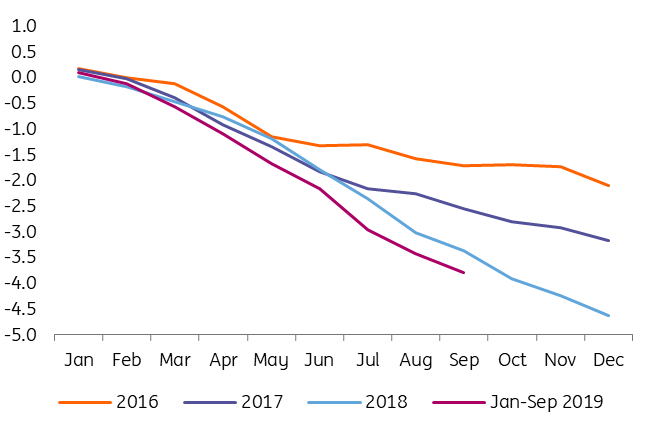

Romania: Current account deficit continues to widen

After three quarters of 2019, the current account deficit stands at EUR8.1 billion, 19% wider than in the same period of 2018. Only half of it is covered by direct investments

To start with the very few positives that can be drawn from today’s data, the widening of Romania’s current account deficit seems to have slowed lately. A 19% year-to-date widening is down from 26.7% in the January-June period and 27.1% after the first quarter. It might not resemble a correction yet, but these could be early signs of a turn in trend.

C/A deficit as % of GDP

The financing structure of the current account deficit has not improved, as foreign direct investments (FDI) still cover around 52% of the deficit as of Sep-2019.

FDI coverage not improving

On a 12-month rolling basis, the total external position (CA+KA+FDI) moved deeper into negative territory, at €2.8 billion.

External position submerging in negative territory

It has become common in recent months for central bank Governor Mugur Isarescu to address the issue of external imbalances (and the current account in particular) on pretty much every occasion. It’s becoming clear though that exchange rate depreciation is not considered a solution, and more is being expected from the fiscal side. Still, we believe that currency depreciation should be considered, at least in line with the inflation differential between Romania and its main trading partners. The Romanian leu has been strengthening in real terms for a while now, adding an additional headache to exporters. In the latest minutes, “some Board members” called for the central bank to stay “alert and prepared for a potential necessary prompt reaction” on externally-driven FX weakness despite the fact that the minutes also acknowledged “price competitiveness losses recorded by some companies, amid higher wage costs and the quasi-stability of the leu exchange rate”.

January-September C/A breakdown as % of GDP

Given that meaningful fiscal consolidation doesn’t look to be on the government’s radar for now, upside pressure on the EUR/RON should remain a theme for the months to come. We still believe a correction higher could be allowed in December 2019 or early 2020. As for the current account deficit, our -5.4% of GDP forecast for 2019 looks realistic, though the chances for a slightly better figure have certainly increased. Still, November’s Black Friday sales and December shopping season should push the deficit to more than -5.0% of GDP.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap