Romania: Budget deficit soars

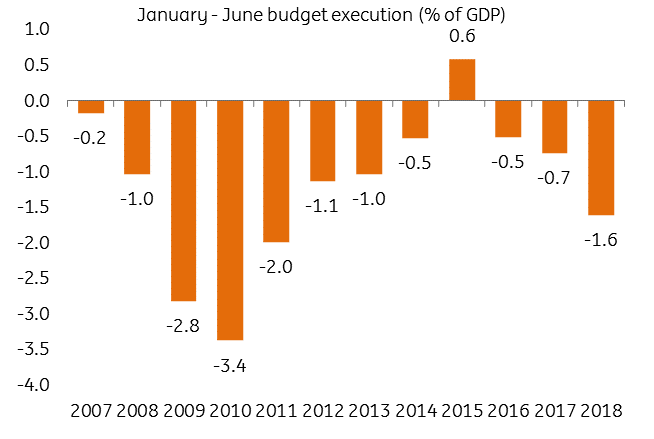

The budget deficit widened to 1.61% of GDP in June- the biggest mid-year gap since 2011. There are two options left for the government: revise the 3% deficit target upwards or come up with some tough measures to boost revenues and/or cap spending

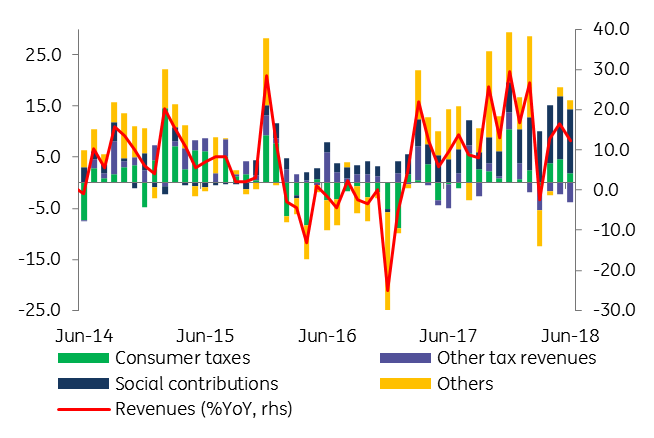

We don’t like what we see on the revenue side

In nominal terms, revenues are falling for the third consecutive month. Except for the VAT collection, which is up by 15.6% year on year (7.7% month on month), pretty much all the other important fiscal revenues are on a downward trend (taxes on profits, on salaries, on goods and services, excises and other smaller taxes). Social contributions have also declined by 2.3% in June versus May, thus bringing the total revenues for the January-June 2018 period only 12.6% higher than the same period of 2017. We say “only” because a lot more is needed to match the ballooning expenditures.

Revenue composition

Expenditures seem a bit out of control

Expenditures grew by 19% YoY boosted by 24.4% higher wage expenses and 13.9% higher social assistance. Public sector wages and social assistance now make 62.3% of total budget expenditures versus 57.2% budgeted for the whole year, which substantially limits the room for a fiscal impulse should the economy need one in the near future.

Expenditure composition

No easy way going forward

As the economy is growing below government expectations while quasi-permanent spending keeps increasing, we believe there are only two options. One is for the government to admit that the 3% of GDP deficit target is too ambitious and revise it upwards. However, we believe that is still not a likely scenario for now. The second option is to stick to the 3% target which opens the way for a further two options: either not to fulfil the budget plan for certain segments (investments primarily), or come up with some compensatory measures to boost revenues. No easy way, but historically, capping capital spending has usually been the preferred option.

Similar pattern...but this time is different, right?

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap