Romania: Unemployment unchanged at all-time low

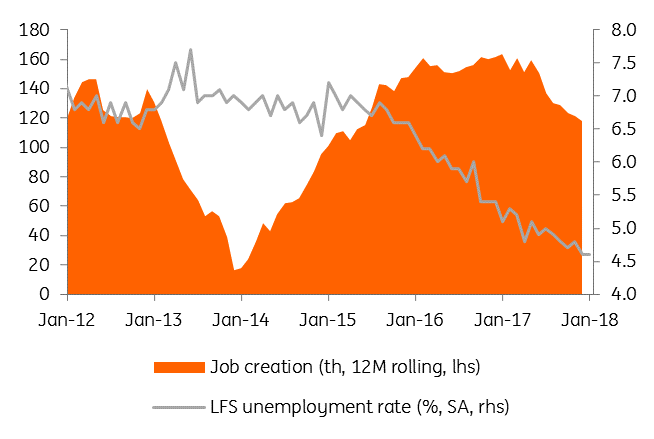

January's unemployment rate came in at 4.6%. At the same time, job creation is softening while more companies are reporting that labour is a drag on growth

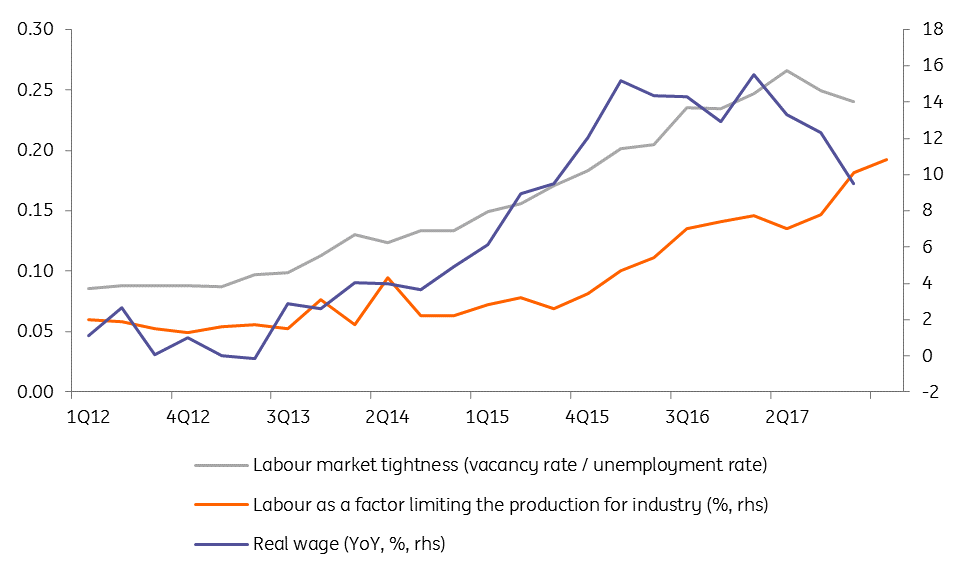

The labour market has softened a bit recently due to a fall in the vacancy rate likely as more automation is employed to overcome the labour supply limitation. Supporting this idea, the European Commission survey shows more companies are citing labour as a factor limiting production in the manufacturing sector. While there is a continuous pressure on wages, including from administrative measures which increased the minimum net wage by c.10% at the start of the year, inflation is taking its toll on real incomes. This year, we could see some targeted wage hikes in the public sector healthcare system to stop labour force migration and maybe also in education. But given the limited budget resources, these decisions might be accompanied by compensatory fiscal measures.

Softening labour market tightness on lower vacancy rate

Given limited resources, job creation on a 12-month rolling basis continued to head lower, reaching 118K in Dec-2017 after hitting an all-time high of 164K in January last year. There is still significant untapped potential as labour force participation is one of the lowest in the EU at 68.7% in 3Q17, but structural reforms are needed to address this issue and boost potential growth. On top of this, more than three million Romanians are working abroad, which has had a negative impact of c0.5ppt on potential growth, according to an IMF study from 2016.

Job creation losing steam on poor labour supply

Both the economic growth forecast on which the budget plan was built and the projection of budget revenues for 2018 are based on a projected rise in job creation of over 200k this year. This looks to us a bit stretched and we believe that a slowdown in job creation and weaker consumption growth are unlikely to be compensated by investments. Hence, our more conservative GDP growth call (versus the official forecast) for this year of 4.7%, which is still at the top end of the Bloomberg consensus of 4.2%. In fact, recent soft data suggest that the risk balance to our forecast is tilted to the downside.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap