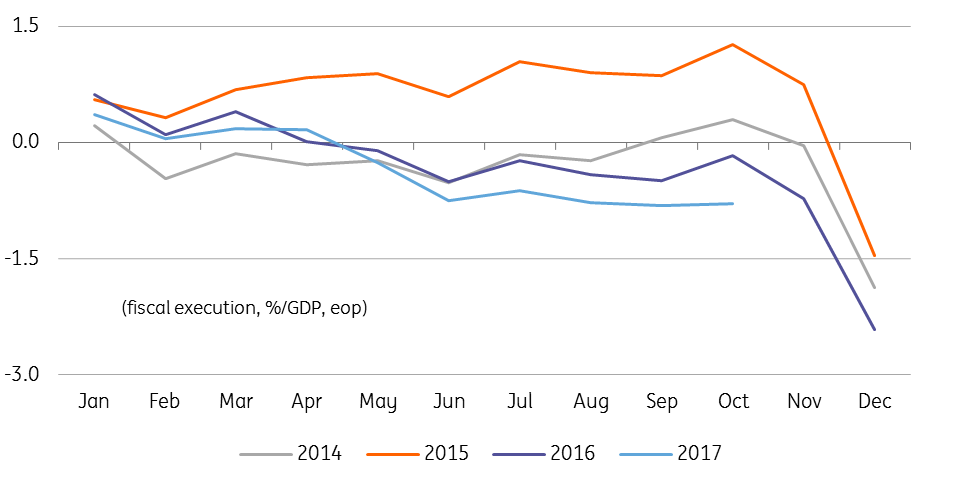

Romania: Same budget execution pattern

The bulk of the budget deficit execution is being left for the last two months of the year, and is likely to swing the banking system liquidity position back to surplus

The budget deficit at the end of October stood at -0.79% of GDP, a bit narrow versus the -0.81% after nine months, but significantly wider than the -0.17% a year ago. Budget revenues increased by 10.8% YoY. Current revenues expanded by 6.8% YoY and are gradually nearing the FY target of 7.4% advance. There is an improvement in revenues from VAT by 0.5% versus a year ago. Budget expenditures spiked by 13.6% YoY driven by the 21.2% increase of the wage envelope, which is significantly above the full year plan of 12%. Current expenditures were also up by 4.2% YoY versus initial plans for some savings from this item. Capex spending remains the main source of savings, and it is down by 17.7% versus the same period of 2016.

Wider gap in 2017 on higher permanent spending

History shows for the previous three years an average cash based deficit of -2.4% of GDP realised in the last two months of the year. Hence, reaching this year budget gap target of -3% of GDP looks achievable. The manner is likely to be suboptimal via reallocation from investments to other items. Hence, creating public debt for the sake of spending the planned resources. This brings a significant liquidity injection into the money market of c.RON10bn and, provided that the depreciation pressure on the RON does not intensify prompting large FX interventions from the NBR, we should see funding rates heading lower into the year-end.

The VAT gap always cited as a resource

For next year, the government is due to submit the budget bill on 29 November, according to the PSD head. While it is likely to be stretched in terms of macroeconomic assumption (5.5% GDP growth in 2018) with ambitions to improve tax collection likely included in the baseline scenario, we expect the 2018 budget draft to target a deficit just below 3.0% of GDP. The budget execution over the last four years (including 2017) shows that due to poor administration of investment projects there are significant buffers left unspent towards the year end which could be tapped, in case of unexpected events, to keep the deficit within the EDP limits.