Russia: Capital outflow may reflect lower investment demand

Capital outflow totalled US$18.6 billion in 2M19, sterilizing 83% of the current account. It means a build-up of international assets, which is partially seasonal and does not reflect higher nervousness about sanctions. Rather, it reflects low investment demand locally, highlighting the structural weakness of Russia's balance of payments

| $18.6 bn |

2M19 net private capital outflow83% of current account surplus |

| Worse than expected | |

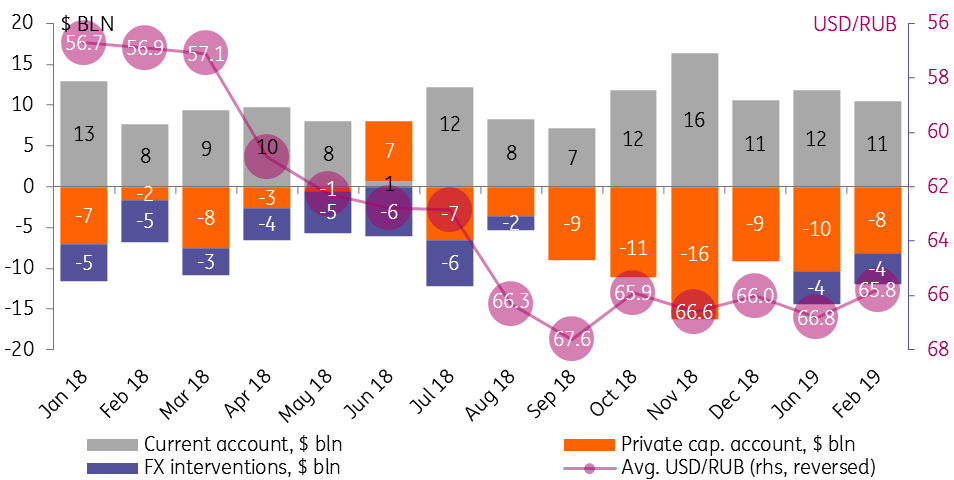

Preliminary balance of payments statistics did not surprise on the current account side - the surplus remained high at US$10.5 billion in February after US$11.8 billion in January - thanks to the strong oil price environment and restrained imports. At the same time, the scale of net private capital outflow - US$8.2 billion in February after US$10.4 billion in January - was larger than expected and reflected an accumulation of corporate international assets. This outflow can be partially attributed to seasonality, as the corporate sector is known to accumulate international assets in 1Q for technical reasons, however, we note that relative to the size of the current account surplus the net private capital outflow increased from 31% in 2M17 and 42% in 2M18 to 83% in 2M19.

The balance of payments numbers do not point to a higher nervousness regarding sanctions, as

- the latter would have translated into more active foreign debt redemption, which does not seem to be the case, based on the commentary by the Bank of Russia

- the risk of sanctions tends to be channelled via portfolio flows related to the state bonds (OFZ), which is not included into the private flow number. According to the Central Bank of Russia (CBR) data, OFZ saw US$0.8 billion portfolio inflows in January, and anecdotal evidence from the market suggest that the positive inflow continued in February

High net private capital outflow and almost US$8 billion of FX purchases in 2M19 did not prevent RUB's appreciation to USD by 6% since the beginning of the year amid 2% appreciation of RUB's EM peers, reflecting a recovery in oil prices and some moderation of Russia-specific risk perception.

Key parameters of monthly balance of payments

At the same time, the corporate sector's low preference to repatriate the current account surplus beyond mandatory tax payments may reflect low local investment demand and possibly low confidence in RUB as a savings currency. Strong corporate capital outflow seems to contradict the CBR's call that the increase in the mandatory FX purchases should automatically lower the amount of FX channelled into the net private capital outflow, and makes our full-year expectations of US$20 billion capital outflow too optimistic. We now see it at least at US$30 billion for 2019, which also forces us to downgrade our year-end 2019 USDRUB target from 65.0 to 66.0. Strong capital outflow also highlights RUB's vulnerability in 2-3Q19, when the current account surplus is seasonally weak, which means that even in the benign external environment RUB trading range may shift to RUB66-68 in the next couple of quarters. This view may be subject to further deterioration in the case of global risk-off on negative foreign policy developments around Russia.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap