak demand narrative, in our view. In part it could be explained by higher-than-expected demand (for example, July car sales were up 6.8% YoY in July vs. -9.1% YoY expectations), but also by low price elasticity.

As with the case of food CPI, non-food CPI will be optically pushed up by the lower base effect starting next month, however the recent RUB depreciation and uncertainty regarding the demand constraints, including the scale of fiscal easing, should be worth watching.

- Services CPI growth remained unchanged at 2.5% YoY in July and maintained a flat 0.6 ppt contribution to the overall CPI growth, despite the lower base of 2019 (July 2019 had lower than ususal indexation of regulated tariffs). Meanwhile, the picture inside the sector is uneven, with the increase in the regulated tariffs and prices for insurance, local tourism, recreation and health recovery offset by disinflation in transport and communication services.

Going forward, services CPI will remain under upward pressure from the lower base, and it remains to be seen whether demand constraints (which so far are not evident in the data) will serve as an offsetting factor.

Figure 1: CPI crawling up, mostly on base effect, still below the 4% target

Figure 2: Food CPI remains the key inflationary component, pressure in other segments stable

Figure 3: Volatility on the global agri prices and FX market remain watch factors

Near-term CPI forecast facing risk of upward revision

For now, we continue to see CPI acceleration in 2H20 as largely technical and limited at 3.7% by this year-end. However, the risks to that forecast are now tilted upwards, given the lack of clear evidence of demand-driven disinflation in July, combined with pronounced cost-side inflationary factors, including resumed gasoline price growth, the recent spike in global grain prices and RUB depreciation.

We take the July CPI numbers as confirmation of our initial take, that notwithstanding Bank of Russia's generally dovish stance, a cut at the next monetary policy meeting is not as obvious a scenario as was the previous one.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap