UK wage growth remains lone hawkish factor for Bank of England

UK wage growth has a hit another post-crisis high as skill shortages continue to bite. There are structural reasons to suggest this trend is unlikely to reverse just yet, but the cyclical story is looking a little less encouraging. We don't expect any change in policy from the Bank of England this year

At 3.6%, UK wage growth (excluding bonuses) has reached another post-crisis high. While this is being partially boosted by an increase in public sector pay at the start of the second quarter, wage growth is nevertheless one of the few remaining hawkish factors for the Bank of England. It has been a key ingredient in policymakers’ recent signal that rates may need to rise if Brexit goes smoothly. The question is, how long will this trend continue?

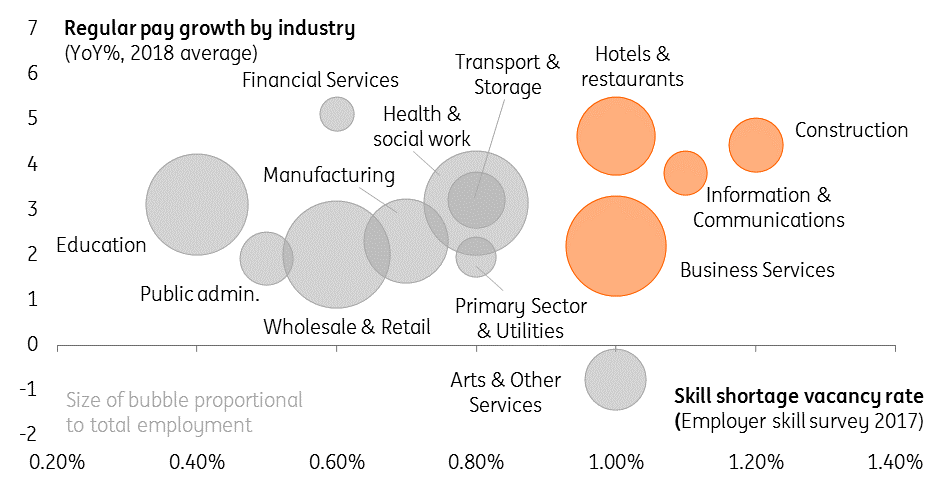

Well, from a structural standpoint, the signs suggest that the upward pressure on wages is likely to persist. The recent uplift in pay is linked to skill shortages in various industries - most notably in construction, IT & hospitality, according to last year’s Employer Skill Survey.

UK skill shortages vs wage growth

In some cases this can be linked back to demographic factors. In the road haulage sector for instance, almost 30% of the workforce is over the age of 55, according to ONS figures. With a fewer number of younger entrants relative to the number of retirees, this is reportedly resulting in shortages of drivers and is prompting firms to offer higher pay packages to guarantee coverage for shifts.

These structural forces are unlikely to fade imminently, however there are some signs that the cyclical story is starting to look a little less positive. Vacancies, while still high, fell for the fifth consecutive month and this tallies with the more lacklustre employment growth – the 3M/3M change in employment slipped to 28,000 in the latest data for May. The latest Markit/RECS jobs report also hints at a slower pace of wage growth, with permanent starting salaries softening to a 25-month low. Bank of England Agents have found a similar story.

For now, we think wage growth will continue to act as one of the few remaining hawkish factors for the Bank of England. Partly for this reason, we think it is too early to pencil in rate cuts in the UK.

That said, there's little doubt that Brexit uncertainty will rise as we reach the October deadline - particularly given the rising risk of an election later in the year. This will continue to act as a drag on economic activity, and means the chances of a rate rise this year are low.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap