Romania: June lending at cruising speed

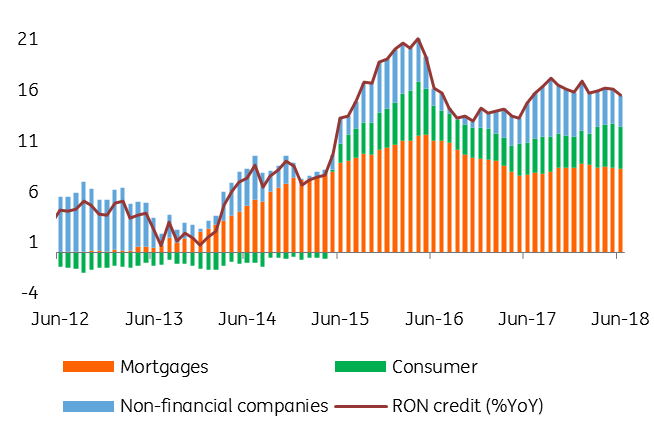

Our credit growth index expanded by 7.2% in June compared to 7.1% in the previous month. Momentum is still good considering the big picture

Lending seems to have stabilised in the higher single-digit area, posting quite stable growth rates for the past 12 months. FX lending seems to be recovering slightly as higher interest rates in local currency and a stable exchange rate make the prospect of FX loans interesting again.

Retail lending doing fine...

Retail lending growth was broadly flat compared to May at 11.6% year on year (adjusted for FX volatility). Consumer loans maintained a good pace at 17.1% YoY while mortgages accelerated in month-on-month terms by 3.9%, the highest rate in the last 12 months.

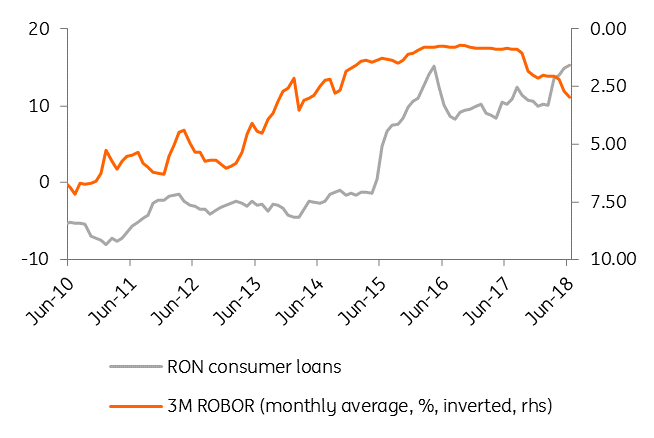

Consumer loans still holding up well

...and corporate lending is slightly better

Corporate lending expanded by 3.0% YoY (1.8% MoM) helped mainly by short- and medium-term (below five years) local currency loans. Corporate loans in Romanian leu with maturity above five years expanded by a modest 2.4% MoM. We monitor this indicator closely, as it should provide reasonable hints about the prospects for private investment.

RON credit growth breakdown

Despite sharply higher nominal interest rates for local currency, real interest rates are still quite deep into negative territory. Today’s data shows again that central bank tightening hasn’t had much effect on slowing down the pace of lending, supporting the fact that recent economic expansion was not credit driven. However, consumer sentiment has been pointing south for some time now amid fiscal uncertainty and concern about job prospects; this could be more effective in slowing down lending than higher interest rates.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap