Riksbank’s historic rate hike likely to be the last

The Riksbank has voted to exit negative rates but, with the economy deteriorating, this is likely to be a 'one-and-done' move. The move is expected to bring little support to SEK, which is set to remain a laggard in the G10 FX cyclical space

One and done

By hiking interest rates by 25bp to 0.0% on Thursday, the Swedish Riksbank has followed through with its pledge to lift the country out of negative rates. It has become pretty clear over recent meetings that policymakers have become warier about negative rates becoming a more permanent state of affairs, and the effect that might have on people’s expectations.

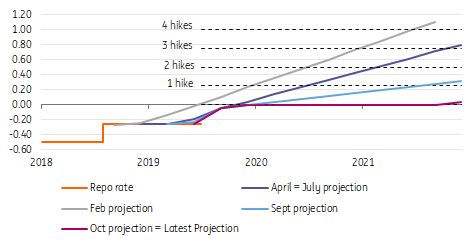

But unsurprisingly, the updated Riksbank interest rate projection signals that this is very much a one-and-done move. The economic backdrop has been weakening, as emphasised by the fact that PMIs have moved further into contractionary territory in recent readings. We’ve also seen a modest decline in inflation expectations, a sign that doesn’t bode well for forthcoming wage negotiations due to conclude in the spring.

Riksbank rate path

We don't see much incentive to hike any further

All of that suggests little impetus to increase rates further. But importantly, while the Riksbank is keen to point out that it could cut rates again, this latest move signals to markets that the bar to do so is set reasonably high. Never say never, but it would take a more pronounced downturn for today’s move to be reversed. It’s worth remembering too that policymakers are much more relaxed about the prospect of currency appreciation than a few years back, following an ongoing period of SEK weakness.

The bottom line is that interest rates are unlikely to move again in either direction any time soon.

SEK: Little support from the hike, SEK to lag other cyclical FX in 2020

As expected, the well-telegraphed rate hike (of a one-and-done nature) had a fairly limited impact on EUR/SEK.

Looking ahead, we expect the currency to be a laggard in the G10 FX cyclical space next year and, within the region, we prefer NOK. Even after today’s rate hike, the SEK implied yield will remain the lowest among G10 cyclical currencies, the real yield is very negative, and the domestic economic and inflation outlooks remain challenging. Although SEK is deeply undervalued on a medium term basis, so are the likes of NOK, NZD or AUD. This, in turn, suggests no meaningful relative advantage for the krona. Hence, on the carry-valuation matrix, SEK doesn’t stand out. In fact, the currency lags its peers.

Our profile for EUR/SEK for 2020 is very flat, with limited upside and downside to the cross. We expect the cross to hover around the current levels for most of 2020.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap