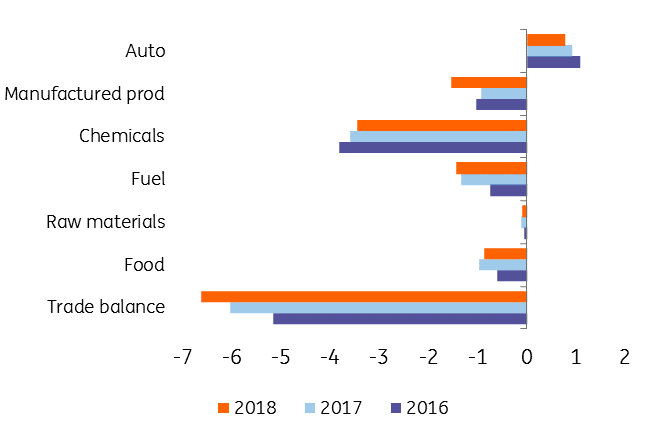

Romania: Trade balance stubbornly negative

The trade deficit widened by EUR1.57 billion in November 2018, up 39.4% from November 2017. The deficit after 11 months of 2018 reached EUR13.4 billion and it's not over yet

Romania’s trade balance widened 18.1% in the first 11 months of 2018 compared to the same period of 2017. That is EUR13.4 billion (or 6.6% of GDP), the highest since 2009. Among the very few positives, we emphasise the levelling off in the deterioration of food items, a trend which started in the second part of 2018 and seems to be slowly consolidating. This comes in the context of – still-decent retail sales and consumer confidence numbers, hence we could attribute the developments to actual structural improvements in the sector. But with a share of only around 8% in both imports and exports, the food sector will not improve the overall picture anytime soon.

Auto sector continues to drive exports

With year-on-year growth of just 2.7%, exports expanded at the slowest pace since June 2017. The auto sector, whose share of total exports is almost 48%, continues to perform well, contributing 2.4 percentage points to the total 2.7% increase, painting quite a monochromatic picture for the export drivers.

Imports accelerate faster than exports

The auto sector also leads on the imports side, as well, contributing 4.0 percentage points to the total 8.7% year-on-year expansion. November 2018 was the second consecutive month when the auto sector posted a negative –albeit small- trade balance. Last time this happened was in October 2012. This is quite worrying as this segment was the only one where Romania still had a predominantly positive trade balance.

January-November trade balance as % of GDP

Negative outlook

As previously mentioned, the Romanian economy seems to be bracing for its highest post-crisis trade imbalance. This is the main driver behind the current account deficit. While in the past, these imbalances were offset by a rather sound financing structure of the current account, this was less the case in 2018. Hence, we maintain our call for a shift higher in the comfort range of the EUR/RON as the National Bank of Romania's flexibility to defend the Romanian leu through its main policy tool has been limited by the government's fiscal plans.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap