Romania: Consumer confidence collapses

As interest rates move higher, the RON weakens and taxation uncertainties weigh on the morale, economic sentiment has turned south as well

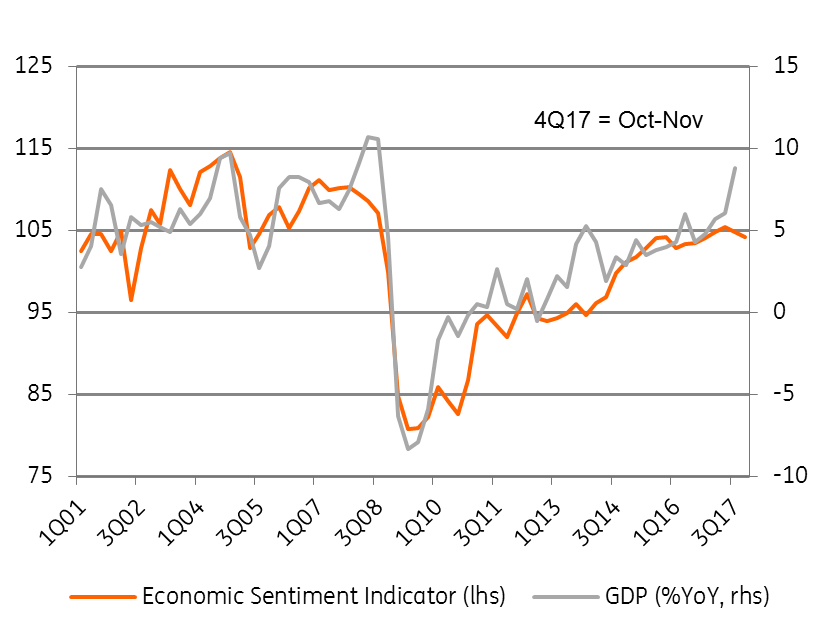

The Economic Sentiment Index (ESI) dropped for the second consecutive month to 103.8 in November from 104.6 in October. This is also lower than the third-quarter reading which was 104.9. It looks like 4Q17 growth will slow down quite significantly in sequential terms.

Confidence for industry improved on higher past and expected production and selling prices, but export orders were down, as well as the employment component. The confidence for services sector decreased on lower past and expected demand, but the sector has an improving outlook for hiring. Retailers’ morale softened, while sentiment improved for construction, though both sectors have a low weight in the broad index.

ESI pointing to a GDP slowdown

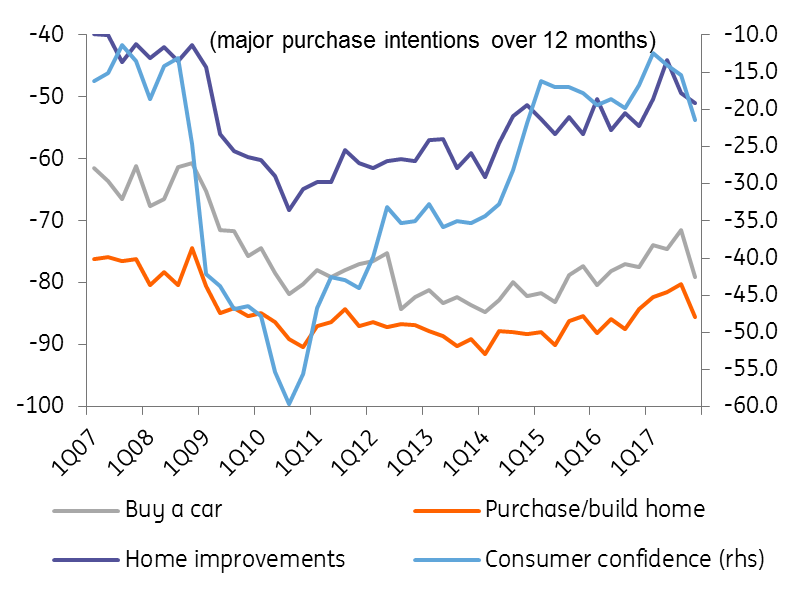

Consumer confidence continued its move south after reaching an all-time high earlier this year in March with a visible acceleration in the first two months of 4Q17. Forward-looking components on the outlook on the financial and economic situation are softening, while employment expectations are improving.

All major purchase intention from consumers took a sharp turn south in 4Q17 on higher interest rates, weaker RON and confusing tax environment outlook. The ESI readings for first two months of the 4Q17 seem to support our call for a sharper sequential slowdown in GDP growth from 2.6% to 0.8% QoQ leading to a deceleration from 8.8% to 7.7% YoY, with FY forecast figure standing at 7.2%.

Purchase intentions for big ticket items plunged

We expect GDP to slow to 4.7% in 2018, based on a number of factors:

(1) Significant monetary policy tightening after the 3M ROBOR interest rate index, relevant for loans, spiked c.150bp over the last three months and potentially underestimated pass-through as transmission improved due to higher share of RON lending (61% of total)

(2) Limited incremental fiscal impulse with budget deficit flat at -3% of GDP

(3) Weaker currency and its potential negative wealth effect (house prices quoted in EUR vs salaries in RON)

(4) Inconsistent public policies, a lower than expected net pay rise in public sector (below 5% vs 25%) and disruption in wage bargaining affecting consumer expectations;

(5) A slowdown in job creation due to a tight labour market and unaddressed structural issues.

The positive news comes from robust external demand, with Eurozone ESI at 17 years high, which should mitigate the risk of hard landing. Otherwise, it looks like the economic laws are working which should force policymakers into taking corrective actions.

Download

Download snap