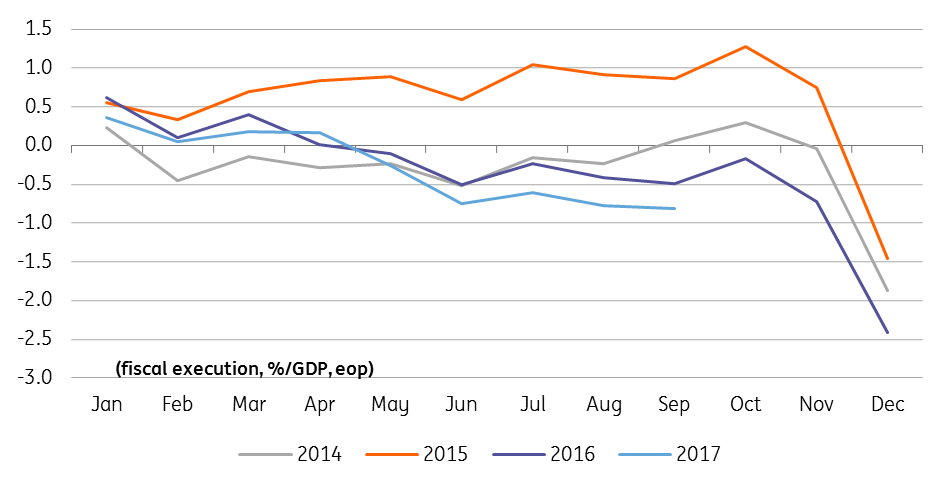

Romania: Budget deficit widens to -0.81% of GDP

The deficit in September widened from -0.78% at the end of August and -0.49% for the first nine months of 2016

Budget revenues increased by 8.8% YoY. Current revenues expanded by 6.4% YoY and are gradually nearing the full-year target of a 7.4% advance. Budget expenditures spiked by 10.5% YoY driven by the 21.6% increase of the wage envelope, which is significantly above the full year plan of 12%. Current expenditures were also up by 3.6% YoY versus initial plans for some savings from this item. Capex spending was down by -20.3% versus the same period of 2016, falling even deeper behind the initial plans.

Despite large spending in the last two months of the year, this year’s budget gap target of -2.96% of GDP looks easily achievable

This is likely to bring significant surplus liquidity into the money market and, provided that the depreciation pressure on the RON does not intensify prompting large FX interventions from the NBR, we should see funding rates heading lower into the year-end.

Fiscal gap wider than in the last years

For the next year, the government is yet to present the budget plan which should be submitted to the parliament by the end of October, according to the PSD head. While it is likely to be stretched in terms of macroeconomic assumptions with ambitions to improve tax collection likely included in baseline scenario, we expect the 2018 budget draft to target a deficit of 3.0% of GDP. Similar expectations hold for the NBR Board as well, which made reference in its latest minutes of ‘the possibility of further corrective fiscal measures in the context of defining the outline of the 2018 budget’.

The VAT gap is always cited as a resource

While the government might adopt compensatory measures, yet to be revealed, the risk of overshooting the target in 2018 are material. Still, the nature of the shift in the allocation of government spending and the identification of the budget resources are likely to be inflationary.