Romanian inflation: the outlier

Easter came early in this year pushing inflation to 5% on the back of higher food prices. As core inflation inched to 3%, the central bank's decision to hold rates seems even weirder

Inflation hit its highest level since June 2013, and the reading was significantly above our call of 4.6% with 0.2 percentage points of our forecast error coming from food prices and another 0.1ppt from fuel.

Food prices were up by 4.0% YoY, non-food jumped by 6.6% YoY driven by higher fuel and regulated prices, while services which tend to reflect more accurately the domestic demand pressures increased by 2.9% YoY.

Both headline and core CPI edging higher

Core inflation inched higher by 0.1ppt to 3%. At the hearing in the parliament economic commission, the National Bank of Romania governor suggested the central bank was aware of the March CPI data ahead of the latest Board decision which surprised the market by keeping key rate flat versus a 25bps hike expected.

This fuels suspicions that there is political influence behind the central bank's decision to hold rates despite rising inflation. It is likely that the NBR wanted to avoid being dragged into the rather unsubstantiated political debate on the current economic developments by getting into the headlines with a rate hike.

Romanian inflation: the outlier

To gain back some credibility and backed by the latest inflation print, a 25bps key rate hike to 2.50% by the NBR looks imminent in our view.

Another rate hike until the end of the year remains pretty much data dependent. 1Q18 GDP data due 14 May might shed some light on the economic backdrop after recent high-frequency data and surveys pointed to a meaningful slowdown. Hence, if this is confirmed, we could see NBR taking a long pause and getting back to ECB/regional dependent policy guidance. In the meantime, firmer liquidity management is likely to be considered.

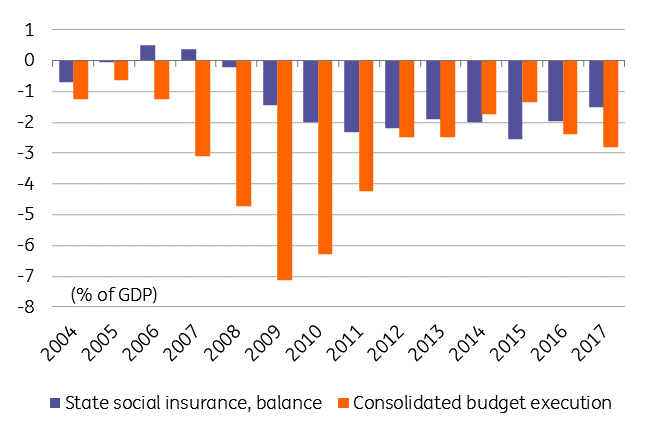

Heavily subsidised public pension system

Higher inflation and softer growth backdrop are negative for local assets, both FX and government debt. Some voices from the government are hinting that the government is prospecting some fiscal rebalancing measures. Still, the denial mode seems to prevail within the policymakers.

As expected, the primary target to raise revenues is the pillar II private pension system which is also the easiest one as the government is yet to tackle the low tax collection problems.

The Financial Ministry suggested that the contribution to the pillar II would become optional and the government analyses solutions to incentivise contributors to transfer their payment to the state-run pay-as-you-go pillar I system, which runs heavy deficits, at the expense of the pillar II. If enacted, this is another roll-back on the structural reform agenda. In any case, the economic adjustment is likely to be suboptimal, in our view, coming mainly via higher inflation and interest rates.

Moreover, 2019 and 2020 are electoral years which reduce the chances of fiscal consolidation.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap