Romania: Wage growth slows

Romanian wages grew 8.8% year-on-year in January, the first single-digit growth rate since October 2015, though the data was certainly affected by base effects and year-end one-off payments

Public sector wage hikes are up by a hefty 11.7% YoY versus a more modest 7.0% YoY increase in the private sector. The newly enacted minimum wage increase in January has mostly affected the private sector. Also, the data for this sector might be distorted by the transfer of social contribution payments from the employer to the employees at the start of the year.

- The public health sector posted a modest acceleration in YoY growth versus Jan-2017, with a 6.8% YoY increase (compared to 6.4% YoY in Dec-2017) versus the 17.3% average increase in 2017. For this sector, the government announced a new round of pay rises starting in March this year.

- Wage hikes have also been announced for public education after the sector posted a 7.0% wage advance in January down from 13.2% in Dec-17 and an average rate of 12.3% for the previous year.

- The public administration sector still seems to be receiving most of the government's attention as wage growth decelerated only marginally to 23.5% YoY from 24.1% YoY in Dec-2017 and an average increase of 26.8% in 2017.

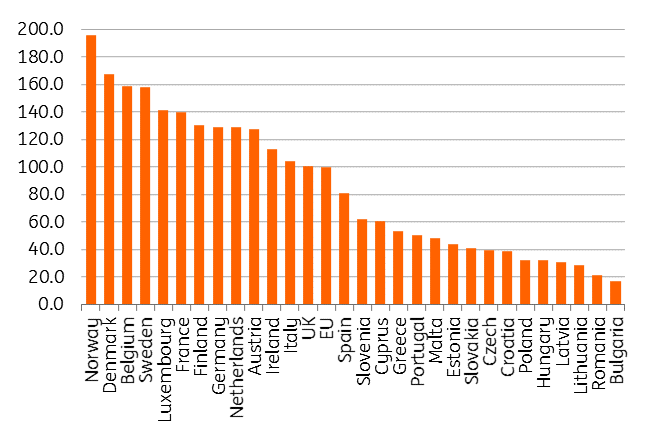

Like public health, the construction sector also posted an acceleration in wages, perhaps benefiting from a mild winter and the rise in the minimum wage. Wages rose 17.2% YoY, the highest since Jun-2016. Wages in manufacturing expanded by 11.5% YoY, a pace similar to December. Despite a recent rise in the cost of labour, that level remains just a fraction of the EU average.

Labour cost as % of EU average

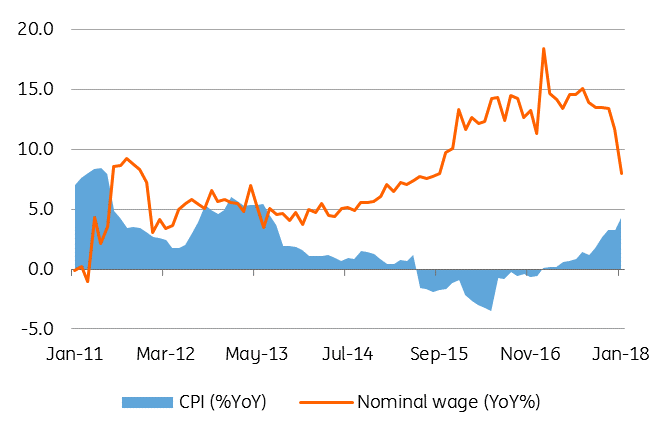

The overall picture starts to look even less rosy when we take into account the higher inflation expected for this year which will start to erode the nominal wage increases. The Jan-2018 CPI was 4.3%, meaning that real average wage growth was a meagre 3.7% YoY, the lowest figure since May-2014. January wages versus October (to exclude the bonuses period) for the private sector show an increase of 3.8% versus 8.2% in 2017, which likely reflects pressure on corporate margins, limiting the room to reward employees.

Inflation starting to erode wages

Further public salary increases are likely to be modest due to budgetary constraints, as the previous increase in wages has already been incorporated into permanent expenditures, limiting the room for fiscal stimulus if the economy needs it. We forecast the CPI to reach a peak of 4.9% in 2Q18 and 3.4% at year-end, which could keep real wage growth in the single digits this year and contribute, among other factors, to a slowdown in consumption.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap