Romania: inflation remains stable in July

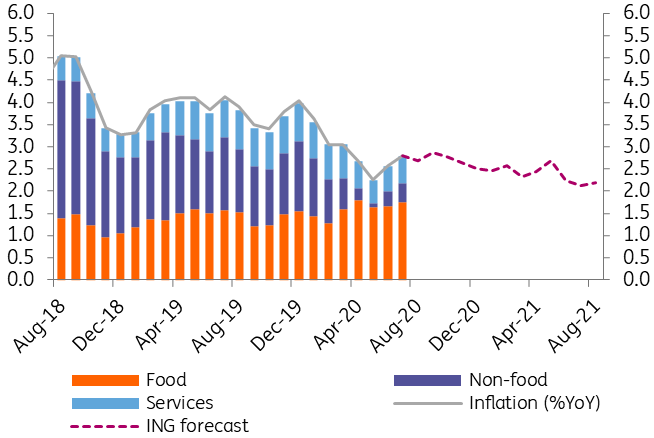

Inflation advanced by 2.80% In July (and was unchanged versus June), in line with the consensus and just a touch above our 2.75% estimate. We maintain our 2.80% forecast for average 2020 inflation with year-end at 2.50% and no change in key policy rate from National Bank of Romania for the rest of this year

Stable but not calm

July inflation confirms the remarkable stable path that prices have embarked this year and which we see continuing through 2021 as well. The underlying drivers are nevertheless not as stable, but they tend to offset each other so the headline number remains quite close to NBR’s central inflation target of 2.50%. So when food prices increased earlier this year the oil price was decreasing to offset that, then the oil price started to increase but the food seasonality calmed down the prices of fruits and vegetables in particular. In July the fuel price continued to rise, seconded by a 2.00%MoM increase in tobacco prices, but this time the drop in electricity and gas prices helped to counter these increases.

Inflation and components

Essentially, all this means that while the headline figure gives the appearance of very calm inflation, the underlying drivers have actually witnessed important shifts.

In August we will probably continue to see a mild increase in fuel prices while food prices should remain relatively stable versus July, hence it will probably be up to the service sector to offset these developments and maintain the monthly inflation close to zero.

For the NBR, inflation will probably remain one of the least worries over the short-to-medium term. An eventual tax hike in 2021 (possibly in VAT) could complicate things a little bit, but the prospects of that to happen still seem fairly distant. We believe that the 1.50% key rate will not be changed at least through mid-2021 and the central bank will continue its easing via the hard currency reserve requirement levels.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap