Russian balance of payments remains fragile

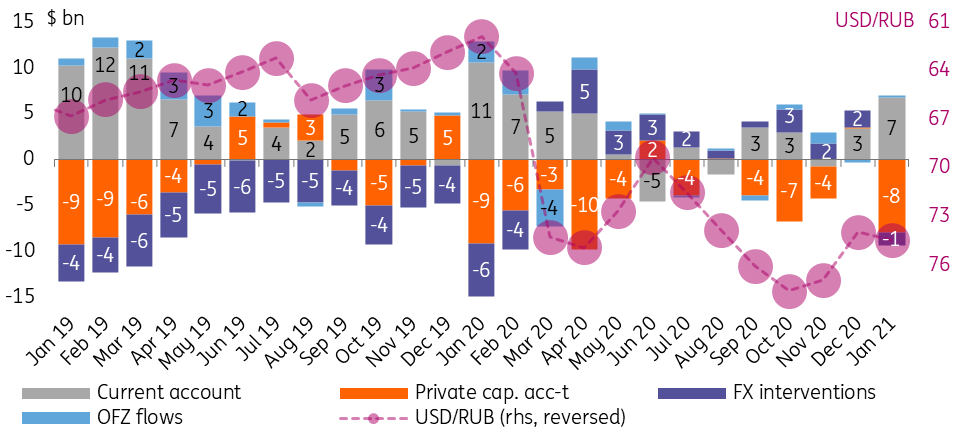

January balance of payments data from Russia points at a continuous weakness of the capital account, while the current account surplus is 35% lower than a year ago and net private capital outflow is closer to last year's levels. This leaves the currency sensitive to portfolio flows, which is good news in the near-term but highlights structural weaknesses

According to the Bank of Russia's preliminary estimates of January balance of payments, the current account surplus came in at US$6.8 bn, while net private capital outflow reached US$8.0 bln, making it the primary reason for the rouble weakness last month.

To recap, the current account surplus was partially neutralised by the US$1.4bn FX purchases in accordance with the fiscal rule. Portfolio flows into local currency public debt (OFZ) were, according to preliminary data, close to zero, also failing to provide support to the balance of payments.

We have the following observations and takeaways:

- January data is normally affected by a number of seasonal factors, such as a reduced number of working days, and therefore should be looked at by year-on-year, rather than on a month-on-month comparison.

- The decline in the January current account surplus from US$10.6bn in 2020 to US$6.8bn in 2021 is largely attributable to the deterioration of the commodity market conditions (Urals price drop from US$63/bbl in January 2020 to US$55/bbl and the cut in physical output as per OPEC+ requirements), but still, it is slightly lower than our US$8-10bn expectations, which may suggest deterioration of non-oil components.

- February current account surplus may suffer from reduced oil exports, though the negative effect on the overall balance of payments should be neutralised by the corresponding drop in the February FX purchases. Meanwhile, starting 2H21, current account may come under pressure of non-oil factors, such as recovery in merchandise imports and outward tourism.

- The net private capital outflow of US$8.0 bn in Jan-21, though largely seasonal, technical, and mirroring high current account surplus, could still be considered elevated, given its rather modest contraction from US$9.1 bn in Jan-20 (compared to the declining in the current account). The structure of the capital outflow is yet to be disclosed, though our guess that the non-technical part of it may reflect the accumulation of FX by households and corporates also seen in November-December last year.

- Portfolio inflows into OFZ, based on preliminary estimates, were slightly positive at US$0.2 bn in January, but the vectors were mixed, with inflows in the first half of the month followed by outflows in the second amid political factors, which seem to have moderated by now.

Net private capital outflow remains high despite the decline in current account surplus year-on-year

January balance of payments is slightly weaker than we expected in terms of key components, making the current recovery in rouble look fragile from a fundamental viewpoint. Recovery in local consumer and investment confidence is crucial to ensure USD/RUB stability in the 70-75 range.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RussiaDownload

Download snap