Romania: Budget gap widens in August

The January-August budget brought more of the same: moderate revenue growth and ballooning expenditures. This has led to the widest eight-month gap since 2011

The budget shortfall widened to -1.54% of GDP in August from -1.26% in the previous month. This is the widest budget deficit after eight months since 2011 when it stood at -2.3% of GDP.

Budget execution

Revenues: reasonable but not great

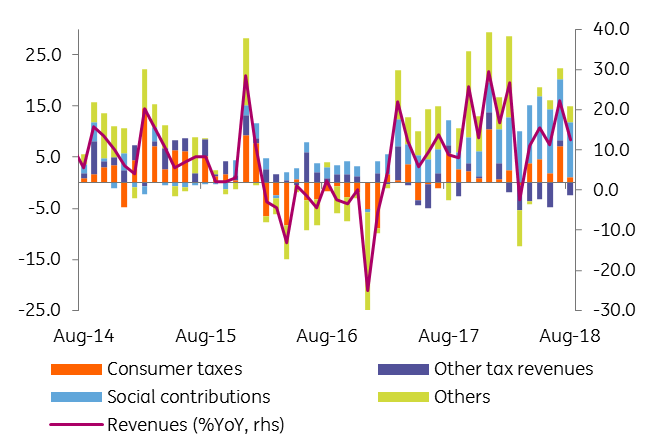

Budget revenues are up 13.7% from a year ago. But after one-off income from profit taxes and dividend payments from state-owned enterprises (SOE’s) in August, the revenues are – in nominal terms – back to this year’s average. Fiscal revenues advanced a skimpy 0.8% year-on-year versus January-August 2017. A structural change in revenues is needed to ensure long-term sustainability. On the brighter side, VAT revenues continue to perform well, posting an 8.6% YoY increase versus the same period of 2017.

Revenue composition

Expenditures: great but not reasonable

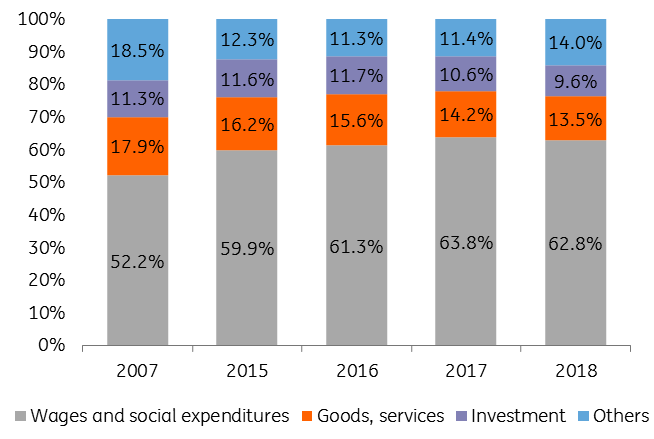

Spending continues to expand strongly, maintaining an 18% YoY growth rate after the first eight months of 2018, similar to the January-July 2018 period. The wage envelope continued to grow for a fifth consecutive month, at 25.2% versus the same period of 2017 and hence further increasing the share of quasi-permanent spending. The share of rigid public spending (wages plus social expenditures) now make up 62.8% of total expenditures.

January-August expenditure composition

Wage envelope + social benefits as % of fiscal revenues + social contributions

It looks like the government remains committed to the deficit target of 3.0% of GDP. The nominal GDP assumption for the budget plan is a bit optimistic versus our forecast. Still, a bit of patchwork here and there by cutting investment expenses, lowering co-financing needs due to below expectations absorption of EU funds, special dividends from SOEs and revising other spending plans that are clustered usually into the year-end will likely do the job for this year as well. Nevertheless, going forward, due to the increasing share of rigid state spending, the commitment to the budget deficit limit of 3.0% of GDP could become a trade-off between political costs associated with this ‘fiscal rule’ and those arising from entering the excessive deficit procedure (EDP), including lower budget flexibility.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap