Rising wages in Hungary risk keeping inflation persistently high

Hungary recorded lower-than-expected gross average wage growth in November, but the acceleration in the rise of regular wages hints at a price-wage spiral

| 20.2% |

Regular wage growth (YoY)Previous 18.5% |

Judging by the headline number, it appears that wage growth in Hungary is moderating. Gross average wages increased by 16.8% year-on-year in November, causing a downside surprise after October’s 18.4% YoY reading.

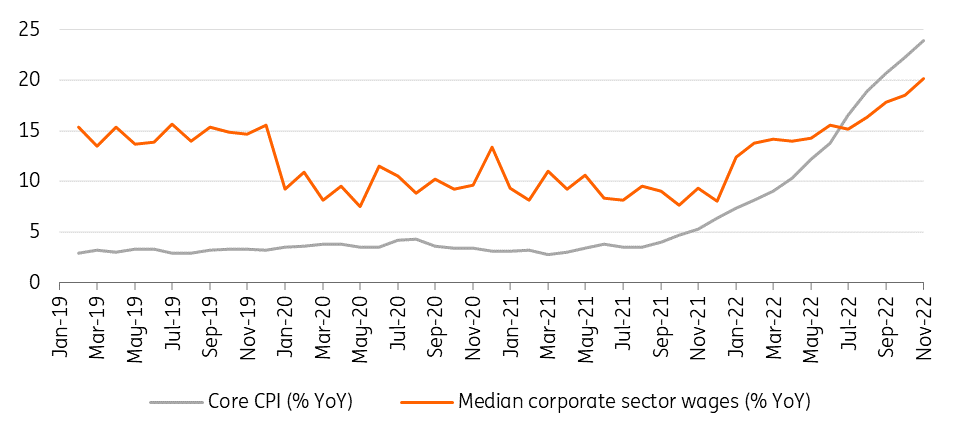

However, the detailed data paint a rather gloomier picture. If we exclude the impact of one-off payments and bonuses, and thus examine regular wage growth dynamics, we see that underlying wage growth has increased significantly to 20.2% YoY from 18.5% in October. What does this signify? In our view, bonus payments in November 2022 were much smaller than in November 2021, as companies converted a significant part of bonuses into regular wages, and this is a key factor in why the all-around wage growth seems to have slowed down. The bottom line is that this is not a sign of slowing wage dynamics, but rather a red flag of a price-wage spiral that is increasingly in play.

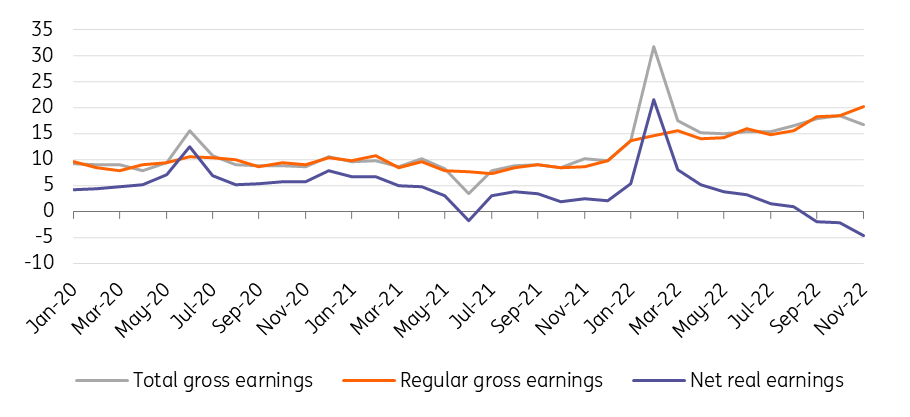

Nominal and real earnings (% YoY)

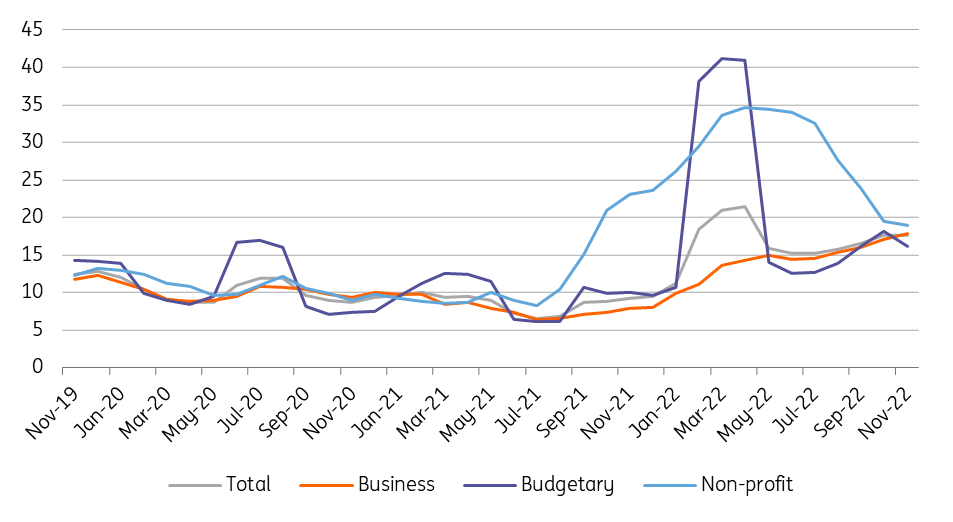

Wage dynamics (3-month moving average, % YoY)

As we dive deeper into the details, we can see yet another material difference between private and public sector wage growth in November. Average gross wage growth (including bonuses) in the private sector rose by 18.7% on a yearly basis, while the median wage growth came in at 20.2%. This indicates that companies mostly adjusted the wages of lower earners considering the extreme inflation environment.

The slowdown in overall wage dynamics has also been heavily influenced by the fact that average wage growth in the public sector has slowed down to 10.5% YoY. This is a sluggish pace (by recent standards) and something which has not been seen since December 2021. Net real earnings unsurprisingly painted a gloomier picture in November, as the combined effect of slower public sector wage growth and lowered bonus payments dragged down the headline data. Real wages fell by 4.7% as November’s headline inflation rose to 22.5%. However, as some sectors continue to face labour shortages, there is extra motivation for companies to retain and attract workers, which can mitigate the rate of contraction in real wages. These sectors include manufacturing as well as the hospitality sector.

Core inflation and median wages in the corporate sector (% YoY)

While the strong underlying wage growth is a positive development for economic growth, there is a growing risk that inflation will remain persistently high. The repricing power of companies may remain strong as they see that consumers’ purchasing power has not fallen dramatically, and households may even make up for the loss in real wages by tapping into savings. Overall, today’s data confirms our picture of fairly strong wage growth in 2023, and while real wages could be negative during this year as whole, this shrinking of purchasing power will be much smaller than previously expected.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap