Romania: August CPI surprises to the upside

Inflation rebounded in August to 5.1%year-on-year, above market consensus of 4.80% and just a touch beyond our call of 5.0%. Core inflation however remains muted at 2.8%

While headline might look worrying, it doesn't change our year-end forecast of 3.6%.

Our forecast was already at the higher end of market expectations as we anticipated inflation to increase in August, from 4.6% in July, on the back of regulated gas price hikes. However, the unexpected increase in the price of electricity explains the 0.1ppt deviation from our forecast.

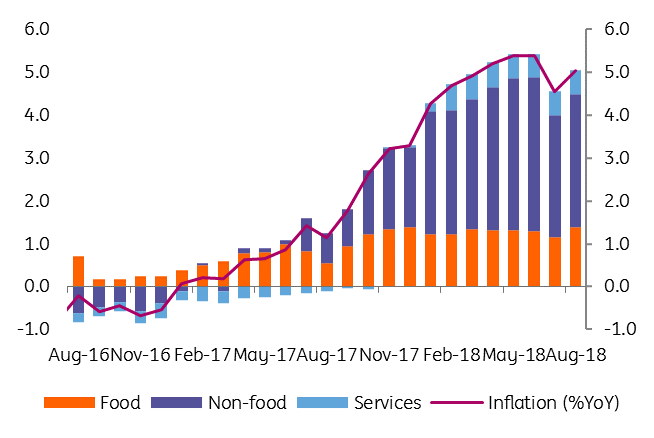

Core inflation came 0.1ppt lower at 2.8% confirming our view of no change in key policy rate for the rest of the year. Food CPI increased to 4.2%YoY from 3.4% in July and thus added some 1.4ppt to the total 5.1% headline while non-food also inched higher in August, to 6.8% from 6.2% in July. This translates to a 3.2ppt contribution.

Previous hikes in regulated prices and excise duties are due to drop out of the statistical base by the end of this year and should push non-food inflation below 4% by December 2018.

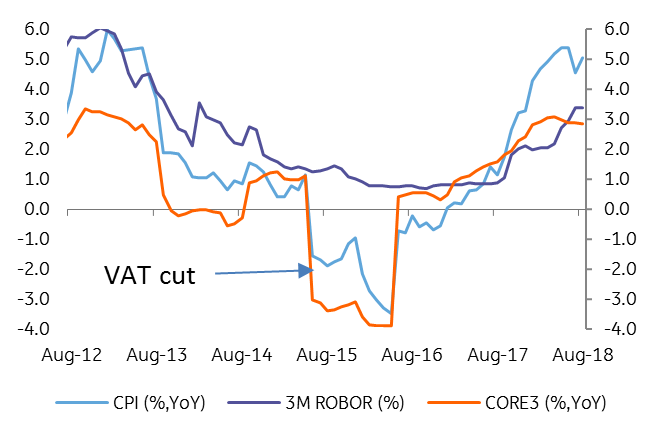

Core inflation lower, headline to follow

CPI breakdown

Services inflation came in lower at 2.6% as demand-driven pressure on prices seem to be softening, inducing a more modest 0.5ppt contribution to August inflation.

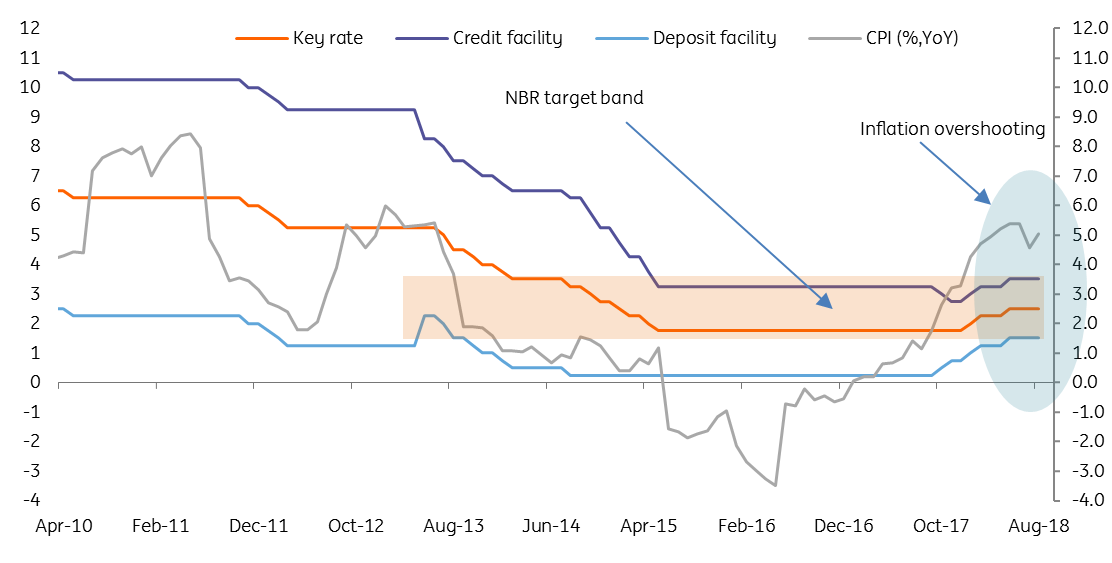

Today’s data supports the central bank's dovish stance.

We expect inflation to print lower headlines in the coming months due to base effects and maintain our year-end forecast of 3.6%. However, the risk balance is still tilted slightly to the upside. The producer price index for the food industry has been recently drifting upwards which poses some risks to the inflation outlook while the recent outbreak of African swine fever could hit the agriculture sector, but the total extent of the damage is yet to be assessed.

Inflation temporary overshooting the target

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap