Romania: Inflation starts to descend

January inflation dropped to 3.6% from 4.0% in December. We think this is just the beginning of the consolidation at lower levels

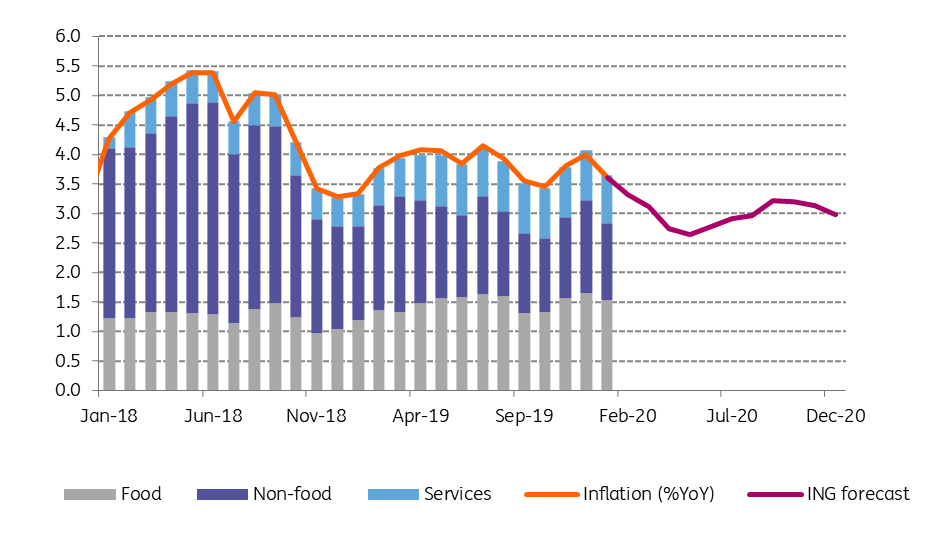

January inflation marked the beginning of what we believe to be an extended period of lower inflation numbers.

Starting next month, we expect headline inflation to start coming in within the central bank's upper target band range (between 2.5% and 3.5%) for the entire 2-year forecast horizon.

In 2020, the low point should come in April-May when we could see prints as low as 2.7%. However, what is slightly more concerning is that core inflation is likely to remain 0.2-0.4bp above the headline figure for the entire forecast horizon, without meaningful prospects for consolidating lower.

Back to January inflation, except for important base effects (almost 0.4ppt), the 0.4% monthly advance versus December 2019 came mainly on the back of higher food prices which advanced by almost 1.0% driven by important advances in fresh fruit and vegetable prices of c.2.0% and c.3.0% respectively.

Non-food items came virtually flat, as the anticipated drop in the fuel price (caused by the elimination of the special excise duty starting 1 January) was balanced by – also anticipated -higher tobacco prices and heating energy.

CPI breakdown and forecast

In their latest February 2020 inflation report, the central bank marginally lowered the year-end inflation forecast, now matching our already long-standing 3.0% projection. This should mean one less headache for the NBR, but we doubt that it will lead to policy easing in 2020.

Albeit projected to fade a bit, the twin deficit issue still remains while core inflation is also looking rather sticky to the downside. Hence, we maintain our forecast for flat key rates at 2.50% this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap