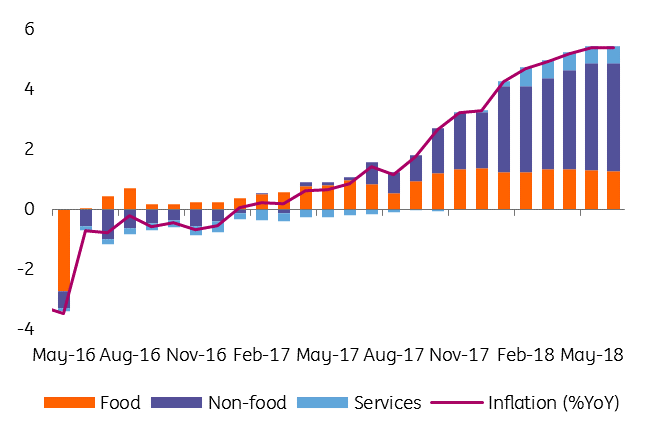

Romania: Inflation peaking at 5.4% in June

CPI was flat month-on-month. Base effects after the Jul-17 0.3% MoM CPI rise due to the regulated energy price hike should lead to a lower July 2018 YoY CPI, at c.5.0%

Some upside risks to the short term inflation profile have arisen. These are due to bad weather conditions, with floods affecting large parts of Romania. Still, the impact is likely to be much lower than historically seen as large retailers with continental supply chains have gained market share. This implies diminished price-setting power for domestic producers.

June CPI was in line with our call and 0.1ppt below Bloomberg consensus. Core inflation came in 0.1ppt lower at 2.9%. CPI is likely to remain subdued during the summer months and annual inflation to stay near or slightly above 5.00% until October, when we expect a 0.8ppt drop due to large base effects - in October 2017 excise duty for fuel was raised and regulated energy prices were hiked.

CORE inflation stabilises on softer private demand

Food and non-food price rises stood flat at 3.9% and 7.8% YoY respectively. Prices for services dropped by 0.1ppt to 2.6% providing more arguments to adherents of a broken Phillips curve theory - wages in private services have been growing at double digit rates annually since 2015 with the latest reading for May-18 at 11.5% YoY.

Large base effects to kick-in from October

The CPI reading is consistent with our year-end inflation forecast of 3.6% YoY which in turn is based on a below-consensus oil price outlook. Hence, upside risks. Our call for an NBR on hold at the 6 August policy meeting is supported by this reading, provided there is no escalation in global tensions that could lead to RON weakening pressures.

We expect the NBR to delay hikes as much as possible and to consider further moves in sync with the ECB. Consequently, if the ECB delivers clearer rate guidance after the September meeting, we could see the NBR hiking once more this year, at its 3 October rate meeting.