Romania: August lending tunes out background noise

For the third consecutive month, our credit growth index (adjusted for FX effects) maintained a 7.2% growth pace

Looking…flat

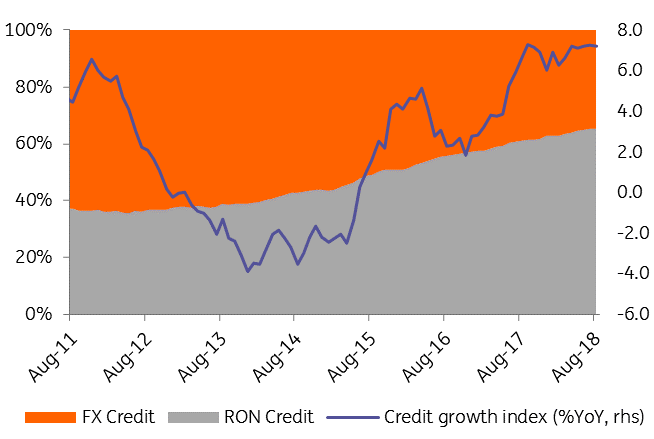

For over three years now, total lending has posted single-digit but remarkably steady growth rates. Romanian leu lending stood unchanged at a 65.3% share of total loans in August in what seems to be a broad stabilisation in the RON/FX lending split. Given a rather impressive track record of exchange rate stability and higher interest rates for local currency loans, we believe that a mild recovery of FX lending in the coming months is plausible.

Total RON/FX lending split

Corporate sector: slow but steady

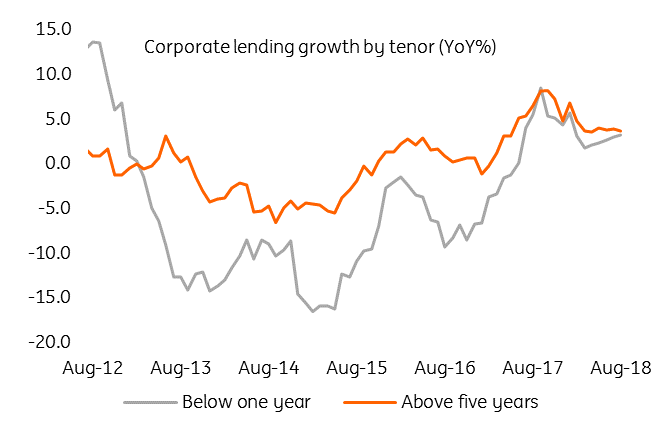

Corporate loans accelerated by 3.7% year-on-year in August from 3.3% in July. RON lending growth was flat in August at 7.9%, while FX lending continued to contract at -5.5% YoY. Short-term versus long-term lending is also gradually shifting in favour of the former.

Corporate lending split by currency

...and by tenor

Retail lending marches ahead

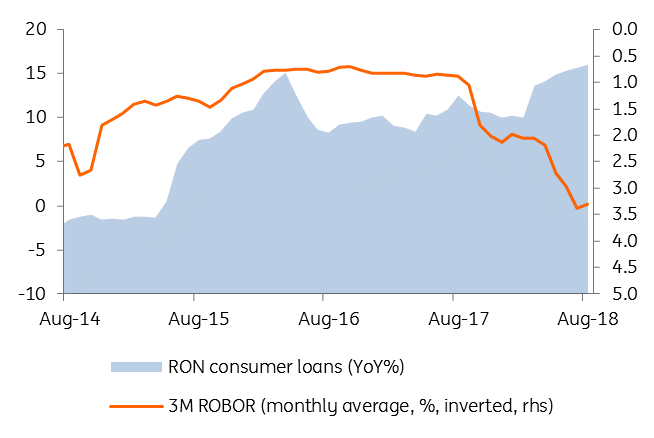

Retail loans grew another 10.9% YoY in August, slightly slower than 11.4% in July. Consumer loans in local currency accelerated for a sixth consecutive month, at 16.0% YoY in August while mortgage lending growth decelerated for the seventh consecutive month, at 34.0% YoY. Last month, Governor Mugur Isarescu announced that some macroprudential measures would be enforced by September. We have yet to see these but demand for consumer loans in the last few months may have been spurred by a possible fear of missing out.

What tightening?

Today’s data is likely to satisfy the central bank as it confirms that past tightening managed to bring inflation lower without compromising credit growth. As for macroprudential measures, we are still in wait-and-see mode. The NBR governor has repeatedly stated that the central bank does not want to cut off credit to the real economy. Hence, the measures are likely aimed at limiting loans to individuals, taking some pressure off the NBR to hike rates in order to keep credit affordable for the corporate sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap