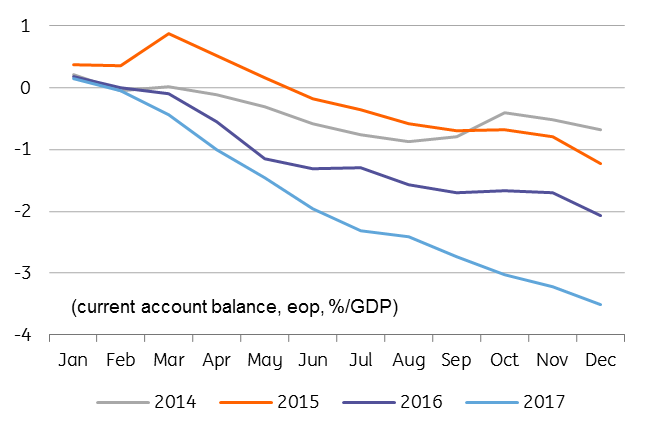

Romania: C/A at -3.5% of GDP in 2017

This is wider than our initial forecast of -3.2%, which did not include the payment of the first tranche for a defence system of c.0.35% of GDP

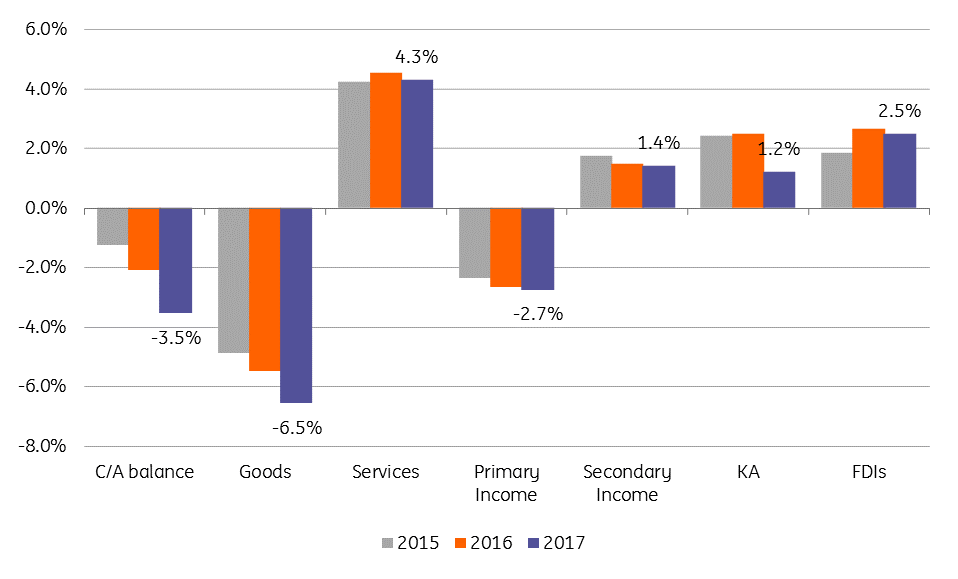

The deterioration of the C/A balance was mostly expected due to the fast widening of the trade deficit by c.30% YoY in 2017. Behind the trade balance shortfall are: uncompetitive food industry, higher oil prices and a lower surplus in the auto sector likely due to the elimination of a car emission tax at the start of the year. The latter, which led to a surge in second-hand car imports, is likely to be reintroduced in some form this year. Second-hand car registration jumped by 75.2% YoY in 2017.

| 71% |

C/A covered by FDIs in 2017from 129% in 2016 |

C/A deterioration

The surplus on the services side increased by a meagre 3.1% YoY in 2017, not keeping up with the widening trade gap for goods. Primary income was another important factor for the C/A deterioration widening by 12.7% to EUR-5bn. FDIs ticked up only by 1.4% YoY and are covering only c.71% of the C/A shortfall vs 129% in 2016. The capital account (C/A) inflows dropped sharply by c.48% to EUR2.2bn. The overall external position (C/A+KA+FDI) barely remained in positive territory at only EUR0.3bn.

External position (% of GDP)

We are comfortable with our projection for C/A widening peaking-out and expect the C/A at -2.8% of GDP in 2018 as we expect a slowdown in consumption. It is likely to be fully funded by FDIs. Our forecast does not include eventual new tranches for the defence system. Hence, it could come 0.3-0.4ppt of GDP wider, but still post a modest improvement from a year ago.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap