Polish inflation in June signals September rate cut

CPI inflation fell to 11.5% year-on-year in June, down from 13% in May, driven by fuel, food and energy. We estimate that core inflation was 11.2% YoY vs 11.5% in May. We expect CPI to inch below 10% YoY in August, allowing the National Bank of Poland to cut interest rates the following month

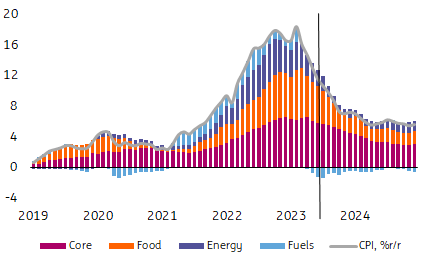

CPI inflation fell to 11.5% YoY in June, below expectations (ING: 11.7% YoY, consensus: 11.6% YoY), and down from 13% YoY in May. The main contributors to the decline were fuel (this contribution fell by 0.6pp), food (0.3pp lower contribution) and energy prices (0.3pp lower contribution). We estimate that core inflation was 11.2% YoY, down from 11.5% YoY in May. Yet this is still a slower decline than elsewhere in the Central and Eastern European region. In conclusion: external supply shocks are rapidly receding, headline inflation is falling faster than expected in many emerging countries, but Poland stands out in the CEE region with a slow decline in the core rate, so we are not in favour of quick NBP cuts, although we do expect that to happen.

CPI structure (%YoY)

Food & fuel prices subside

At this rate of decline, we will see CPI at 9.8% YoY in August, so we think the NBP can cut rates in September. By year-end, CPI inflation may slow closer to 7% YoY, and the NBP's July inflation projection (to be presented next week) should reflect this. Hence another interest rate cut in October is also very likely.

Could financial markets perceive this as a policy mistake? Not really, as the NBP will join other emerging market central banks (Hungary, Chile, Brazil, and perhaps the Czech Republic) in starting a cycle of cuts. We note that in this cycle, EM central banks started to hike earlier than developed market banks, so they may now start to cut earlier.

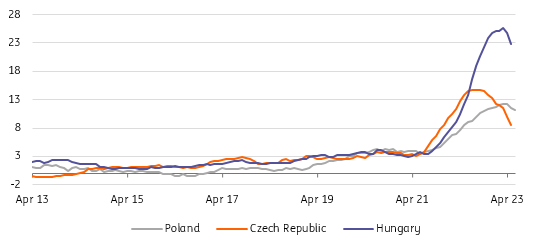

Stubbornly slow decline of core CPI in Poland

Core inflation (%YoY) across Central Europe. Poland until June; others until May

However, an important difference between Poland and LATAM is that real interest rates are already positive there, while in Poland they are still negative. Also, the difference between Poland and countries in the CEE region (Czech Republic, Hungary, Romania) is also visible in core inflation, which is falling much faster there than in Poland (from the peak). We are concerned that the rate cuts in Poland (more than one in 2023) will mean that it will take a long time for inflation to return to target. Our models indicate that core inflation may stabilise around 5% YoY in 2024-25 given, for example, the tight labour market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap