Romania: NBR raises inflation forecast

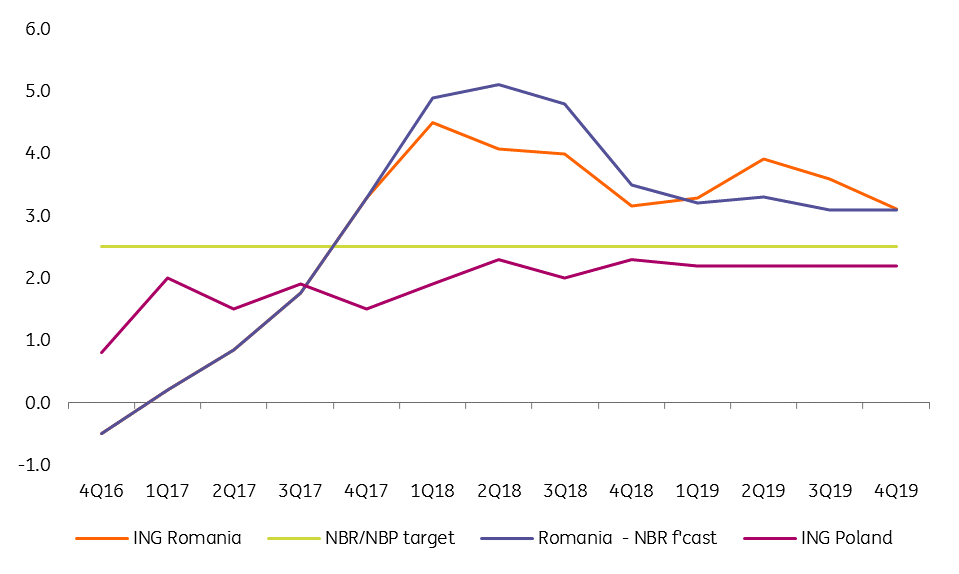

The central bank raised its end-2018 CPI forecast by 0.4ppt to stand at 3.5% and the bank's governor signalled rate hikes ahead

The central bank's 0.4ppt increase in its CPI forecast for end-2018 was slightly higher than our expectation for a 0.3ppt upward revision. We have our end-2018 projection at 3.2% year-on-year, with most of the difference between our forecast and that of the NBR likely due to ING's oil forecast relative to the consensus, which is used by NBR.

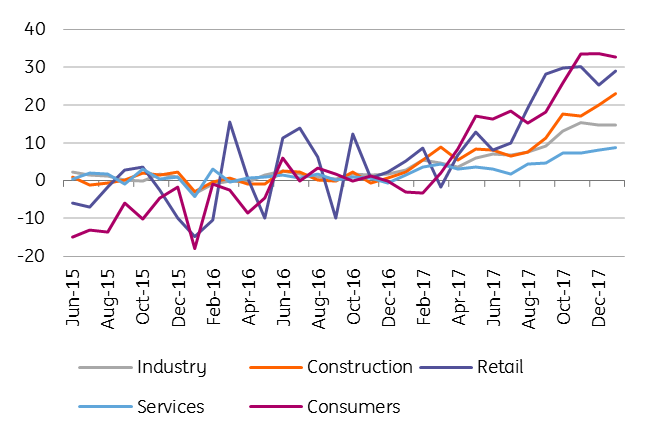

During the presentation of the Inflation Report, Governor Mugur Isarescu spent a lot of time explaining the impact of past supply-side shocks on inflation and on the forthcoming inflation spike, which is expected to peak at 5.1% by end-2Q18, promising more active communication from the central bank to tame inflation expectations. This comes after the significant spike in inflation expectations across economic sectors and consumers. In fact, this seems to be the main concern for the central bank.

Spiralling inflation expectations

EC

The core inflation forecast was adjusted higher from 2.9% to 3.3% for end-2018, while its medium-term trajectory remains outside the NBR target band throughout 2019, ending next year at 3.6%. This received less attention during the speech. The governor’s remarks were focused more on the effort to temper inflation expectations, which are the source of the outlook for core inflation, aside from persistent excess demand.

The Inflation Report also mentioned the ‘accommodative stance... of real monetary conditions’ as a factor behind the outlook for higher core inflation. On this topic, the governor repeated examples of real negative interest rates in peer countries and globally, sounding rather dovish.

In the same vein, he mentioned that the deposit facility level would remain the operational instrument, fearing that higher carry would lead to an undesirable appreciation in the Romanian leu. Still, he acknowledged that more rate hikes could be expected, saying that the NBR inflation forecast is consistent with a ‘non-accommodative’ policy stance, though he dismissed the need to present any forward guidance due to uncertainty. Overall, the NBR continues its balancing act between higher key rates to keep inflation expectations anchored and limiting the transmission of hikes into the cost of credit to mitigate the likely political/public pressures. This weakens the transmission channel and is likely to lead to higher forecast errors for core inflation.

Romania CPI stabilises higher over the policy horizon

NBR, NBP, ING

On the currency, the governor reiterated that he sees no room for RON gains, but favours relatively low volatility due to its impact on inflation and inflation expectations.

More hikes to come

We expect two more interest rate hikes this year in 2Q and 3Q and a gradual tightening of the liquidity management between them. Firm control at the key rate is likely by the year-end. Given the outlook for core inflation and the NBR's reluctance to be pro-active, we see three more hikes next year with the external environment also helping ease fears of unsustainable RON strengthening. For the next rate-setting meeting, on 4 April, given the sharp CPI spike in the short-term, the NBR has to deliver once more. We believe that a rate hike is more likely than a decision to tighten the liquidity management.

Download

Download snap