Romania: July CPI undershoots estimates

Inflation came in at 4.6% year-on-year in July compared to the Bloomberg consensus of 5.1% and ING's forecast of 4.8%. This supports the dovish stance from the National Bank of Romania (NBR) but we could still see rate hikes if the negative emerging market backdrop persists

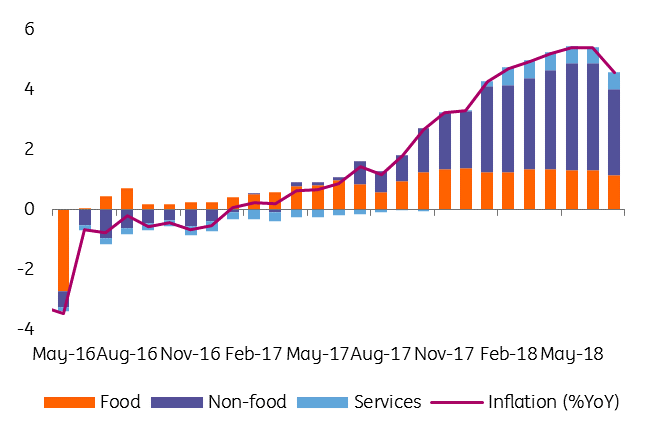

Core inflation was flat at 2.9% YoY, in line with our forecast. On the headline, while we were at the bottom of the consensus, the surprise for us came from a sharper fall in volatile food prices and a slightly bigger than announced fall in regulated energy prices.

- Food CPI is 3.4% YoY, after a 0.5 percentage point monthly drop.

- Non-food inflation plunged from 7.8% in June to 6.2% YoY in July, as the energy price increase from July 2017 dropped out of the statistical base, followed by a cut decided by the regulator for July this year. Other hikes in regulated prices and excise duties are due to drop out of the statistical base by the end of this year.

- Services inflation stands at 2.7% YoY, up by 0.1ppt from the previous month, supporting the idea of meaningful demand-side pressures on prices.

CPI drops on base effects, food prices

We expect August inflation to inch a bit higher to 4.8-4.9% YoY mainly due to the increase in regulated gas prices. September and October CPI should be lower again due to base effects, with the October CPI likely to print just below 4.0% YoY.

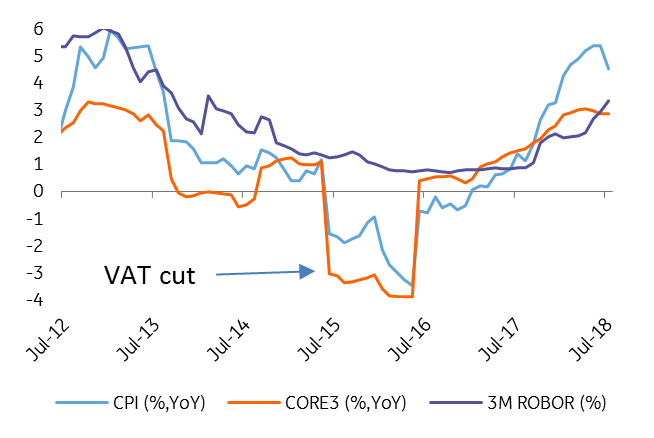

Headline falls, core stabilises

After the surprise July CPI release, our year-end forecast moves 0.2ppt lower, back to 3.6% YoY. Nevertheless, the balance of risks is tilted to the upside, as it is hard to gauge the impact of recent unusual weather conditions (drought in late spring affecting wheat crops and heavy rain and floods in the first two months of the summer) and the recent outbreak of African swine fever. The July CPI supports the dovish NBR stance, but we still could see rate hikes if the negative emerging market backdrop persists.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap