Romania: Current account deficit balloons

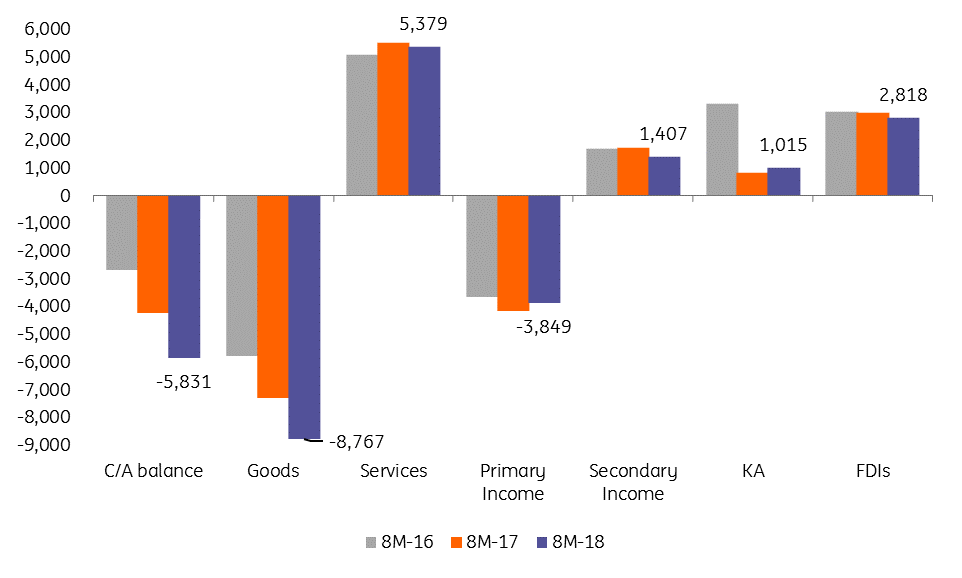

We are revising our 2018 forecast for the current account (C/A) deficit from -3.7% to -4.2% of GDP after it widened by a whopping 37.8% to €5.83 billion in January-August 2018, compared to the same period of 2017

After the trade deficit posted a 20.2% year-on-year widening in January-August 2018 to €8.8 billion (4.4% of GDP), the C/A deficit followed with a no less impressive 37.8% widening for the same period, reaching 2.9% of GDP. Trade balance aside, low EU funds absorption and a levelling-off in the services surplus also contributed to the widest C/A gap since 2012 (when it reached 3.4% by August).

January-August C/A (euro bn)

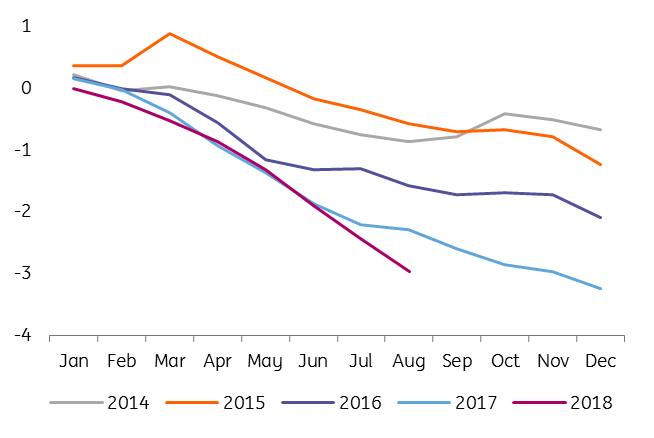

January-August C/A (% of GDP)

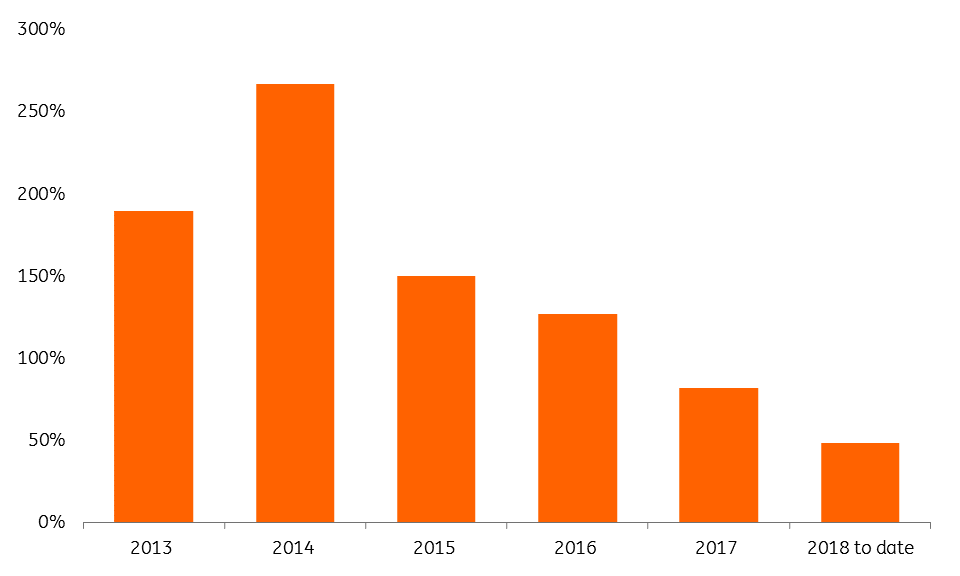

On the year, foreign direct investments (FDIs) cover only 48% of the C/A deficit compared to 82% for the full 2017, which should raise an eyebrow from the central bank. This is even more important in the context of a relative appreciation of the Romanian leu versus its regional peers since the beginning of this year, while Romania is running trade deficits with most of its neighbours.

FDI coverage of C/A (%)

Given the persistent widening of the trade deficit even as the economy slows down, a levelling off of surpluses on the services balance and a sluggish absorption of EU funds, we revise our 2018 forecast for the C/A deficit from 3.7% to 4.2% of GDP. While these developments normally call for some nominal depreciation of the Romanian leu, the central bank seems ready to let it slide for now as headline inflation is still printing way above the target band of 2.5%±1ppt. Structural factors affecting the competitiveness in some sectors (mainly agriculture) could also be cited for the widening of the trade deficit. Hence, no reasons for optimism regarding the external position in the near-term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap