Polish wage growth comes in against MPC centrist members’ rhetoric

Wage growth numbers support the case for a prompt hike, but centrist members of the Polish central bank are unlikely to discuss such a move anytime soon

| 7.4 |

Wage growth (%YoY)In enterprise sector |

| Better than expected | |

Corporate wages accelerated to 7.4% year-on-year, strongly above market consensus which was at 6.0%.

According to the recent quarterly data from the national economy, growth of salaries in the enterprise sector is outpacing total dynamics by 1pp.In 3Q17, corporate wages accelerated by 5.9%YoY, while national wages only grew by 4.8%YoY.

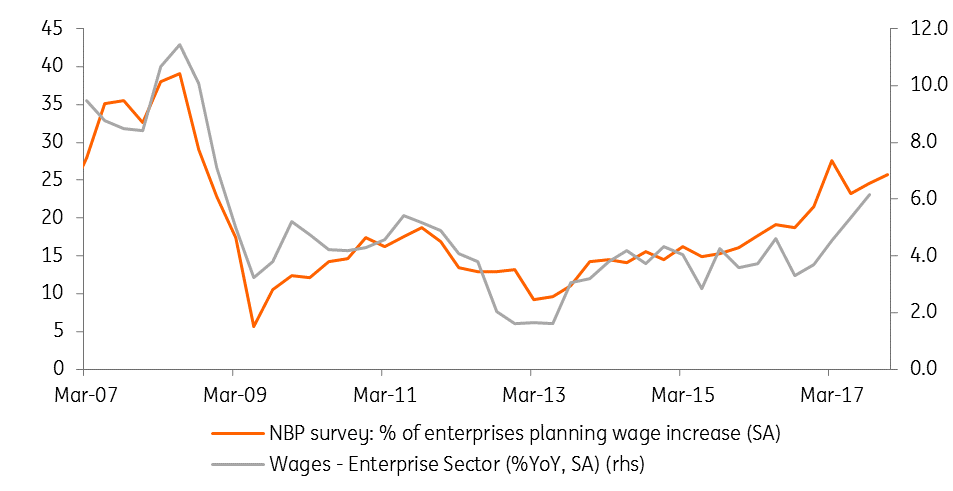

In 1H17 both measures came in at 4.8%YoY and 4.6%YoY with a limited 0.2pp discrepancy.Still, the share of companies reporting labour shortage problems remains historically high and the share of enterprises planning wage hike also remains sound. The next months are likely to maintain sound pace – the upward pressure should be supported by mining bonuses, payments of additional rewards to standard salaries in the mining sector.

Enterprise employment slowed down from 4.5%YoY to 4.4%YoY in line with consensus expectations. Data indicates that major share of retiring persons came outside of enterprise sector, there is limited evidence in both headline average figures and end of the month volume.

Companies reporting wage hikes (%) vs. enterprise wages (%YoY)

All in all today's data strongly supports the case for a prompt rate hike. Still after declarations from centrist MPC members including G.Ancyparowicz and J.Kropiwnicki, discussion towards such a move is unlikely in the next month as both announced no need for rate increase in the 12-month window.

In our view, we expect a rate hike will most likely take place in 4Q18.