Russia: Net capital outflow a key uncertainty

The strong current account surplus of $26.4 billion in 3Q18 could possibly widen in 4Q18. With the Minfin’s FX purchases on hold till year-end 2018, the rouble could regain ground. Yet net capital outflows, export revenue non-repatriation and the sanctions-related portfolio outflows are risks to this view

| $26.4bn |

3Q18 Current account surplus$75.8bn for 9M18 |

| Better than expected | |

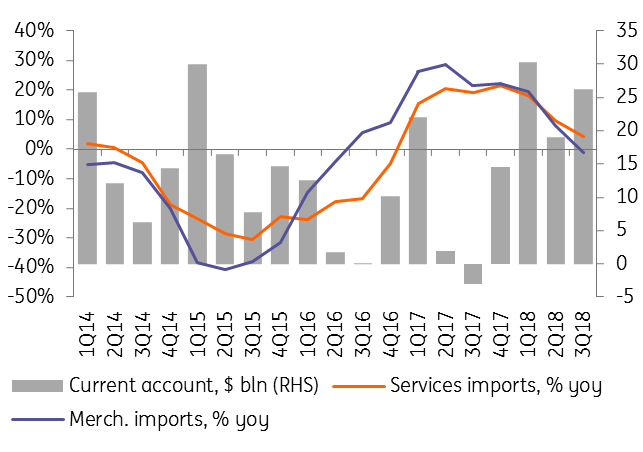

The current account surplus is better than we (US$20bn) and the market (US$24bn) expected for the quarter. The outperformance was caused not only by high oil prices, but also thanks to the downward pressure on imports - following the recent RUB depreciation - and a reduction in the current debt servicing payments. According to our estimates, should the average Brent price stay above US$75/bbl in 4Q18, the quarterly current account surplus may exceed US$30bn in 4Q18. This is potentially good news for the rouble in the short-term, as the Central Bank of Russia has put FX purchases on the open market on hold till year-end 2018, having purchased US$7bn in 3Q18. All else being equal, the current account suggests that USD/RUB has a chance of returning to RUB60-65 range in 4Q18.

Russian current account: key parameters

Yet obviously the 'all else being equal' part is not guaranteed, and the capital account side of Russia's balance of payment is a good illustration. The 3Q18 net capital outflow by the corporate sector totalled US$19.2bn and the US$2.3bn outflow from the government sector (including US$1.5bn net portfolio outflows from OFZ) may increase in 4Q18 due to several considerations:

- the net corporate foreign debt redemption, which we believe may have amounted up to US$10bn in 3Q18 (to be confirmed in the coming days by official statistics) could increase in 4Q18 due to a tighter gross redemption schedule: US$25bn in 4Q18 vs US$19bn in 3Q18 and the lower preference to roll over foreign debt amid persisting risk of further corporate sanctions

- the easing in the export revenue repatriation requirement for some companies may lower the incentive for the corporate gross capital inflows going forward

- the expected return of CBR/Minfin FX purchases on the local market in 2019 prevents any improvement in the longer-term rouble exchange rate expectations, limiting portfolio and corporate inflows in Russian assets

- the persisting risk of sanctions against the new state debt may result in continuing or higher portfolio outflows from OFZ

Overall, based on the headline 3Q18 BoP data our current RUB72/USD house view for year-end 2018 appears overly pessimistic. Yet the more constructive RUB60-65 range suggested by the current account is achievable only under the assumption that there is no material tightening in the sanction regime against Russia at least in the coming three months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap