Russia: consumption growth continues to decelerate in April

Russian GDP may have recovered in April vs. a very modest 0.5% YoY in 1Q19, but this acceleration is driven only by the calendar effects in industrial production. The underlying consumption and investment trends remain anaemic and are likely to stay that way until 2H19 pending acceleration in the budget spending

| +1.2% YoY |

April retail trade+1.7% YoY for 4M19 |

| Worse than expected | |

Consumption growth in Russia has continued decelerating, as April retail trade growth was reported at 1.2% year on year, in line with our expectations, but lower than 1.4% consensus and 1.8% YoY growth reported for 1Q19.

The real salary growth of 1.6% YoY was much better than we and the market expected, but still suggesting a deceleration vs. the recently upgraded March growth of 2.3% YoY. As the salary growth slightly outperformed consumption, the household savings trend improved slightly, with retail deposit growth accelerating to 7% YoY in April from 6% YoY in March (adjusted for FX revaluation effect). Leverage remains an important source of financing, as retail lending growth crawled up from 23.5% to 23.8% YoY in April but now seems to have approached its peak, especially given the Bank of Russia's (CBR) efforts to cool down the consumer loan segment.

Given the still weak income fundamentals, that also reportedly lead to a deterioration in the consumer sentiment, we remain cautious on the consumption growth trend for the mid-term.

Key indicators of the Russian consumer trend

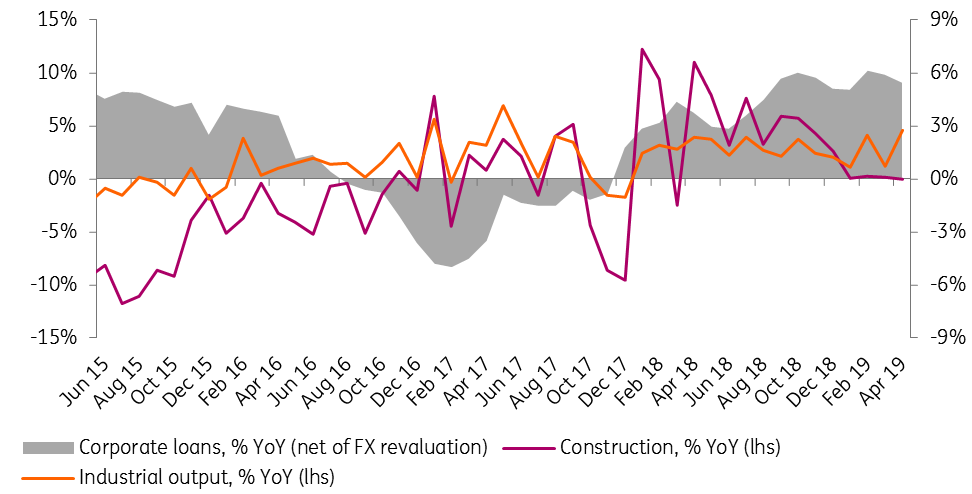

The producer trend also remains weak, as construction growth remains close to zero, corporate lending growth (adjusted for FX revaluation effect) keeps hovering within modest 5-6% YoY range over the last 6 months, and around half of the April's spike in industrial output by 4.6% YoY (downgraded from the initial estimate of 4.9% YoY ) is explained by favourable calendar and other statistical effects. The latter seems to be the only explanation for the acceleration in the GDP growth from 0.5% YoY in 1Q19 to 1.6% YoY in April, estimated by the Ministry of Economic Development.

Lack of recovery in the construction sector is an indirect sign that the investment growth, which was reported at just 0.5% YoY for 1Q19 after, has remained anaemic at the beginning of 2Q19 as well.

Key indicators of the Russian producer trend

We continue to attribute weak producer trends to the seasonality of the budget execution, as only 13% out of this year's RUB1.7 trillion state allocation for the 'National projects' has been executed in 1Q19. Regarding the total budget spending, as of 4M19, budget spending growth totalled 6% YoY, below the full-year plan of 9%, suggesting a room for acceleration going forward. This should provide some support to the economic activity in 2H19, however, the fact that budget spending seems to be the primary driver of real sector trend is in itself a concern regarding the mood in the private sector, which seems to prefer accumulating FX assets to implement CAPEX locally.

Weak economic trends may also result in additional pressure on the CBR to ease the monetary policy. The upcoming key rate decision on 14 June might become a litmus test. We believe that the current CPI trends justify a 50 bp cut until the year-end from the current 7.75% level, although it is still not obvious that this argument alone is strong enough that the first cut should come as early as June.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap