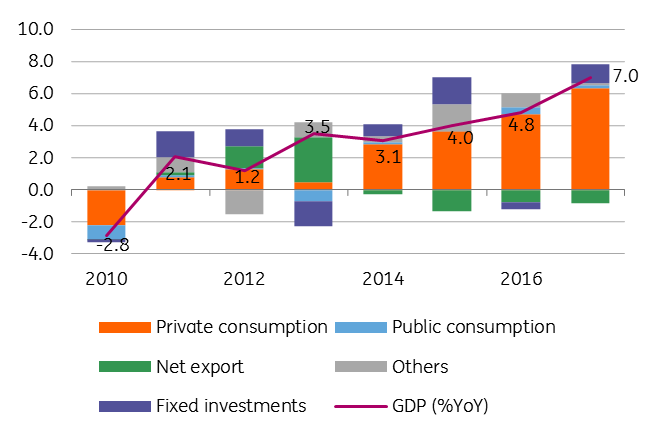

Romania’s GDP growth rises to 7% in 2017

But given that the fourth quarter sequential growth was very weak, we expect 2018 GDP expansion at 4.7% with the risk balance tilted to the downside

6.4ppt of growth came from private consumption leading to a negative net export contribution of -0.8ppt, while fixed investments added 1.2ppt. Hence, the growth picture for 2017 points to an unsustainable backdrop as recently consumer confidence was hit by fiscal uncertainties, higher interest rates and a weaker currency.

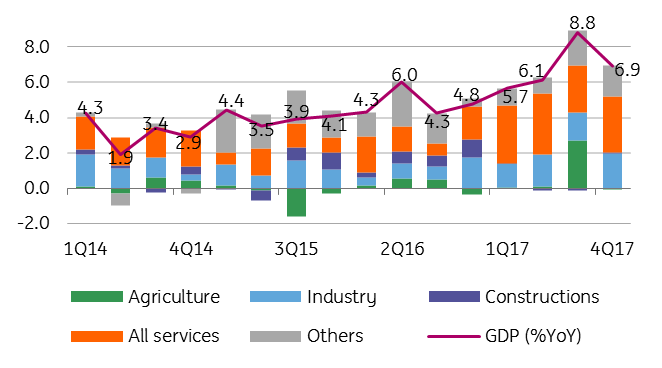

On the supply side, services were the main driver adding 3.7ppt to growth, the industry contributed 1.9ppt, with construction having a neutral impact on the 7.0% expansion in 2017. The significant positive contribution from agriculture of 0.7ppt is worth noting, which is why the potential upside surprise from this volatile sector in 2018 is somewhat limited.

GDP growth: demand side drivers

GDP growth: supply side drivers

| 6.9% |

4Q17 YoY GDP growthconfirmed |

| As expected | |

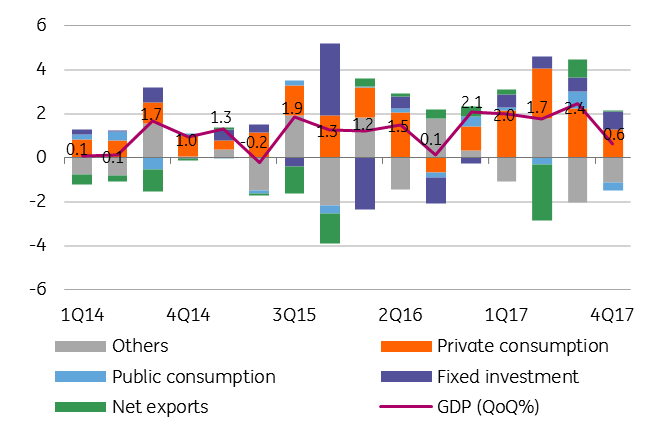

The 6.9% YoY GDP growth rate in 4Q17 resulted mainly from private consumption adding 7.4ppt and gross fixed capital formation bringing 2.8ppt, while net exports and inventories had a negative contribution of -1.3ppt and -1.5ppt respectively.

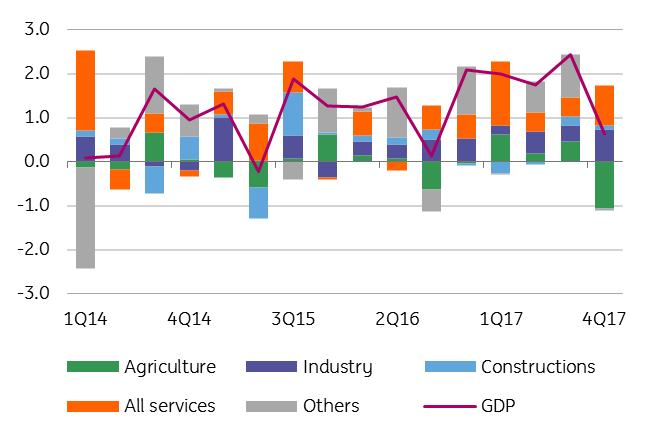

On the supply side, out of 6.9% growth, services provided 3.6ppt, industry 2.2ppt, while construction 0.1ppt amid heavy budget spending in December. The sequential growth of 0.6% QoQ was negatively influenced by agriculture as most of the production was registered in 3Q17, with services and industry increasing their positive contribution versus the previous quarter. Private consumption was the main driver of the sequential growth, followed by investments, while public consumption had a negative impact.

As suggested by retail sales data, private consumption slowed down to 2.2% QoQ from 3.2% previously, significantly reducing its contribution to 4Q17 QoQ expansion. Gross fixed capital investments accelerated to 3.7% QoQ from 2.8% previously. Nevertheless, it was not enough to offset the slowdown in consumption. Net export contribution to 4Q17 QoQ dynamic was neutral.

GDP growth: demand side drivers

GDP growth: supply side drivers

Despite an expected acceleration in investments in the absorption of the EU funds, it is unlikely to offset the downturn in consumption, with confidence indicators pointing south across the board recently.

2018 could see the industry performing well on robust external demand, while services are slowing down as consumers are likely to reassess their spending priorities. Construction is heavily reliant on state investments which are planned to increase versus the previous year.

Nevertheless, if the budget falls short of revenues due to weaker than expected growth, public investments are the usual suspect to fill the budget gaps.

Sequential growth: demand side split (QoQ)

Sequential growth: supply side split (QoQ)

| 4.7% |

ING forecast for 2018 GDP growthrisks balance tilted to the downside |

| Higher than expected | |

The fourth quarter sequential growth was very weak at 0.6% QoQ versus 2.0% average for the previous three quarters, with full-year average QOQ growth coming in at 1.7%. Hence, a negative carry-over effect impacting 2018 growth outlook.

We keep our call for 2018 GDP expansion at 4.7%, but the risk balance is tilted to the downside. This compares to 4.2% Bloomberg consensus, 5.5% assumed in the state budget plan and 6.1% latest official forecast.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap