Romania: Above consensus January CPI

Inflation came out at 4.3% YoY versus our call of 4.2% and NBR forecast of 4.4%, while Bloomberg consensus was 3.9% and Reuters median 4.1%

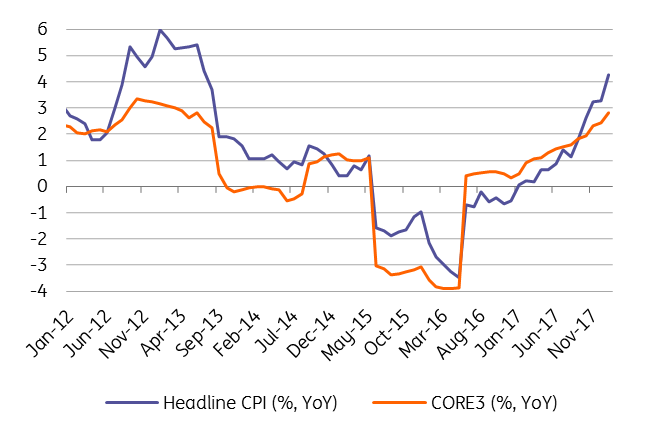

The forecast error for Romanian CPI on our side comes mainly from volatile food prices. The base effect played an important role in the January inflation profile as 1ppt VAT cut and a cut in excise duty for fuel from January-2017 dropped out of the statistical base. Core inflation came in at 2.8%, in line with our expectations, inching up from 2.4% previously.

| 4.3% |

Romania CPI January (YoY, %)ING forecast: 4.2% and NBR at 4.4%; Bloomberg consensus at 3.9% |

| Worse than expected | |

Both headline and core heading higher

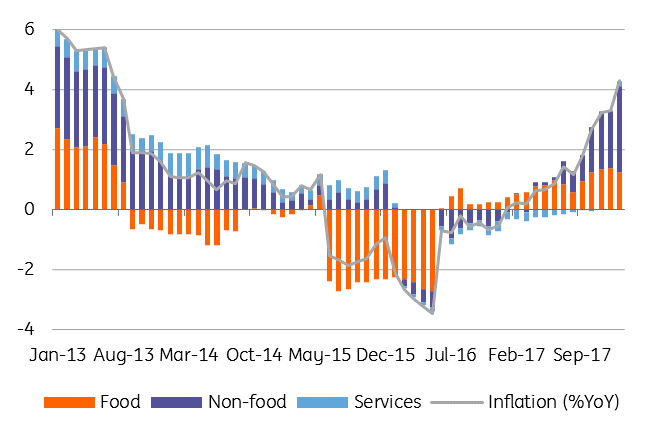

Food inflation slowed down to 3.7% in January from 4.1% YoY in December. Prices for non-food items accelerated from 4.1% to 6.2% due to hikes in regulated prices for gas and energy, responsible for 0.56ppt out of 1.08% MoM advance. Prices for services spiked from 0.2% to 0.9% YoY with weaker RON and base effects factored in. CPI for services is expected to accelerate in February due to base effect as indirect tax cuts from February-2017 are going out of the statistical base. Hence, we could see February headline inflation jumping further to 4.7% YoY.

Broad based inflationary pressures

The 0.1ppt forecast error in January is pushing our year-end projection by a similar amplitude higher to 3.4% YoY, with risks balance for our call tilted to the upside. We see the peak of inflation in 2Q18 at 4.8% and project it to remain above the NBR target band until December. Our forecast for average inflation stands at 4.4% YoY for 2018 which is expected to slow-down consumption by eroding the purchasing power. On the other hand, negative real interest rates are leaning the balance between consumption and savings in favour of the former.

NBR decision time

With inflation climbing higher, the NBR will be forced into a decision on either hiking the key rate or tightening liquidity controls at the next meeting on 4 April. Adopting both measures at the same time could be viewed by a dovish Board as wasting bullets, with the next three meetings being held in the context of rising inflation, according to the central bank’s forecast. We are inclined to think that the NBR Board would prefer increasing rates without absorbing the liquidity via open market operations. We have two more key rate hikes pencilled in for this year with gradual tightening via liquidity management. If the consensus in the NBR Board on loose liquidity management remains unchanged, we could see one more hike on top of our baseline scenario.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap