Romanian GDP: Not that bad, but…

Romanian 2Q20 GDP contracted by 12.3% versus 1Q20 broadly in line in market expectations. We see this as mildly positive, but not enough to change our forecast for 5.5% GDP contraction this year. For 2021, we downgrade our forecast to 5.2% from 7.1% as the economic rebound looks more gradual than expected

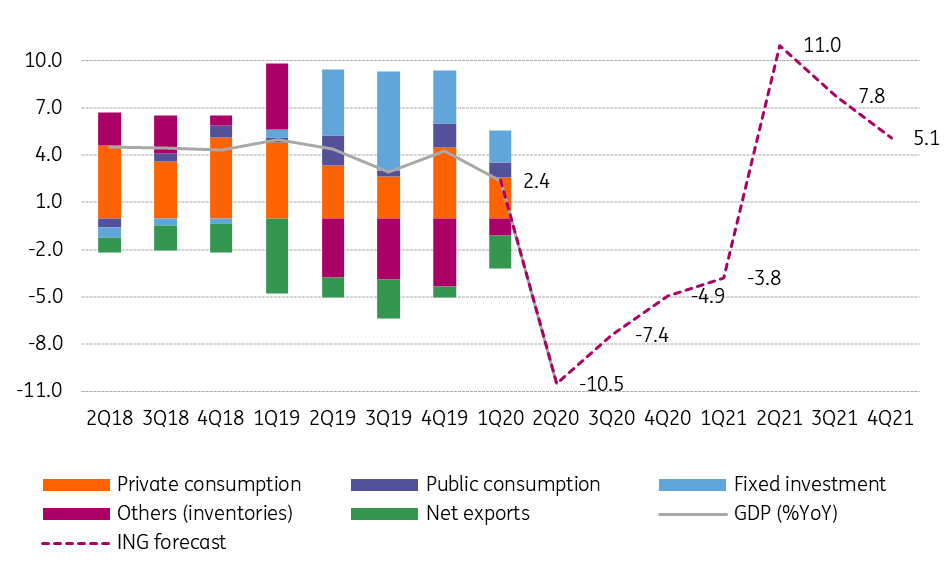

Compared to the same quarter of 2019, Romanian 2Q20 GDP contracted by 10.5%, in line with Bloomberg consensus and better than our -12.9% estimate.

The breakdown will be released on 8 September, but we doubt that the details will reveal something spectacularly different than our assumptions, which is that all sectors had negative contributions to the quarterly contraction.

Some questions arise from the public consumption area as the second quarter has seen the budget deficit reaching historic highs and that might imply a slightly less negative contribution of this sector. Similarly, total investments have probably contracted by less than expected given the acceleration in public investments this year. Net exports have likely deepened their negative contributions judging by the widening trade balance. And it goes without saying that private consumption was a serious drag on second-quarter growth.

GDP growth (YoY%) and main components

While today’s GDP data was not necessarily a positive surprise, it does confirm some degree of economic resilience.

There are signs however that this could just lead to a flatter “V” shaped growth, meaning that the subsequent recovery from the third and fourth quarter will be less pronounced. Reasons to believe that come from the pandemic evolution which has intensified in the third quarter - the electoral context which dampens sentiment to some extent as blurs policy visibility and the flattening of most confidence surveys in July.

We, therefore, maintain this year's growth forecast at -5.5% and downgrade next year's growth numbers from an admittedly optimistic 7.1% to 5.2%, as the recovery looks to take place at a more gradual pace than initially expected.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap