Romania: Budget deficit within the target for 2017

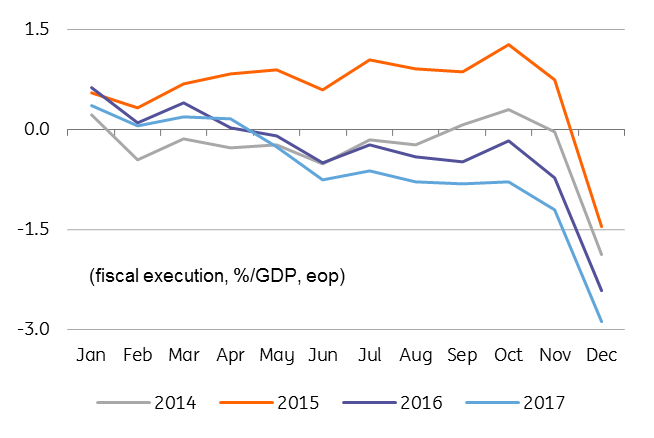

The pattern of budget execution remained unchanged, with a cash-based deficit at -2.9% of GDP in December from -1.2% after eleven months, versus the -3.0% target

A few days ago the FinMin was quoted saying that ESA budget gap was at -2.8% of GDP for the previous year. Reaching the budget deficit with excessive spending in December was likely suboptimal via reallocation from investments to other items . If we exclude the expenditure for a defence system, the MinFin injected in December c.RON11bn into the money market, but the payments were likely made towards the end of the month as the NBR data showed an average deficit of RON0.9bn in December. This is likely to keep the liquidity backdrop in comfortable surplus for the next few months.

Uneven budget execution pattern

Budget revenues came in lower versus the initial plan by 1.1%, despite better-than-expected economic growth. Budget revenues stood at 29.9% of GDP versus 31.2% planned. The government made some savings on budget expenditures which came 1.0% below the plan. Expenditures stood at 32.8% of GDP versus 32.9% planned. The wage envelope increased by 22.0% versus 2016 versus a plan of a 12.0% increase, or 9.0% higher than target. The largest savings came from capital expenditures -50.4% lower than planned, ending 2017 at 2.3% of GDP versus initial target of 4.8%. As a percentage of GDP this is the lowest allocation for public investments on record, with detailed data available since 2006.

The budget execution suggests a weak underlying budget structure and reduced fiscal room to respond to unexpected shocks. It also suggests enhanced risks for keeping the 2018 budget gap within the -3.0% of GDP target in the absence of compensatory measures. The government is unlikely to count on some one-off revenues from 2017. Add to this a too optimistic economic outlook, stretched ambitions to improve in tax collection and likely underestimation of social spending and the risks of overshooting are almost everywhere. Still, the government seems committed to the -3.0% of GDP threshold and we could see some savings from investment spending (planned at 4.2% of GDP for 2018), some measures to increase revenues via higher indirect taxation similar to the ones in 2017 (like an increase in the excise duty). The rather unrealistic plans are also keeping alive fears of further cuts to the contributions to the private pension system. The fiscal policy is likely to remain a risk for Romanian sovereign debt. Add to this the upside risks to the inflation outlook and the backdrop for ROMGBs is not at all rosy.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap